Japanese Intelligence Agency to Screen Foreign Investments, as Govt Looks to Emulate U.S.

Prime Minister’s Office

16:31 JST, December 28, 2025

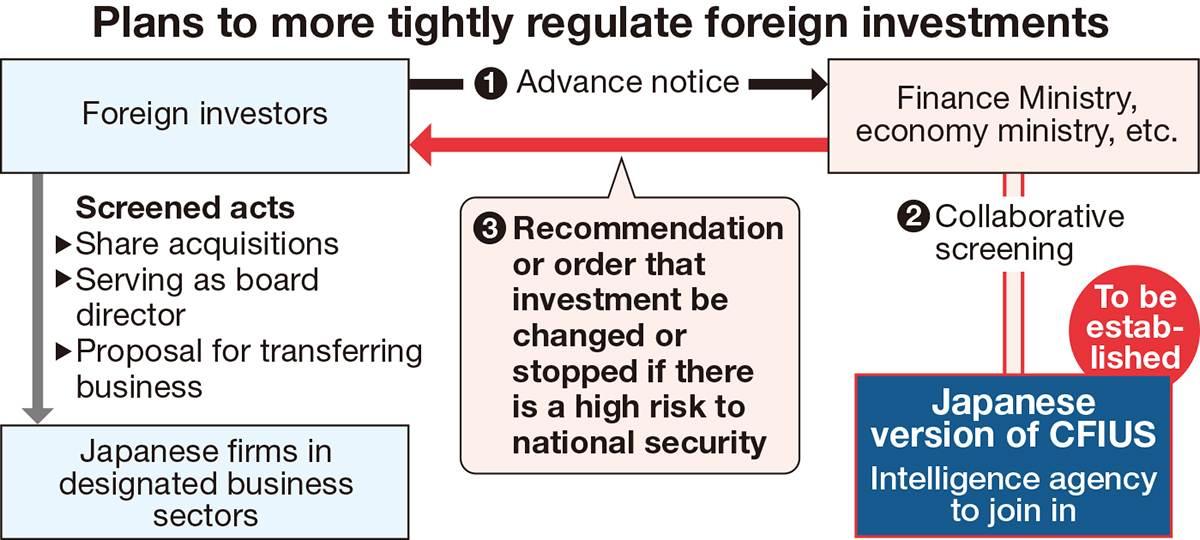

The government plans to require that foreign companies and investors be screened by an intelligence body before investing in Japanese companies, if there are high-level risks for national security.

In 2026, the government will establish a new organization equivalent to the Committee on Foreign Investment (CFIUS) in the United States, and this organization will then participate in the screenings.

The aim is to prevent technologies and information held by Japanese companies from being leaked overseas.

CFIUS is an inter-departmental organization that, for national security purposes, screens foreign companies attempting to obtain shares in U.S. companies. It is chaired by the U.S. treasury secretary. If CFIUS believes there is a national security risk, it can recommend that the president block the acquisition of the U.S. company.

Currently in Japan, the Foreign Exchange and Foreign Trade Law regulates capital contributions to Japanese companies by foreign companies and investors.

If foreign companies or investors obtain 1% or more of the shares of a listed Japanese company or even a single share in an unlisted Japanese company in “designated business sectors,” such as space development or nuclear energy, viewed as key to national security by the government, they must report their investment plans to the government beforehand and be screened.

The law also regulates foreign nationals taking posts on boards of directors and proposals or agreements on the transfer of businesses.

If the screenings uncover problems, the government can recommend or order that the investment be changed or stopped. If foreign companies or investors ignore the recommendations or orders, the government can order them to sell the Japanese company’s stock.

However, screenings are conducted by the Finance Ministry, the Economy, Trade and Industry Ministry and other administrative bodies that have jurisdiction. The role of Japanese intelligence organization in screenings has never been clarified. So far, there has only been one case in which the government issued a recommendation or order to stop an investment.

In the United States, there have been 10 cases in which the government has issued orders to prohibit the purchase of a company based on screenings by CFIUS, according to the records of the Japan External Trade Organization.

Excluding Nippon Steel Corp.’s purchase of the United States Steel Corp., every case has involved a Chinese company or investment fund in the acquisition plans.

There have been calls for Japan to strengthen its screening, and in 2026, the government plans to submit to an ordinary Diet session a bill to revise the Foreign Exchange and Foreign Trade Law.

The government is looking to limit the range of investments that will be subjected to tighter screenings to those that involve high risk for national security and are in the designated business sectors. It also aims to strengthen checks on foreign companies acquiring other foreign firms that hold shares in Japanese companies.

For Japan’s version of CFIUS, it is likely that officials from the Finance Ministry, the Economy, Trade and Industry Ministry and the National Security Secretariat will take part.

There is also a plan to involve officials from a national security bureau that the government aims to set up as the command center for intelligence activities, as well as officials from the Cabinet Intelligence and Research Office, under the Cabinet Secretariat.

Additionally, the Finance Ministry currently has about 70 officials, mainly in the International Bureau and local Finance Bureaus, conducting the screenings. The government plans to double the number to 140 or so.

In fiscal 2024, there were 2,903 applications for screenings, according to the Finance Ministry. That was about eight times higher than in the United States, which has a similar screening system.

The plan to establish Japan’s version of CFIUS is a key policy pledge of Prime Minister Sanae Takaichi.

A coalition agreement between the Liberal Democratic Party and the Japan Innovation Party says that the two parties aim to establish a committee to monitor foreign investments in Japan during the ordinary Diet session in 2026.

Top Articles in Politics

-

Japan PM Takaichi’s Cabinet Resigns en Masse

-

Sanae Takaichi Elected Prime Minister of Japan; Keeps All Cabinet Appointees from Previous Term

-

Japan’s Govt to Submit Road Map for Growth Strategy in March, PM Takaichi to Announce in Upcoming Policy Speech

-

LDP Wins Landslide Victory, Secures Single-party Majority; Ruling Coalition with JIP Poised to Secure Over 300 seats (UPDATE 1)

-

LDP Wins Historic Landslide Victory

JN ACCESS RANKING

-

Producer Behind Pop Group XG Arrested for Cocaine Possession

-

Japan PM Takaichi’s Cabinet Resigns en Masse

-

Man Infected with Measles Reportedly Dined at Restaurant in Tokyo Station

-

Israeli Ambassador to Japan Speaks about Japan’s Role in the Reconstruction of Gaza

-

Videos Plagiarized, Reposted with False Subtitles Claiming ‘Ryukyu Belongs to China’; Anti-China False Information Also Posted in Japan