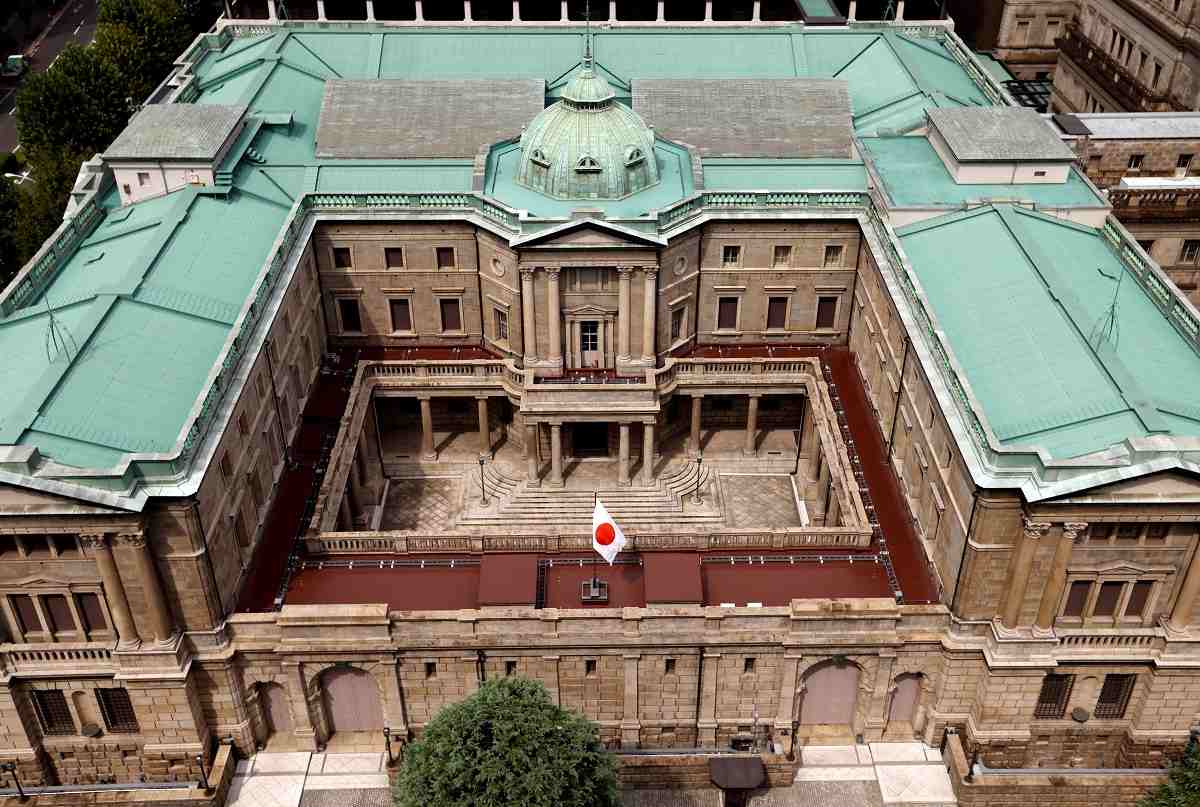

The Bank of Japan is seen in Tokyo in September 20, 2023.

12:47 JST, June 6, 2024

SAPPORO, Japan (Reuters) – Japan may see inflation fall short of the central bank’s 2% target next year if consumption stagnates, its dovish policymaker Toyoaki Nakamura said on Thursday, highlighting uncertainty over the timing of further interest rate hikes.

Nakamura, a sole dissenter to the Bank of Japan’s decision to exit negative interest rates in March, also warned of recent weak signs in consumption and slowing global growth that have clouded the outlook for Japan’s economy.

“While resilient, household spending has been sluggish recently as growth in disposable income has been small compared with rises in wages,” Nakamura said.

“I’m not confident that wage rises will be sustained” as small- and mid-sized firms have yet to undertake sufficient reforms to boost profits and keep raising pay, he said.

In current projections made in April, the nine-member board’s median forecast is for core consumer inflation to hit 1.9% in both the fiscal year beginning in April 2025, and the one following in fiscal 2026.

“My view is that inflation may not reach 2% from fiscal 2025 onward” if households curb spending and discourage companies from raising prices further, Nakamura said in a speech to business leaders in Japan’s northernmost city of Sapporo.

While big firms offered bumper pay hikes in this year’s annual wage negotiations with unions, there was uncertainty on whether smaller counterparts – which hire 80% of Japan’s workforce – can follow suit, Nakamura said.

Rising social welfare costs and a growing number of pensioners meant households’ disposable income has not risen as much as the wage increases suggest, he said, adding that some households likely tapped savings to weather rising living costs.

“Real wages need to turn positive and households’ disposable income to rise more, for a cycle of rising income and expenditure to strengthen,” Nakamura said, adding that it was appropriate to maintain current monetary policy for the time being.

While Nakamura is a dovish outlier in the nine-member board, his views highlight lingering uncertainties over whether the BOJ will see conditions fall in place to raise interest rates this year from current near-zero levels.

Japan’s economy shrank an annualized 2.0% in the first quarter as companies and households reduced spending, casting doubt on the central bank’s view of a moderate recovery.

Analysts expect growth to rebound in the current quarter, but a weak yen is weighing on household sentiment by pushing up the cost of imports for fuel and food.

BOJ Governor Kazuo Ueda has said the central bank will raise rates again if underlying inflation, which takes into account various price gauges, accelerates toward 2% as it projects.

Many market players expect the BOJ to raise rates again this year, though they are divided on whether it will happen in the third or fourth quarter.

Top Articles in News Services

-

Survey Shows False Election Info Perceived as True

-

Hong Kong Ex-Publisher Jimmy Lai’s Sentence Raises International Outcry as China Defends It

-

Japan’s Nikkei Stock Average Touches 58,000 as Yen, Jgbs Rally on Election Fallout (UPDATE 1)

-

Japan’s Nikkei Stock Average Falls as US-Iran Tensions Unsettle Investors (UPDATE 1)

-

Japan’s Nikkei Stock Average Rises on Tech Rally and Takaichi’s Spending Hopes (UPDATE 1)

JN ACCESS RANKING

-

Producer Behind Pop Group XG Arrested for Cocaine Possession

-

Japan PM Takaichi’s Cabinet Resigns en Masse

-

Man Infected with Measles Reportedly Dined at Restaurant in Tokyo Station

-

Israeli Ambassador to Japan Speaks about Japan’s Role in the Reconstruction of Gaza

-

Videos Plagiarized, Reposted with False Subtitles Claiming ‘Ryukyu Belongs to China’; Anti-China False Information Also Posted in Japan