A man looks at a stock quotation board showing Nikkei share average outside a brokerage in Tokyo

10:26 JST, April 3, 2025

TOKYO, April 3 (Reuters) – Japan’s Nikkei share average slumped to an eight-month low on Thursday after U.S. President Donald Trump revealed a broad set of reciprocal tariffs, including a 24% levy on Japanese goods.

The Nikkei .N225 fell as much as 4.6% in early trading, dropping to 34,102.00 for the first time since August 7. By 0050 GMT, the benchmark index recouped some losses to 2.9%.

Of the Nikkei’s 225 components, 216 were in the red, while just nine showed gains.

The broader Topix .TOPX lost as much as 4.3% before recovering slightly to trade down 3.1%.

“We thought tariffs would be 10%, maybe 20%, but instead they were a whopping 24%,” said Kazuo Kamitani, an equities strategist at Nomura Securities.

“Call it the Trump tariff shock,” he said. “The market is firmly in risk-off mode.”

Banks .IBNKS.T were the worst performers among the Tokyo Stock Exchange’s 33 industry groupings, sliding 6.4%, as a sharp decline in bond yields at home and abroad darkened the outlook for income from lending and investing.

The bourse’s automaker sub-index .ITEQP.T dropped nearly 4%, with a separate 25% tariff on car exports to the United States set to go into effect later on Thursday. Shares of Toyota Motor 7203.T slid 4.7%.

Chip-sector heavyweights also saw significant sell-offs. Tokyo Electron 8035.T, a chip-making equipment manufacturer, dropped 5.8%, while Advantest 6857.T, a chip-testing equipment maker and Nvidia supplier, slumped 4.9%.

Top Articles in Business

-

Japan, Italy to Boost LNG Cooperation; Aimed at Diversifying Japan’s LNG Sources

-

Honda to Launch New Electric Motorbike in Vietnam

-

Asics Opens Factory for Onitsuka Tiger Brand in Western Japan

-

Japan’s ANA to Introduce Nationwide Logistics Service Using Drones, Will Be Used to Deliver Supplies in Remote Areas

-

JR Tokai, Shizuoka Pref. Agree on Water Resources for Maglev Train Construction

JN ACCESS RANKING

-

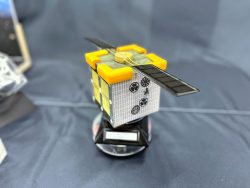

Univ. in Japan, Tokyo-Based Startup to Develop Satellite for Disaster Prevention Measures, Bears

-

JAL, ANA Cancel Flights During 3-day Holiday Weekend due to Blizzard

-

China Confirmed to Be Operating Drilling Vessel Near Japan-China Median Line

-

Japan Institute to Use Domestic Commercial Optical Lattice Clock to Set Japan Standard Time

-

China Eyes Rare Earth Foothold in Malaysia to Maintain Dominance, Counter Japan, U.S.