Customs Fails to Collect ¥2.1 Billion in Consumption Tax from Visitors to Japan in FY22

Foreign customers go through tax-free procedures at the Takashimaya Shinjuku department store in Shibuya Ward, Tokyo.

6:00 JST, May 16, 2023

Japan’s customs authorities were unable to collect about ¥2.1 billion in consumption tax last fiscal year from visitors to Japan who made tax-free purchases of goods that were deemed not to have actually met tax exemption requirements, it has been learned.

The authorities have determined that last fiscal year, a total of ¥2.2 billion in consumption tax should have been collected on such purchases, but nearly all of that went uncollected because many of those who made such purchases left Japan without paying. Experts suspect that shady operators who make a profit on the domestic resale of such goods are behind the cases, and urge early discussions with a review of the nation’s customs system in mind.

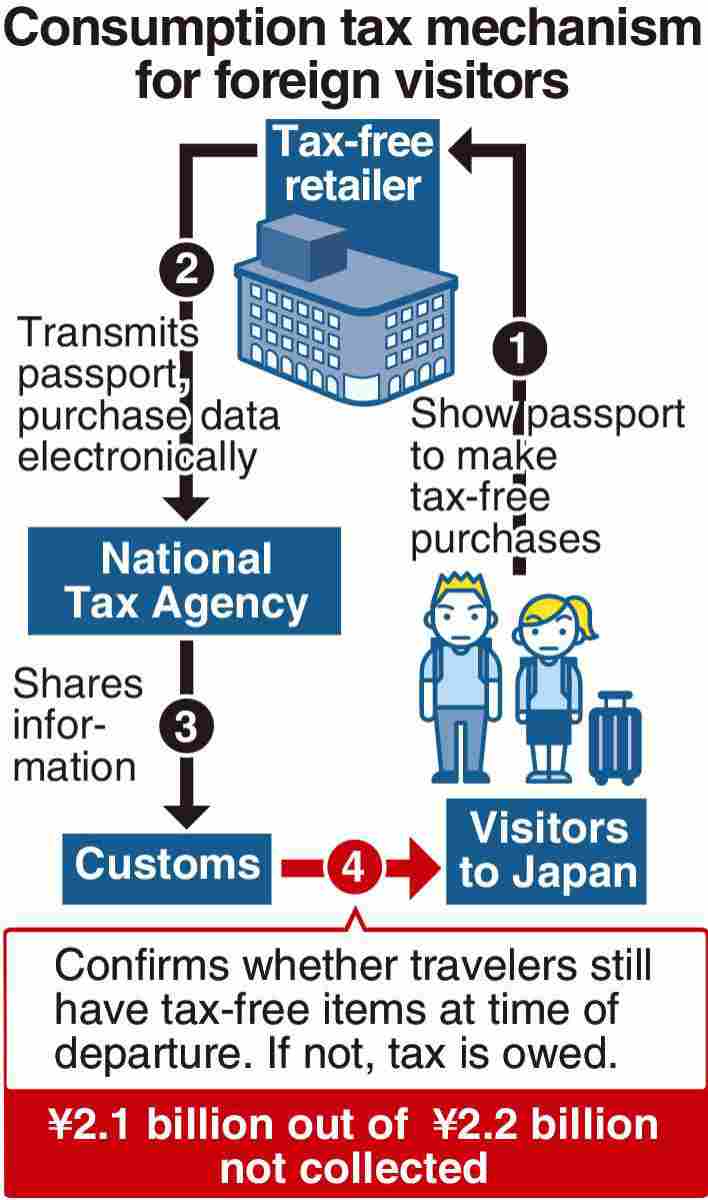

Consumption tax is imposed on goods and services consumed domestically, so visitors to Japan who wish to take goods out of the country are allowed to purchase them tax-free. Goods purchased in this way are not allowed to be resold in Japan, and consumption tax is levied when visitors leave Japan if they no longer possess the goods they bought tax-free.

Starting in fiscal 2020, customs authorities stepped up efforts to check if visitors still possess their tax-free purchases when they leave Japan. Thanks to the computerization of tax-free procedures in the same fiscal year, passport information and purchase record data are electronically transmitted from duty-free stores to the National Tax Agency (NTA) and then shared with customs authorities.

The technology has allowed the authorities to immediately recognize information on people who made bulk buys or other suspicious purchases, stop them at the airport before their departure and decide that consumption tax is owed if they do not have the items in question on hand.

According to the Finance Ministry, customs authorities intended to collect about ¥2.2 billion in total from 366 visitors to Japan last fiscal year, but only 213 people paid the tax — about ¥70 million in total — and about ¥2.1 billion went uncollected.

In one case, according to a customs official, a Taiwanese couple in their 30s who purchased about ¥470 million worth of luxury watches and cosmetics tax-free did not have their purchases with them at the time of their departure. The couple claimed that the items had been sent by international mail. Since the names and quantities of the items listed on the postal invoice receipt did not match the purchase record, customs decided to levy about ¥47 million in consumption tax, but the couple left Japan without paying it.

It is usually difficult to take visitors into custody and keep them from leaving the country for not paying the tax. And it is virtually impossible to collect the tax once they leave the country.

Since goods obtained without paying consumption tax can yield a profit if they are resold in Japan, there are cases in which resellers pay visitors to make tax-free purchases of goods on their behalf in Japan.

Customs investigations have found cases of young people in their 20s purchasing large quantities of high-value items allegedly for the purpose of resale.

“They are probably getting paid by resellers and buying duty-free goods as if it were some kind of part-time job,” a customs official said.

In Japan, customers visiting from overseas present their passports at the time of purchase and pay an amount that is exempt from consumption tax.

In contrast, there are other countries that adopt a tax refund system, which generally does not allow tax to be waived at the time of purchase, but instead gives tax refunds after the items to be taken out of the country are confirmed to be in the travelers’ possession at the time of departure. This method is said to prevent reselling.

Liability for purchasers

The national taxation authorities, like their customs counterparts, can also check visitors who made suspicious large purchases based on data transmitted from tax-free retailers. However, according to the NTA, only 30 such inspections were carried out nationwide in the year through June 2022. Behind the low number of inspections is that in many cases, the purchasers’ whereabouts were unknown or they had already returned to their home countries.

Under the circumstances, a revised consumption tax law was enacted on May 1 to strengthen measures against operators that buy duty-free goods from travelers. The revised law allows not only tax-free goods purchasers but also vendors who buy from them to be liable for paying taxes if resale is confirmed.

“We will strengthen investigations to prevent unscrupulous tax-free purchases for resale,” a senior NTA official said.

Top Articles in Society

-

Producer Behind Pop Group XG Arrested for Cocaine Possession

-

Man Infected with Measles Reportedly Dined at Restaurant in Tokyo Station

-

Man Infected with Measles May Have Come in Contact with Many People in Tokyo, Went to Store, Restaurant Around When Symptoms Emerged

-

Woman with Measles Visited Hospital in Tokyo Multiple Times Before Being Diagnosed with Disease

-

Australian Woman Dies After Mishap on Ski Lift in Nagano Prefecture

JN ACCESS RANKING

-

Producer Behind Pop Group XG Arrested for Cocaine Possession

-

Japan PM Takaichi’s Cabinet Resigns en Masse

-

Man Infected with Measles Reportedly Dined at Restaurant in Tokyo Station

-

Israeli Ambassador to Japan Speaks about Japan’s Role in the Reconstruction of Gaza

-

Videos Plagiarized, Reposted with False Subtitles Claiming ‘Ryukyu Belongs to China’; Anti-China False Information Also Posted in Japan