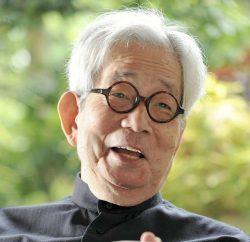

Economic Revitalization Minister Ryosei Akazawa looks on during a press conference after meeting U.S. Secretary of the Treasury Scott Bessent, in Osaka on July 19.

15:38 JST, July 27, 2025

TOKYO (Reuters) — Japan’s $550 billion investment package agreed in this week’s U.S. tariff deal could help finance a Taiwan firm building semiconductor plants in the U.S., Japan’s top trade negotiator Ryosei Akazawa said on Saturday.

Japan agreed to the sweeping U.S.-bound investment initiative, which includes equity, loans and guarantees, in exchange for lower tariffs on its exports to the U.S.

However, the structure of the scheme remains unclear.

“Japan, the United States, and like-minded countries are working together to build supply chains in sectors critical to economic security,” Akazawa told public broadcaster NHK.

To that end, he said projects eligible for financing under the package are not limited to U.S. or Japanese firms.

“For example, if a Taiwan chipmaker builds a plant in the U.S. and uses Japanese components or tailors its products to meet Japanese needs, that’s fine too,” he said, without specifying companies.

The U.S. is significantly reliant on Taiwan’s TSMC 2330.TW for advanced chip manufacturing, raising economic security concerns due to geographic proximity to China.

TSMC announced plans for a $100 billion U.S. investment with U.S. President Donald Trump at the White House in March, on top of $65 billion pledged for three plants in the state of Arizona, one of which is up and running.

Japan will use state-owned Japan Bank for International Cooperation (JBIC) and Nippon Export and Investment Insurance (NEXI) for the investments. A recent law revision has enabled JBIC to finance foreign companies deemed critical to Japan’s supply chains.

Akazawa told NHK that equity investment would account for just about 1%-2% of the $550 billion, suggesting that the bulk will come in the form of loans and guarantees.

When asked about the White House statement that the U.S. would retain 90% of the profits from the package, he clarified that the figure refers only to returns on equity investment, which would represent a small fraction of the total.

While Japan initially hoped to secure half of the returns, a loss from the concession on the profit-sharing would be marginal compared to the roughly ¥10 trillion ($67.72 billion) in tariff costs that could be avoided under the deal, he said.

He added that Japan aims to deploy the $550 billion investments during Trump’s current term.

Top Articles in News Services

-

Survey Shows False Election Info Perceived as True

-

Hong Kong Ex-Publisher Jimmy Lai’s Sentence Raises International Outcry as China Defends It

-

Japan’s Nikkei Stock Average Falls as US-Iran Tensions Unsettle Investors (UPDATE 1)

-

Japan’s Nikkei Stock Average Touches 58,000 as Yen, Jgbs Rally on Election Fallout (UPDATE 1)

-

Japan’s Nikkei Stock Average Rises on Tech Rally and Takaichi’s Spending Hopes (UPDATE 1)

JN ACCESS RANKING

-

Producer Behind Pop Group XG Arrested for Cocaine Possession

-

Japan PM Takaichi’s Cabinet Resigns en Masse

-

Man Infected with Measles Reportedly Dined at Restaurant in Tokyo Station

-

Israeli Ambassador to Japan Speaks about Japan’s Role in the Reconstruction of Gaza

-

Videos Plagiarized, Reposted with False Subtitles Claiming ‘Ryukyu Belongs to China’; Anti-China False Information Also Posted in Japan