Nonalcoholic cocktails are served at the Green Spot bar in Chuo Ward, Osaka. More and more bars are offering such cocktails.

14:00 JST, December 24, 2023

The market for nonalcoholic drinks is expanding. In addition to people becoming more health-conscious following the COVID-19 pandemic, major beer manufacturers are seeing increased business opportunities in the sector and continue to launch new products. There is a growing trend of drinking less alcohol, especially among young people.

On Oct. 24, Asahi Breweries, Ltd. launched its nonalcoholic beer brand “Asahi Zero,” which is currently being sold exclusively in the Kansai region. The company says that the drink has a nice flavor and smooth texture comparable to alcoholic beer, which was achieved by brewing a stronger-than-usual beer and then completely removing its alcohol content using a unique method.

For Asahi, which already sells two nonalcoholic beer brands, this is the first brand that tries to replicate the authentic taste of alcoholic beer.

At a press conference held in Osaka on the day of the launch, Toshinori Kurachi, general manager of the company’s Kinki region headquarters, said: “Until now, nonalcoholic beers have been consumed as a beer substitute as there is no other choice. This time, we have created a taste that is clearly different from the conventional nonalcoholic beers. We will continue striving to make beer that people choose as they want to drink it.”

Asahi Breweries is rapidly introducing several nonalcoholic drinks. In February last year, the company revamped its Dry Zero brand, and on Nov. 14 they added a yogurt-flavored product to the cocktail-style Style Balance series, which contains L-92 lactic acid bacteria that is said to help maintain immune function.

“More and more people want to enjoy the atmosphere of alcohol, even if they don’t want to get drunk. We want to meet various needs,” said Kurachi.

Kirin Brewery Co. and Suntory Holdings Ltd. have also improved and launched nonalcoholic drinks this year. Nonalcoholic drinks are becoming the main battleground for beer giants.

‘Sober curious’

Nonalcoholic drinks are surprisingly new. The first completely alcohol-free beer was introduced in 2009. Before then, there were some drinks that were marketed as nonalcoholic but actually contained a small amount of alcohol. In April 2009, Kirin launched Kirin Free, the world’s first completely alcohol-free beer.

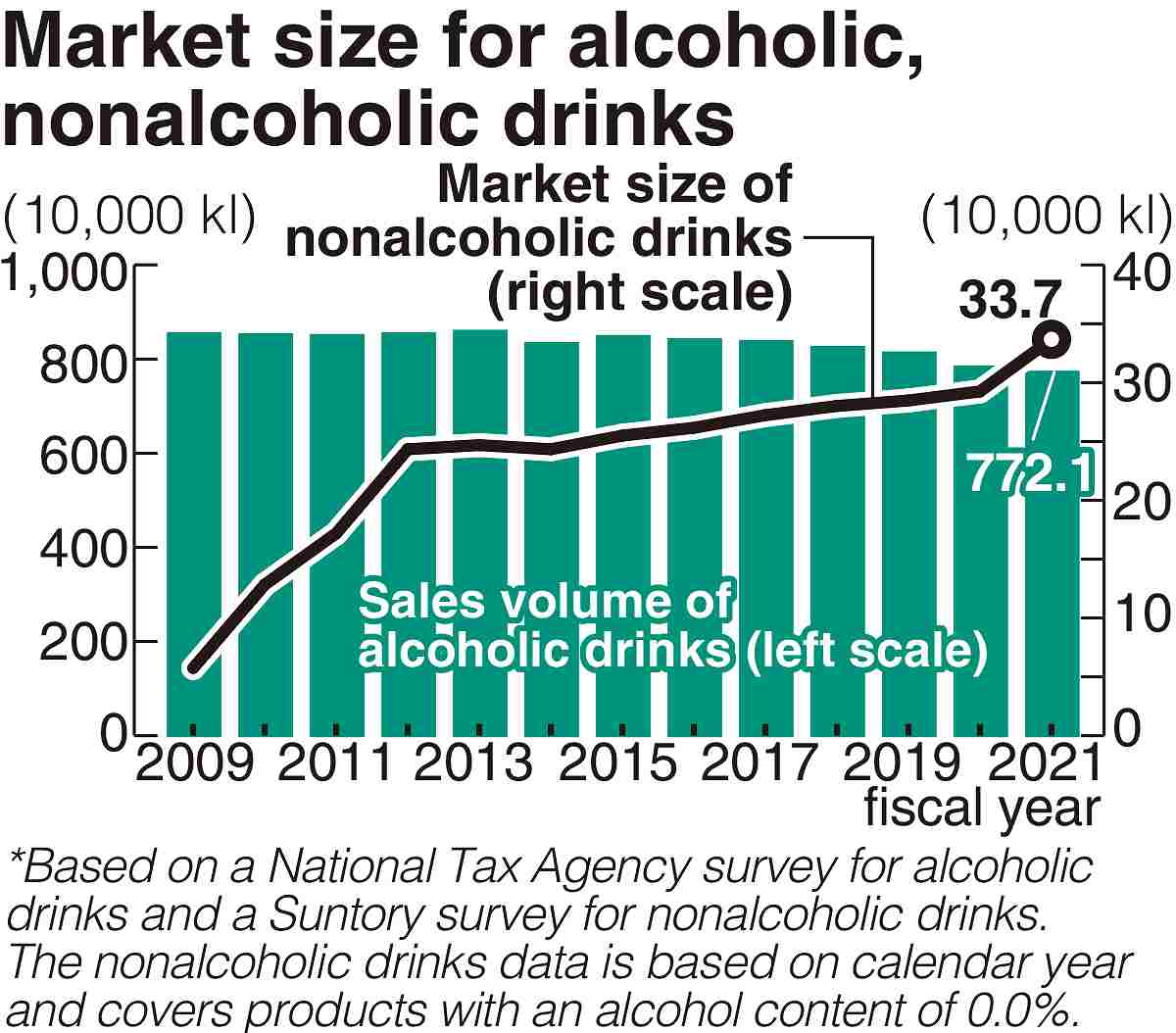

At the time, drunk driving was a social problem, so other beer giants also began to launch similar products. A variety of other nonalcoholic drinks, such as cocktails and sours, were also made available over time. They became more popular as consumers became more health-conscious. Suntory estimates that the market size for nonalcoholic drinks in 2021 was 337,000 kiloliters, double that of 10 years ago.

The beer companies’ focus on nonalcoholic drinks is largely driven by a sense of crisis over the growing public trend of drinking less alcohol, in both quantity and frequency, especially among young people. According to the National Tax Agency, the domestic sales volume of alcoholic drinks in fiscal 2021 was 7,721,000 kiloliters, a 20% decrease from its peak in fiscal 1996.

The lifestyle of not drinking alcohol despite being able to drink is called “sober curious.” It started in Europe and the United States and is spreading in Japan, too. According to the 2019 National Health and Nutrition Survey conducted by the Health, Labor and Welfare Ministry, 53.1% of the respondents do not or rarely drink alcohol. For those in their 20s, the percentage was 55.9%.

Amid this trend, there have been moves by other companies to enter the nonalcoholic drink market. In October last year, Takara Shuzo Co. returned to the market after a 15-year absence with the launch of “Karakuchi Zero Ball,” a nonalcoholic canned chu-hai (a shochu-based drink). The product has a dry taste with no sugar or purine and is selling well, the company says.

Takara Shuzo used to sell a beer-flavored drink, called Barbican, but withdrew from the nonalcoholic drink market in 2007. The company official in charge said enthusiastically: “At that time, the concept of nonalcoholic drinks was not widely accepted and we struggled so hard. Now, at last, there is an environment in which we can be fully active.”

‘Mocktails’ in bars

The nonalcoholic drink boom is also spreading to the restaurant industry. Green Spot, a bar in Shinsaibashi area of Osaka, has been offering alcohol-free “mocktails” (the word comes from a combination of “mock” and “cocktail”) since the bar opened in 2016. Its menu lists 19 standard and original mocktails.

“I can’t drink a lot, but I want to have a good time with friends over drinks. With mocktails, I can come to a bar with peace of mind,” said a company employee from Osaka.

Owner and bartender, Takefumi Yagi, 40, said: “Offering mocktails can lower a psychological barrier for people who can’t drink to go to bars. I hope both people who can drink and people who can’t drink will enjoy the atmosphere and conversation at my bar.”

Japanese sake popular overseas

As the alcohol consumption in Japan continues to decline, major Japanese alcoholic drink manufacturers are focusing on overseas markets. Some companies have developed and are actively promoting new products aimed at wealthy consumers in North America and China.

The export value of alcoholic drinks reached a record high of ¥139.2 billion in 2022, an increase of 21.4% from the previous year. Among these, whisky saw the largest increase by 21.5% to ¥56 billion, followed by sake, increased by 18.2% to ¥47.4 billion. Shochu (including awamori) also increased by 24.4% to ¥2.1 billion.

Takara Shuzo International Co., a group company of Takara Shuzo that operates businesses overseas, developed Sho Chiku Bai Shirakabegura “Shiho,” a sake exclusively for overseas markets, and began exporting it to the United States in August last year. The sake, with a fruity aroma, is a luxury junmai daiginjo type made from the Yamadanishiki sake rice produced in Hyogo Prefecture. The company says that the sake has been well received. It is mainly sold to high-end Japanese restaurants in the United States. The company exports the sake in a 640-milliliter bottle to be served to restaurant customers for about $900 (about ¥130,000).

“Japanese sake becoming more popular, partly thanks to the Japanese food boom. High-quality premium sake is especially popular,” the company official in charge said.

Top Articles in Features

-

Tokyo’s New Record-Breaking Fountain Named ‘Tokyo Aqua Symphony’

-

Sapporo Snow Festival Opens with 210 Snow and Ice Sculptures at 3 Venues in Hokkaido, Features Huge Dogu

-

Tourists Flock to Ice Dome Lodge at Resort in Hokkaido, Japan; Facility Invites Visitors to Sleep on Beds Made of Ice

-

High-Hydration Bread on the Rise, Seeing Increase in Specialty Shops, Recipe Searches

-

Heirs to Kyoto Talent: Craftsman Works to Keep Tradition of ‘Kinran’ Brocade Alive Through Initiatives, New Creations

JN ACCESS RANKING

-

Japan PM Takaichi’s Cabinet Resigns en Masse

-

Japan Institute to Use Domestic Commercial Optical Lattice Clock to Set Japan Standard Time

-

Israeli Ambassador to Japan Speaks about Japan’s Role in the Reconstruction of Gaza

-

Man Infected with Measles Reportedly Dined at Restaurant in Tokyo Station

-

Videos Plagiarized, Reposted with False Subtitles Claiming ‘Ryukyu Belongs to China’; Anti-China False Information Also Posted in Japan