The logo of Rakuten is pictured at the headquarters of Rakuten in Tokyo on May 15, 2019.

17:55 JST, April 1, 2024

TOKYO (Jiji Press) — Rakuten Group Inc. said Monday that it will begin talks with publicly traded unit Rakuten Bank over reorganizing the group’s fintech businesses.

The group is aiming to consolidate its banking, credit card, securities, insurance and other finance operations in October.

Rakuten Group hopes to boost its earning power by further improving the management efficiency of its robust finance businesses through the reorganization, after the group incurred losses for five consecutive years due to its sluggish mobile phone business.

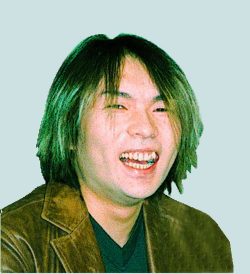

“There is greater synergy when [finance operations] are together than when they are apart,” Rakuten Group Chairman and CEO Hiroshi Mikitani told reporters in Tokyo Monday after a ceremony for the company’s newly hired employees.

Rakuten Group’s finance businesses posted a combined operating profit of ¥122.9 billion in 2023, exceeding the ¥76.8 billion profit of its internet-related businesses.

Rakuten Bank, in which the group owns a 49 pct stake, boasted over 15 million accounts as of February, the most among Japanese online banks. Rakuten Bank made its debut on the Tokyo Stock Exchange’s top-tier Prime section last April.

The group’s online brokerage firm Rakuten Securities Holdings Inc. is popular among individual investors, including those who began investing following the January expansion of the Nippon Individual Savings Account, or NISA, tax exemption scheme for small-lot investments. It had about 10.2 million accounts as of the end of 2023.

Rakuten Securities has been establishing strong ties with Mizuho Financial Group Inc., receiving investments through Mizuho Securities Co. of the megabank group.

Rakuten Group is expected to give up plans to take Rakuten Securities Holdings public.

Top Articles in Business

-

Prudential Life Insurance Plans to Fully Compensate for Damages Caused by Fraudulent Actions Without Waiting for Third-Party Committee Review

-

Narita Airport, Startup in Japan Demonstrate Machine to Compress Clothes for Tourists to Prevent People from Abandoning Suitcases

-

Japan, U.S. Name 3 Inaugural Investment Projects; Reached Agreement After Considerable Difficulty

-

Toyota Motor Group Firm to Sell Clean Energy Greenhouses for Strawberries

-

SoftBank Launches AI Service for Call Centers That Converts Harsh Customer Voices into Softer Voices

JN ACCESS RANKING

-

Japan PM Takaichi’s Cabinet Resigns en Masse

-

Japan Institute to Use Domestic Commercial Optical Lattice Clock to Set Japan Standard Time

-

Israeli Ambassador to Japan Speaks about Japan’s Role in the Reconstruction of Gaza

-

Man Infected with Measles Reportedly Dined at Restaurant in Tokyo Station

-

Videos Plagiarized, Reposted with False Subtitles Claiming ‘Ryukyu Belongs to China’; Anti-China False Information Also Posted in Japan