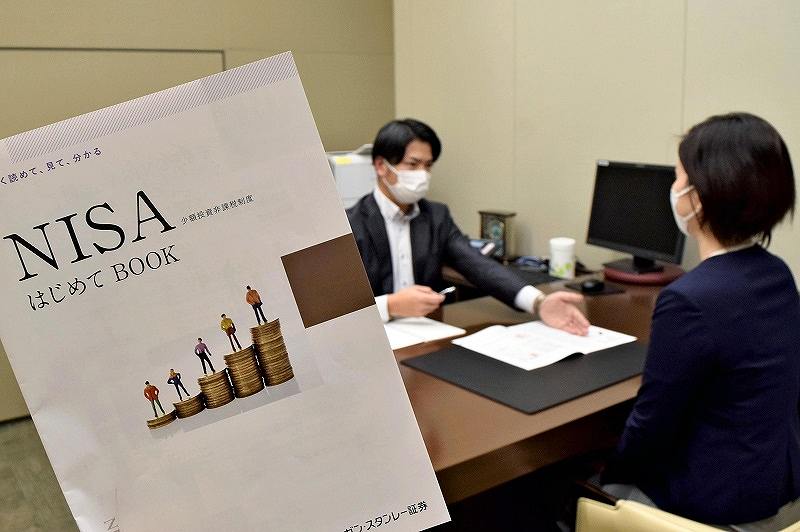

A Mitsubishi UFJ Morgan Stanley Securities Co. representative explains about NISA at a customer service counter/the company’s service counter in Chiyoda Ward, Tokyo, Nov. 25.

2:00 JST, December 14, 2022

The government and the ruling parties have begun discussions on revising the Nippon Individual Savings Account (NISA) investment scheme by integrating two different types of NISA with a lifetime investment limit of ¥18 million.

The plan will be included in the ruling parties’ tax reform plan for fiscal 2023, and will be the centerpiece of Prime Minister Fumio Kishida’s plan to double asset income.

Currently, investors can choose to open either an installment-type or a general NISA. The installment-type NISA is designed for medium- to long-term asset building and allows investment through trusts, while the general NISA allows investors to purchase stocks.

In the plan, the lifetime investment limit of the general NISA will be ¥12 million, or two-thirds of the total lifetime investment, and the annual investment limit will be ¥2.4 million, double the current limit. The annual investment limit for the installment-type will be tripled from ¥400,000 to ¥1.2 million.

The government will make the system permanent after 2024, and income and capital gains from financial products managed under NISA will be exempted from tax indefinitely.

At an executive meeting of the Liberal Democratic Party’s Research Commission on the Tax System on Monday, a proposal was discussed to set the lifetime investment limit at ¥15 million and the new general NISA limit at half that amount, ¥7.5 million. It is believed that subsequent discussion with the government resulted in an increase in the cap.

Top Articles in Society

-

Producer Behind Pop Group XG Arrested for Cocaine Possession

-

Man Infected with Measles Reportedly Dined at Restaurant in Tokyo Station

-

Man Infected with Measles May Have Come in Contact with Many People in Tokyo, Went to Store, Restaurant Around When Symptoms Emerged

-

Woman with Measles Visited Hospital in Tokyo Multiple Times Before Being Diagnosed with Disease

-

Australian Woman Dies After Mishap on Ski Lift in Nagano Prefecture

JN ACCESS RANKING

-

Producer Behind Pop Group XG Arrested for Cocaine Possession

-

Japan PM Takaichi’s Cabinet Resigns en Masse

-

Man Infected with Measles Reportedly Dined at Restaurant in Tokyo Station

-

Israeli Ambassador to Japan Speaks about Japan’s Role in the Reconstruction of Gaza

-

Videos Plagiarized, Reposted with False Subtitles Claiming ‘Ryukyu Belongs to China’; Anti-China False Information Also Posted in Japan