Japan’s Parties Promise Consumption Tax Cuts, But Bill Must Be Paid in the Future

A customer puts vegetables into a shopping basket at a supermarket on Jan. 23 in Koshigaya, Saitama Prefecture.

18:55 JST, February 8, 2026

In the House of Representatives election held on Sunday, most political parties, including the ruling Liberal Democratic Party and the opposition Centrist Reform Alliance, made campaign pledges to reduce or eliminate the consumption tax. The pledges were presented as measures against rising prices and for stimulating the economy.

The consumption tax is an important financial resource for four key areas: pensions, healthcare, nursing care and support for child-rearing. As Japan’s aging population and declining birthrate will push up such social security expenditures, cutting the tax or abolishing it without securing alternative financing resources could shift the burden onto taxpayers in the future.

Support for pensions, medical care

The consumption tax was introduced on April 1, 1989, at a rate of 3%. After increases in 1997, 2014 and 2019, the rate currently stands at 10% for most goods and services, with a reduced rate of 8% applied to certain items, such as food.

Since fiscal 1999, the consumption tax revenue has financed the three areas of pensions, healthcare and nursing care. From fiscal 2014 onward a fourth area was added — childcare support.

The consumption tax is borne by everyone, regardless of age or gender, when purchasing goods or services. It has been considered a financing resource suitable for social security systems, which are used by a broad range of generations, from young people to the elderly.

In the initial budget for fiscal 2026, the “four social security expenditures,” meaning combined national and local government spending on pensions, healthcare and other areas, totaled ¥48.9 trillion.

The spending has been growing year after year due to rising pension and medical costs amid the low birthrate and aging population, as well as expanded child-rearing support measures, such as free high school education.

Of these expenses, national expenditures totaled ¥34.6 trillion, up ¥6.4 trillion from fiscal 2016, a decade ago. The breakdown shows pensions at ¥14.6 trillion, accounting for the largest portion, followed by healthcare at ¥12.7 trillion, nursing care for the elderly at ¥3.8 trillion and childcare support at ¥3.6 trillion.

Meanwhile, the national and local consumption tax revenue combined is expected to reach ¥34.0 trillion. Although this shows an increase of ¥12.2 trillion from fiscal 2016 due to such factors as price increases in 2022 and later, it does not fully cover the four major social security expenditures.

The government has made up for the financing shortfall by issuing deficit-covering government bonds, among other measures.

A significant part of the consumption tax revenues serves as a resource for financing local governments’ social security measures. When the standard 10% rate is divided between the national and local governments, the share for the national government is 7.8%, and it is 2.2% for local governments.

But 1.52% essentially passes through the central government on its way to local governments as local tax grants. The bottom line is that nearly 40% of the consumption tax revenue becomes a financing resource for local governments.

Array of party promises

In the lower house election, the LDP and its junior coalition partner, the Japan Innovation Party, pledged to temporarily exempt food items from the consumption tax “for two years,” while the CRA advocates a policy of permanently eliminating the tax on food items.

Meanwhile, the Democratic Party for the People calls for uniformly lowering the rate to 5% “until wage increases stably reach the level of the inflation rate plus 2%.”

The Japanese Communist Party, seeking to eventually abolish the tax, calls for an immediate cut to a uniform 5%.

Sanseito and Reiwa Shinsengumi advocate for the abolition of the tax. Team Mirai prioritizes lowering social insurance premiums and advocates that it will “protect” the consumption tax rate as a resource to cover social security expenses.

Considering such proposals mathematically, reducing the tax on food items to zero would result in annual tax revenue losses of approximately ¥5 trillion, cutting the rate to a flat 5% would lead to ¥16 trillion in losses, and scrapping it would cause ¥34 trillion in losses.

Regarding alternative revenue sources, the LDP proposes reviewing special taxation measures that reduce corporate taxes and the like, and utilizing nontax revenue. The CRA proposes utilizing profits made through the management of government-affiliated funds and breaking into the special-purpose state funds. The JCP advocates reviewing what it calls the excessively preferential tax system for large corporations and the wealthy.

However, it remains unpredictable whether reviewing special taxation measures and the like alone can cover the revenue shortfall.

Even if the government relies on profits from government-affiliated funds, it remains uncertain whether they can provide a stable financing resource. The alternative funding proposals need to be more specific.

Regarding the proposal to temporarily lower the consumption tax rate, there is debate over whether it would really be possible to raise the rate again later.

Should the consumption tax be cut or abolished without securing stable alternative financing resources, it would further widen the revenue shortfall for social security expenditures. In that case, increasing the issuance of deficit bonds becomes an option. But the ratio of government debt to GDP in Japan stands at approximately 230%, the worst level among advanced nations.

Increasing government bond issuance too easily could trigger higher interest rates in the market, potentially leading to an increased burden on businesses and households in the form of higher borrowing costs.

If the national and local governments’ spending combined cannot cover the costs of the social security system, it becomes increasingly likely that working generations will face higher social insurance premiums, or that benefit and service levels for healthcare and childcare support will have to be reduced.

Related Tags

Top Articles in Politics

-

Japan Tourism Agency Calls for Strengthening Measures Against Overtourism

-

Voters Using AI to Choose Candidates in Japan’s Upcoming General Election; ChatGPT, Other AI Services Found Providing Incorrect Information

-

Japan’s Prime Minister: 2-Year Tax Cut on Food Possible Without Issuing Bonds

-

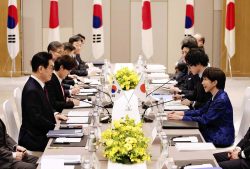

Japan-South Korea Leaders Meeting Focuses on Rare Earth Supply Chains, Cooperation Toward Regional Stability

-

Japanese Government Plans New License System Specific to VTOL Drones; Hopes to Encourage Proliferation through Relaxed Operating Requirements

JN ACCESS RANKING

-

Japan Institute to Use Domestic Commercial Optical Lattice Clock to Set Japan Standard Time

-

China Eyes Rare Earth Foothold in Malaysia to Maintain Dominance, Counter Japan, U.S.

-

Man Infected with Measles May Have Come in Contact with Many People in Tokyo, Went to Store, Restaurant Around When Symptoms Emerged

-

Japan, Qatar Ministers Agree on Need for Stable Energy Supplies; Motegi, Qatari Prime Minister Al-Thani Affirm Commitment to Cooperation

-

Australian Woman Dies After Mishap on Ski Lift in Nagano Prefecture