Consumption Tax Cut Could Cause Headaches for Retailers; Updates to Point-of-Sale Systems Expected to Take Time

A sales floor is crowded with shoppers in Kochi City.

15:10 JST, February 5, 2026

Japan’s major political parties have made cutting the consumption tax rate part of their campaign pledges ahead of Sunday’s House of Representatives election, but these promises could lead to practical difficulties at the checkout counters of stores across the country.

Implementing a reduced consumption tax rate will require updating the systems that manage product sales records, and both the retailers that use these systems and the manufacturers that provide them are likely to find themselves scrambling to carry out this overhaul as quickly as possible.

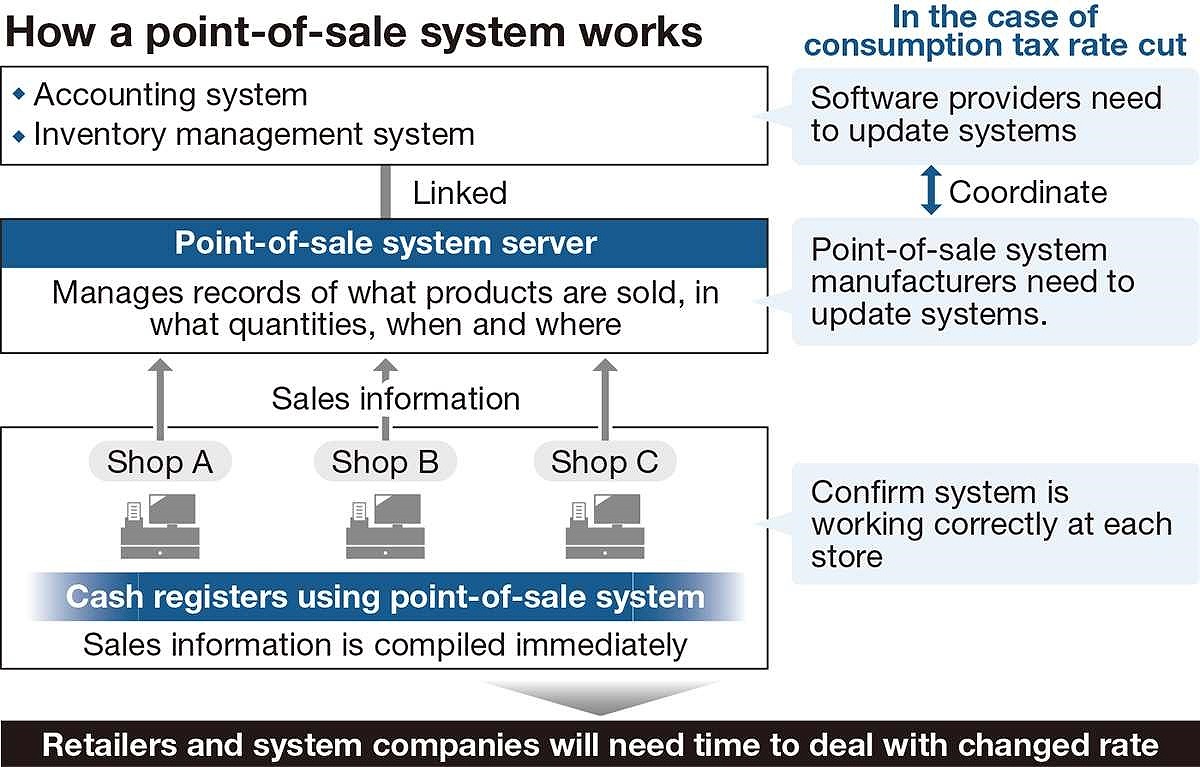

Supermarkets, convenience stores and many other retailers use “point-of-sale” systems that manage sales records, including what items are sold, and when and where transactions take place.

When a sale is made at one of these stores, a cash register reads a barcode containing product information such as the price. These details are checked against the system’s product data, and data on the sale is recorded. The point-of-sale system compiles this information, which the retailer then uses for purchase planning and sales management.

Electronic cash registers used at individually owned stores and small businesses are not connected to such networks, so many of them will be able to adjust their systems in accordance with a consumption tax cut within the space of a few hours.

By contrast, businesses that employ point-of-sale systems will require significantly more time to prepare for such a change. According to one major manufacturer of these technologies, not only retailers’ management systems but also their point-of-sale systems will have to be updated, because these are connected to their accounting and inventory management systems.

Recruit Co., which supplies point-of-sale services mainly to small and midsize businesses, predicts that implementing such changes could take “from six months to one year.” Large system manufacturers that have many clients across a broad range of industries will likely require even longer to complete this work.

“System-related business operators with a large market share will take at least one year to make these upgrades,” Prime Minister Sanae Takaichi told the lower house’s Budget Committee in November.

“The modifications to be made will differ depending on factors such as what items receive a tax cut and what the new rate is,” said an official at a major system maker. “It’s hard to say exactly how we’ll deal with this issue.”

Should the consumption tax rate be trimmed only temporarily, point-of-sale systems will need to be updated again when the cut expires. “We’ll need to simulate various scenarios,” an official at another system manufacturer said.

Related Tags

Top Articles in Politics

-

Japan Tourism Agency Calls for Strengthening Measures Against Overtourism

-

Japan Seeks to Enhance Defense Capabilities in Pacific as 3 National Security Documents to Be Revised

-

Japan’s Prime Minister: 2-Year Tax Cut on Food Possible Without Issuing Bonds

-

Japan-South Korea Leaders Meeting Focuses on Rare Earth Supply Chains, Cooperation Toward Regional Stability

-

Voters Using AI to Choose Candidates in Japan’s Upcoming General Election; ChatGPT, Other AI Services Found Providing Incorrect Information

JN ACCESS RANKING

-

Univ. in Japan, Tokyo-Based Startup to Develop Satellite for Disaster Prevention Measures, Bears

-

JAL, ANA Cancel Flights During 3-day Holiday Weekend due to Blizzard

-

Japan Institute to Use Domestic Commercial Optical Lattice Clock to Set Japan Standard Time

-

China Eyes Rare Earth Foothold in Malaysia to Maintain Dominance, Counter Japan, U.S.

-

Japan, Qatar Ministers Agree on Need for Stable Energy Supplies; Motegi, Qatari Prime Minister Al-Thani Affirm Commitment to Cooperation