Traders work on the floor at the New York Stock Exchange (NYSE) in New York City, U.S., December 17, 2025.

11:57 JST, December 30, 2025

NEW YORK, Dec 29 (Reuters) – Wall Street’s main indexes ended lower on Monday, kicking off the final week of the year on a softer note, as heavyweight technology stocks retreated from last week’s gains that had pushed the S&P 500 to record highs.

The information technology sector weighed on the S&P 500, as most tech and AI-linked stocks declined. Nvidia slipped 1.2% and Palantir Technologies dropped 2.4%.

“This is (not) the beginning of the end of the tech dominance, it’ll turn out to be a buying opportunity,” said Hank Smith, director and head of investment strategy at Haverford Trust.

“A big reason for that is the top tech names, excluding Tesla, do not have challenging valuations given their growth rate, the moat around their business and their financial strength, which is unparalleled.”

The S&P 500 lost 24.20 points, or 0.35%, to 6,905.74 and the Nasdaq Composite lost 118.75 points, or 0.50%, to 23,474.35.

The Dow Jones Industrial Average fell 249.04 points, or 0.51%, to 48,461.93.

Tesla fell 3.3% after hitting a record high last week, weighing on the consumer discretionary sector.

Materials slipped, with precious-metal miners sliding as silver dropped sharply after topping $80 per ounce for the first time, while gold also fell after back-to-back record highs last week.

Conversely, energy stocks gained almost 1%, tracking a 2% rise in oil prices.

Bank stocks also retreated after a strong rally this year. Citigroup, among major gainers this year due to progress on resolving some regulatory problems, dropped 1.9% on Monday. The stock has gained nearly 68% since the start of the year.

Stocks pulled back after the S&P 500 was within 1% of the 7,000-point mark. The blue-chip Dow hit a record closing high last week.

Some investors were hoping for a “Santa Claus rally,” a seasonal phenomenon where the S&P 500 typically posts gains in the last five trading days of the year and the first two in January, according to Stock Trader’s Almanac.

All three indexes were headed for firm monthly gains, with the Dow and S&P 500 on pace for their eighth consecutive month in the green.

The bull market, which began in October 2022, stayed intact despite concerns over high valuations of technology companies and market volatility. With traders still optimistic about AI, interest-rate cuts and a resilient economy, all three main indexes are set for their third consecutive yearly gain.

Most strategists also expected gains in 2026.

With expectations for continued global economic expansion and further easing by the Federal Reserve, it would be unusual to see a significant equity setback or bear market without a recession, said Peter Oppenheimer, chief global equities strategist at Goldman Sachs, in a recent note.

On the macro front, minutes from the Fed’s previous meeting and a weekly reading of jobless claims will be on the radar in an otherwise data-light week.

The S&P 500 has added about 17% so far this year, as the frenzy to capitalize on AI helped the U.S. benchmark overtake Europe’s STOXX 600, despite investors diversifying away from U.S. stocks earlier in the year.

DigitalBridge surged 9.6%, with Japan’s SoftBank Group set to acquire the digital infrastructure investor in a deal valued at $4 billion.

Declining issues outnumbered advancers by a 1.63-to-1 ratio on the NYSE. There were 154 new highs and 83 new lows on the NYSE.

On the Nasdaq, 1,386 stocks rose and 3,305 fell as declining issues outnumbered advancers by a 2.38-to-1 ratio.

The S&P 500 posted 10 new 52-week highs and 2 new lows while the Nasdaq Composite recorded 37 new highs and 249 new lows.

Volume on U.S. exchanges was 13.08 billion shares, compared with the 16.2 billion average for the full session over the last 20 trading days.

Top Articles in News Services

-

Arctic Sees Unprecedented Heat as Climate Impacts Cascade

-

Prudential Life Expected to Face Inspection over Fraud

-

South Korea Prosecutor Seeks Death Penalty for Ex-President Yoon over Martial Law (Update)

-

Trump Names Former Federal Reserve Governor Warsh as the Next Fed Chair, Replacing Powell

-

Japan’s Nagasaki, Okinawa Make N.Y. Times’ 52 Places to Go in 2026

JN ACCESS RANKING

-

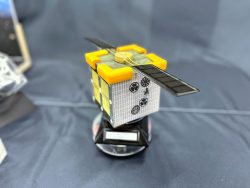

Univ. in Japan, Tokyo-Based Startup to Develop Satellite for Disaster Prevention Measures, Bears

-

JAL, ANA Cancel Flights During 3-day Holiday Weekend due to Blizzard

-

China Confirmed to Be Operating Drilling Vessel Near Japan-China Median Line

-

China Eyes Rare Earth Foothold in Malaysia to Maintain Dominance, Counter Japan, U.S.

-

Japan Institute to Use Domestic Commercial Optical Lattice Clock to Set Japan Standard Time