Japan’s Nikkei Stock Average Treads Water as Central Bank Meetings, Tariff Deadline Loom (UPDATE 1)

The Tokyo Stock Exchange

12:39 JST, July 30, 2025 (updated at 16:15 JST)

TOKYO, July 30 (Reuters) – Japan’s Nikkei share average ended flat on Wednesday as investors braced for a three-day period that will see policy decisions from the Federal Reserve and Bank of Japan, followed by U.S. President Donald Trump’s deadline for trade deals.

The Nikkei .N225finished the day little changed at 40,654.70. Of the index’s 225 components, 155rose, 67 fell and three were unchanged.

The broader Topix .TOPX rose 0.4%.

The Fed sets rates on Wednesday, and while policymakers are widely expected to stand pat, investors will be watching closely for signs that an interest rate cut may be on the way later this year.

Similarly, the BOJ is seen keeping policy steady on Thursday, but markets will search for clues on when the central bank is likely to resume rate hikes.

On Friday, most U.S. trade partners that have not agreed deals with Washington will receive higher tariff rates.

“There are still a lot of uncertainties over tariffs, and that’s going to limit the upside for stocks,” said Maki Sawada, an equities strategist at Nomura Securities.

As a result, “there’s no particular sense of direction” in Japanese stock trading currently, she said.

Airlines .IAIRL.T made up the worst performing Topix sub-index among the 33 industry groupings, led lower by a more than 4% drop for ANA Holdings 9202.T following its earnings report.

Earnings also weighed on chip-testing equipment maker Advantest 6857.T, which slipped 1.1%.

Sumitomo Pharma 4506.T surged more than 16% to be the biggest percentage gainer.

Top Articles in News Services

-

Prudential Life Expected to Face Inspection over Fraud

-

Arctic Sees Unprecedented Heat as Climate Impacts Cascade

-

South Korea Prosecutor Seeks Death Penalty for Ex-President Yoon over Martial Law (Update)

-

Trump Names Former Federal Reserve Governor Warsh as the Next Fed Chair, Replacing Powell

-

Japan’s Nagasaki, Okinawa Make N.Y. Times’ 52 Places to Go in 2026

JN ACCESS RANKING

-

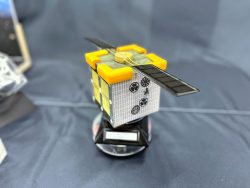

Univ. in Japan, Tokyo-Based Startup to Develop Satellite for Disaster Prevention Measures, Bears

-

JAL, ANA Cancel Flights During 3-day Holiday Weekend due to Blizzard

-

China Confirmed to Be Operating Drilling Vessel Near Japan-China Median Line

-

China Eyes Rare Earth Foothold in Malaysia to Maintain Dominance, Counter Japan, U.S.

-

Japan Institute to Use Domestic Commercial Optical Lattice Clock to Set Japan Standard Time