17:48 JST, April 1, 2025

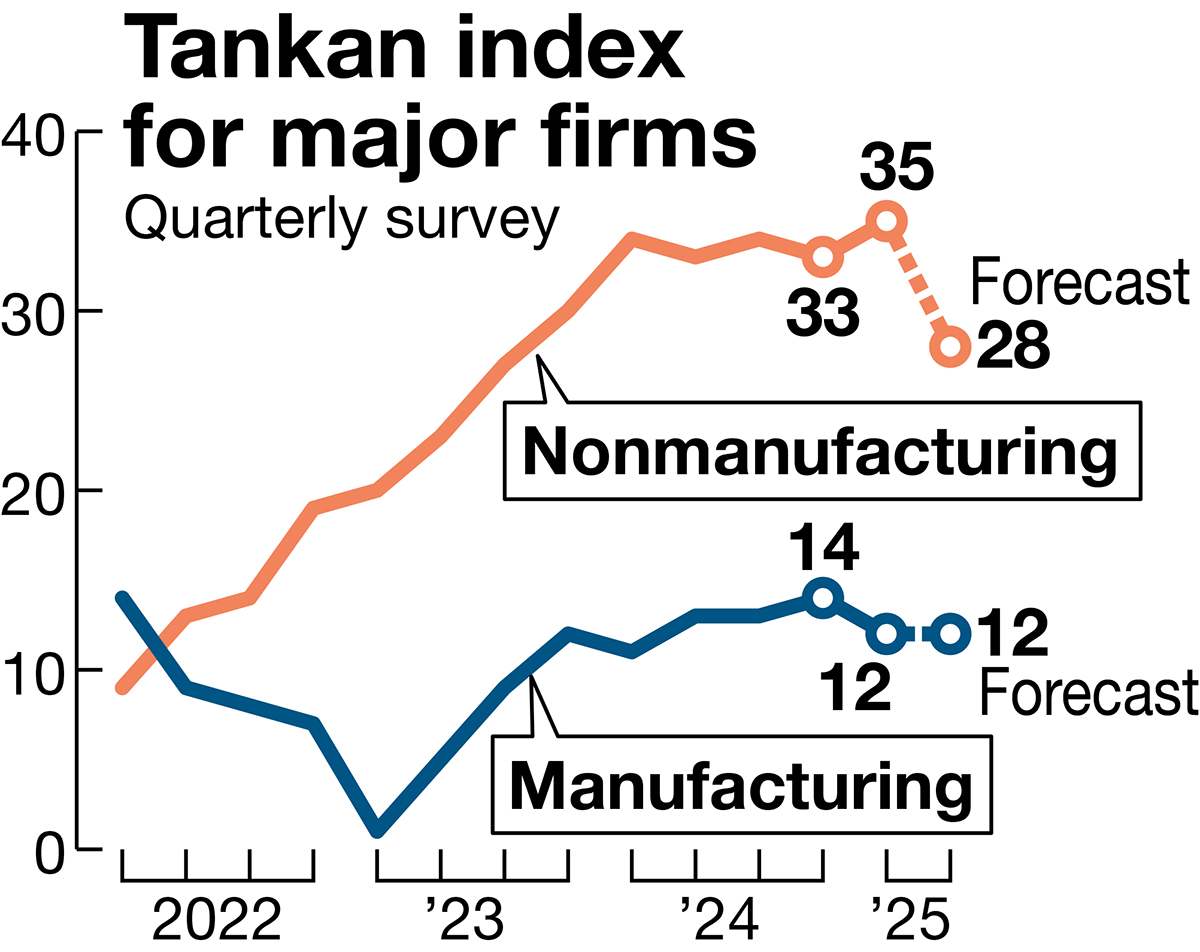

Big manufacturers’ sentiment declined slightly in the Bank of Japan’s March Tankan survey, which was released Tuesday. The firms’ confidence slipped to 12 on the survey’s index of business confidence, down by 2 points compared to the December Tankan, marking the first drop in four quarters.

The drop was apparently due to uncertainty felt over U.S. President Donald Trump’s protectionist policies. However, the index for major nonmanufacturers rose to 35, up 2 points from the previous survey.

The index fell for 11 of the 16 manufacturing industries, and iron and steel saw a 10-point drop to minus 18. The United States imposed new tariffs on steel in March.

Materials-related industries, which were affected by higher raw material costs, saw a significant decline: The index fell 23 points to zero for textiles, 7 points to 18 for pulp and paper, and 8 points to 13 for chemicals.

Motor vehicles improved by 5 points to 13, thanks to a recovery in production, and nonferrous metals rose by 3 points to 15.

Sentiment among major nonmanufacturers improved for the first time in two quarters, reaching the highest level in 33 years and seven months, or since August 1991. Their confidence was backed by steady demand from foreign visitors to Japan and progress in passing on price hikes to customers.

The index improved in seven of the 12 nonmanufacturing industries. It rose 6 points to 24 for “services for individuals” and by as many points to 46 for “accommodations, eating and drinking services.”

Progress in passing on higher materials costs helped small manufacturers rise by 1 point in the index to 2. Small nonmanufacturing firms remained flat at 16.

As for forecasts of sentiment in the next Tankan survey, set for June, major manufacturers stayed put at 12. Though improvements are expected in the materials sector, the outlook for motor vehicles slumped by 4 points to 9. Trump’s tariffs on automobiles seem to have increased uncertainty about the future. Major nonmanufacturers were forecast a drop of 7 points to 28. High raw material costs are expected to keep weighing on their earnings.

“As the full picture of the Trump’s protectionist policies has not been made clear, there were many factors not reflected in the latest Tankan survey,” said Masato Koike, senior researcher at Sompo Institute Plus Inc. “When it comes to future business sentiment, we’ll just have to watch carefully to see the impact of the tariffs.”

Top Articles in Business

-

Prudential Life Insurance Plans to Fully Compensate for Damages Caused by Fraudulent Actions Without Waiting for Third-Party Committee Review

-

Narita Airport, Startup in Japan Demonstrate Machine to Compress Clothes for Tourists to Prevent People from Abandoning Suitcases

-

JR Tokai, Shizuoka Pref. Agree on Water Resources for Maglev Train Construction

-

Toyota Motor Group Firm to Sell Clean Energy Greenhouses for Strawberries

-

KDDI Opens AI Data Center at Former Sharp Plant in Osaka Prefecture; Facility Will Provide Google’s Gemini AI Model for Domestic Users

JN ACCESS RANKING

-

Japan PM Takaichi’s Cabinet Resigns en Masse

-

Japan Institute to Use Domestic Commercial Optical Lattice Clock to Set Japan Standard Time

-

Israeli Ambassador to Japan Speaks about Japan’s Role in the Reconstruction of Gaza

-

Man Infected with Measles May Have Come in Contact with Many People in Tokyo, Went to Store, Restaurant Around When Symptoms Emerged

-

Man Infected with Measles Reportedly Dined at Restaurant in Tokyo Station