14:55 JST, February 6, 2022

The government will boost support for Japanese companies in securing overseas rights to rare metals such as lithium and nickel that are used in batteries for electric vehicles, The Yomiuri Shimbun has learned.

The main part of the plan calls for the government to increase the limit of capital investment in mining projects from the current 50% to less to 100%. The government’s increased involvement will reduce risks for companies in taking on such projects.

As the global trend toward decarbonization picks up pace and competition for resources intensifies, the government is aiming to ensure a stable supply of resources for Japan. But increased government funding also brings with it a fear of large losses of taxpayer money for projects that do not pan out.

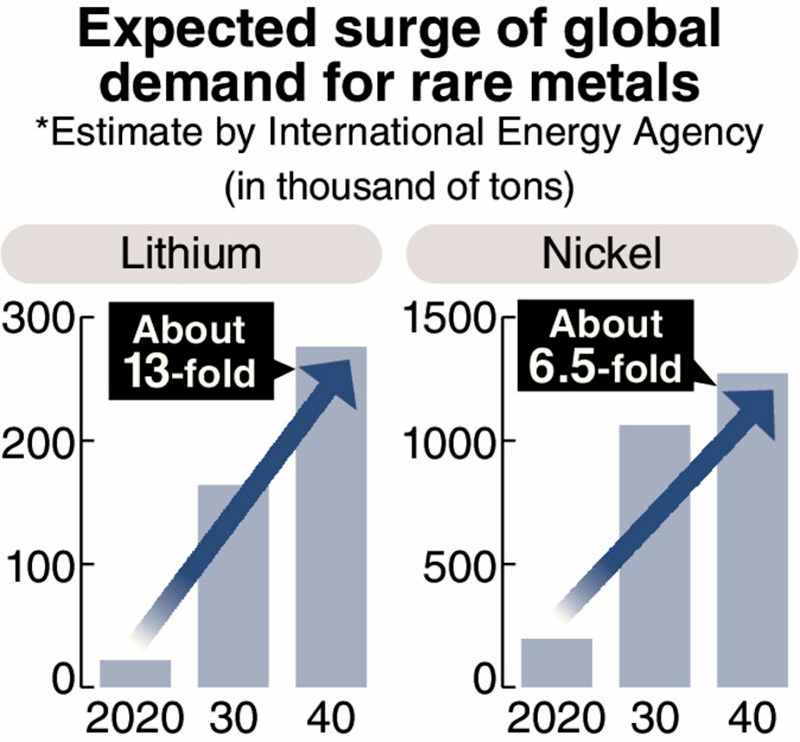

Lithium and nickel are used in batteries to store electricity generated from renewable energy sources such as solar and wind power, and as such hold the key to decarbonization. The International Energy Agency estimates that global demand for lithium will surge 13-fold to about 280,000 tons in 2040 compared to 2020, and nickel demand will jump 6.5-fold to 1.3 million tons.

Japan relies almost entirely on imports from South America and Southeast Asia. From the perspective of economic security, it is essential to increase rights to secure rare metals overseas.

The government will raise the maximum amount of capital injection by the Japan Oil, Gas and Metals National Corp. (JOGMEC) in overseas mining projects as much as possible to encourage private sector participation in such projects. The higher the percentage of Japanese capital investment, the more advantageous it will be to secure the rights. JOGMEC will change its bylaws as early as this year.

Among Japanese companies, Toyota Tsusho Corp. has rights to lithium in Argentina, and Sumitomo Metal Mining Co. is participating in nickel refining projects in the Philippines and other countries. However, China, expecting an increase in domestic demand, is stepping up efforts to secure rights backed by its financial strength.

The cost of developing a mine for lithium or other rare metals can exceed ¥100 billion, which is a heavy burden for an individual company to bear. There are also risks that the amount mined will not reach the estimated level, or that a project will be halted due to the local political situation. As such, companies have been calling for more government support.

The government is also planning to amend the law to allow JOGMEC to make capital investments in rare metal refining businesses in Japan. Until now, JOGMEC has been able to invest in the overseas refining projects of Japanese companies, but the government intends to increase domestic refining to reduce the risk of supply disruptions.

Top Articles in Business

-

Prudential Life Insurance Plans to Fully Compensate for Damages Caused by Fraudulent Actions Without Waiting for Third-Party Committee Review

-

Narita Airport, Startup in Japan Demonstrate Machine to Compress Clothes for Tourists to Prevent People from Abandoning Suitcases

-

Japan, U.S. Name 3 Inaugural Investment Projects; Reached Agreement After Considerable Difficulty

-

Toyota Motor Group Firm to Sell Clean Energy Greenhouses for Strawberries

-

SoftBank Launches AI Service for Call Centers That Converts Harsh Customer Voices into Softer Voices

JN ACCESS RANKING

-

Japan PM Takaichi’s Cabinet Resigns en Masse

-

Japan Institute to Use Domestic Commercial Optical Lattice Clock to Set Japan Standard Time

-

Israeli Ambassador to Japan Speaks about Japan’s Role in the Reconstruction of Gaza

-

Man Infected with Measles Reportedly Dined at Restaurant in Tokyo Station

-

Videos Plagiarized, Reposted with False Subtitles Claiming ‘Ryukyu Belongs to China’; Anti-China False Information Also Posted in Japan