Honda, Nissan Seek Stronger Position Against Foreign Rivals; Challenges Include Realignment of Business Partners

From left to right: Nissan Motor Co. President Makoto Uchida, Honda Motor Co. President Toshihiro Mibe and Mitsubishi Motors Corp. President Takao Kato stand on the podium at a press conference held in Tokyo on Monday.

17:08 JST, December 24, 2024

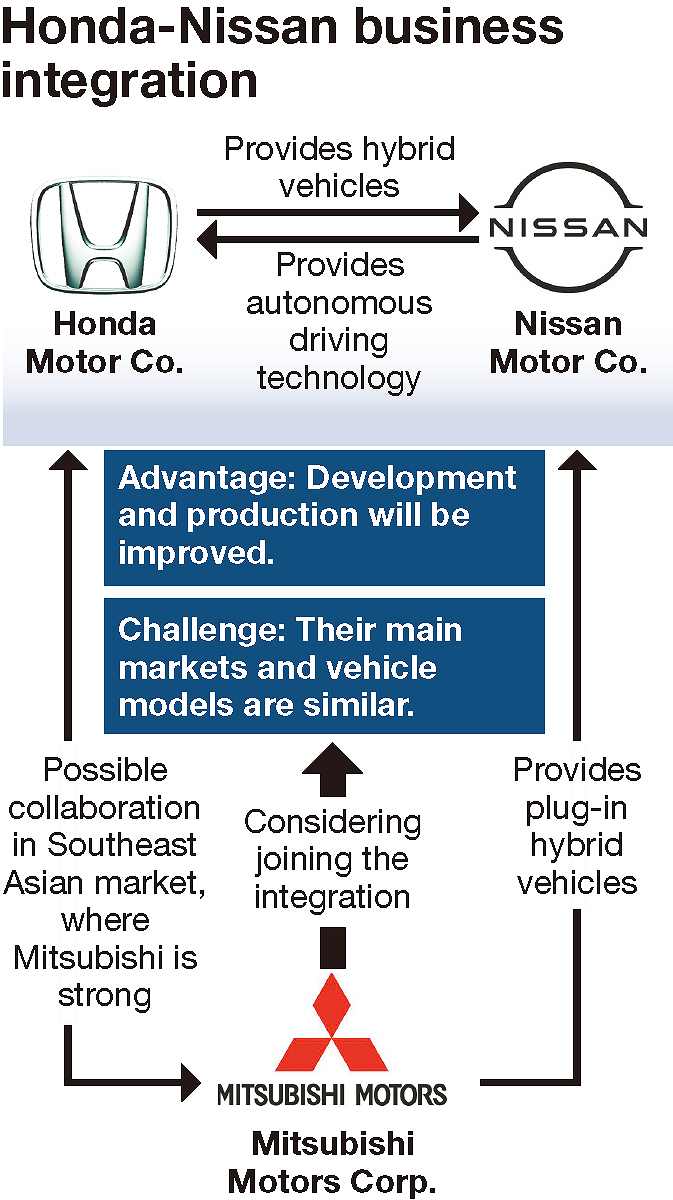

TOKYO/BRUSSEL — Two major Japanese automakers are heading for a historic merger, as Honda Motor Co. and Nissan Motor Co. signed a basic agreement to start full-fledged talks on integrating their businesses Monday.

With the rise of electric vehicles manufactured by U.S. and Chinese companies, the auto market is undergoing a radical change. Much attention is being paid to whether the Honda-led business integration will enable the two companies to once again assert their presence in the global market.

Environmental shifts

“The impact of synergies from the business integration will be greater than we expect,” Honda President Toshihiro Mibe stressed at a press conference Monday.

The two automakers will integrate their R&D functions and procurement operations to improve efficiency in all areas.

According to Mibe, the auto industry is facing a tectonic shift in which newcomers such as Chinese automaker BYD are coming to the fore with massive investments in EVs and software development. The two companies decided that traditional collaboration would not be sufficient to overcome the challenges they are facing, he said.

Honda spent about ¥980 billion on R&D, and Nissan about ¥610 billion, in the year ending March 31, 2024. Their combined R&D spending exceeds that of the world’s top-selling automobile manufacturer, Toyota Motor Corp. which spent about ¥1.2 trillion.

Given that Mitsubishi Motors Corp. is strong in the Southeast Asian market, where both Honda and Nissan have a weak presence, Mitsubishi’s participation in the business integration will allow them to draw up new global strategies.

The leaders of the three companies reported their discussions to the Economy, Trade and Industry Ministry on Monday morning. “Business realignment is one of the effective methods to increase corporate value,” Economy, Trade and Industry Minister Yoji Muto said at a press conference after a Cabinet meeting Friday, though he said he was speaking in general terms.

Difficult challenges

However, there are many challenges to optimize the effects of the business integration.

The most important market for both Honda and Nissan is North America. Their core car models are similar, as both companies focus on sports utility vehicles. Nissan does not sell hybrid vehicles (HVs) in North America, and the business integration may enable it to put its HVs into the North American market at an early date.

Meanwhile, the business integration will benefit Honda by helping the company increase the sales of HV systems. However, the two auto brands could end up competing with each other over customers in the same market. “Having strength in the same region will bring about more synergies,” Nissan President Makoto Uchida stressed. However, the future of the business integration is uncertain.

Another challenge is the realignment of their business partners. According to Tokyo Shoko Research, Ltd., the three automakers have a total of nearly 30,000 business partners in Japan. Of this number, over 5,000 companies do business with both Honda and Nissan and produce the same parts for each of them. Streamlining the contractors is an urgent issue.

Mibe emphasized that he did not deny the possibility of the business integration falling through, depending on Nissan’s restructuring measures.

Benefits for Renault

France’s Renault Group, which holds a slightly less than 40% stake in Nissan, is reportedly positive about the planned business integration between Nissan and Honda. A Renault official issued a statement Monday that they would consider all options based on the best interests of the group and its stakeholders.

Renault Group sold about 2.23 million vehicles in 2023, nearly 40% down from 3.88 million vehicles in 2018. European automakers also need to raise funds to develop EVs and other vehicles. If the business integration pushes up Nissan’s stock price, it would be perfect timing for Renault, which plans to sell some of Nissan shares it holds in stages.

Top Articles in Business

-

Prudential Life Insurance Plans to Fully Compensate for Damages Caused by Fraudulent Actions Without Waiting for Third-Party Committee Review

-

Narita Airport, Startup in Japan Demonstrate Machine to Compress Clothes for Tourists to Prevent People from Abandoning Suitcases

-

Japan, U.S. Name 3 Inaugural Investment Projects; Reached Agreement After Considerable Difficulty

-

Toyota Motor Group Firm to Sell Clean Energy Greenhouses for Strawberries

-

SoftBank Launches AI Service for Call Centers That Converts Harsh Customer Voices into Softer Voices

JN ACCESS RANKING

-

Japan PM Takaichi’s Cabinet Resigns en Masse

-

Japan Institute to Use Domestic Commercial Optical Lattice Clock to Set Japan Standard Time

-

Israeli Ambassador to Japan Speaks about Japan’s Role in the Reconstruction of Gaza

-

Man Infected with Measles Reportedly Dined at Restaurant in Tokyo Station

-

Videos Plagiarized, Reposted with False Subtitles Claiming ‘Ryukyu Belongs to China’; Anti-China False Information Also Posted in Japan