The Tokyo Stock Exchange

Reuters

9:56 JST, April 7, 2025

TOKYO (Reuters) — Japan’s Nikkei share average tumbled nearly 9% early on Monday, while an index of Japanese bank stocks plunged as much as 17%, as concerns over a tariff-induced global recession continued to rip through markets.

The Nikkei dropped as much as 8.8% to hit 30,792.74 for the first time since October 2023. The index was trading down 7.3% at 31,318.79, as of 0034 GMT.

All 225 component stocks of the index were trading in the red.

The broader Topix sank 8% to 2,284.69.

A topix index of banking shares slumped as much as 17.3%, and was last down 13.2%. The bank index has borne the brunt of the sell-off in Japanese equities, plunging as much as 30% over the past three sessions.

Most Read

Popular articles in the past 24 hours

-

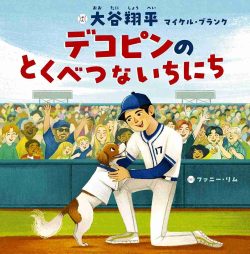

Japanese Version of Shohei Ohtani's Picture Book Published

-

Milano Cortina 2026: Japan’s Speed Skater Takagi Sinks to 6...

-

Osaka: 40 Ninjas Display Shuriken Throwing Skills at Japan Champi...

-

Padres Reliever Yuki Matsui's WBC Status with Japan Is in Questio...

-

Tottori: 95-Year-Old Japanese Descendent from Philippines Visits ...

-

Hiroshima: Land Scape, Special Architecture to Offer Unique Beaut...

-

Miyazaki: Japanese Woman Walks in Footsteps of Samurai Ancestor W...

-

Japan PM Sanae Takaichi Declares ‘Responsible Diplomacy’ in Her P...

Popular articles in the past week

-

Japan PM Takaichi’s Cabinet Resigns en Masse

-

Man Infected with Measles Reportedly Dined at Restaurant in Tokyo...

-

Sanae Takaichi Elected Prime Minister of Japan; Keeps All Cabinet...

-

Japan's Govt to Submit Road Map for Growth Strategy in March, PM ...

-

Bus Carrying 40 Passengers Catches Fire on Chuo Expressway; All E...

-

Tokyo’s New Record-Breaking Fountain Named ‘Tokyo Aqua Symphony’

-

Milano Cortina 2026: Figure Skaters Riku Miura, Ryuichi Kihara Pa...

-

Japan, U.S. Name 3 Inaugural Investment Projects; Reached Agreeme...

Popular articles in the past month

-

Japan PM Takaichi’s Cabinet Resigns en Masse

-

Japan Institute to Use Domestic Commercial Optical Lattice Clock ...

-

Israeli Ambassador to Japan Speaks about Japan’s Role in the Reco...

-

Man Infected with Measles Reportedly Dined at Restaurant in Tokyo...

-

Videos Plagiarized, Reposted with False Subtitles Claiming ‘Ryuky...

-

Man Infected with Measles May Have Come in Contact with Many Peop...

-

Prudential Life Insurance Plans to Fully Compensate for Damages C...

-

Woman with Measles Visited Hospital in Tokyo Multiple Times Befor...

Top Articles in Business

-

Prudential Life Insurance Plans to Fully Compensate for Damages Caused by Fraudulent Actions Without Waiting for Third-Party Committee Review

-

Narita Airport, Startup in Japan Demonstrate Machine to Compress Clothes for Tourists to Prevent People from Abandoning Suitcases

-

Japan, U.S. Name 3 Inaugural Investment Projects; Reached Agreement After Considerable Difficulty

-

JR Tokai, Shizuoka Pref. Agree on Water Resources for Maglev Train Construction

-

Toyota Motor Group Firm to Sell Clean Energy Greenhouses for Strawberries

JN ACCESS RANKING

-

Japan PM Takaichi’s Cabinet Resigns en Masse

-

Japan Institute to Use Domestic Commercial Optical Lattice Clock to Set Japan Standard Time

-

Israeli Ambassador to Japan Speaks about Japan’s Role in the Reconstruction of Gaza

-

Man Infected with Measles Reportedly Dined at Restaurant in Tokyo Station

-

Videos Plagiarized, Reposted with False Subtitles Claiming ‘Ryukyu Belongs to China’; Anti-China False Information Also Posted in Japan