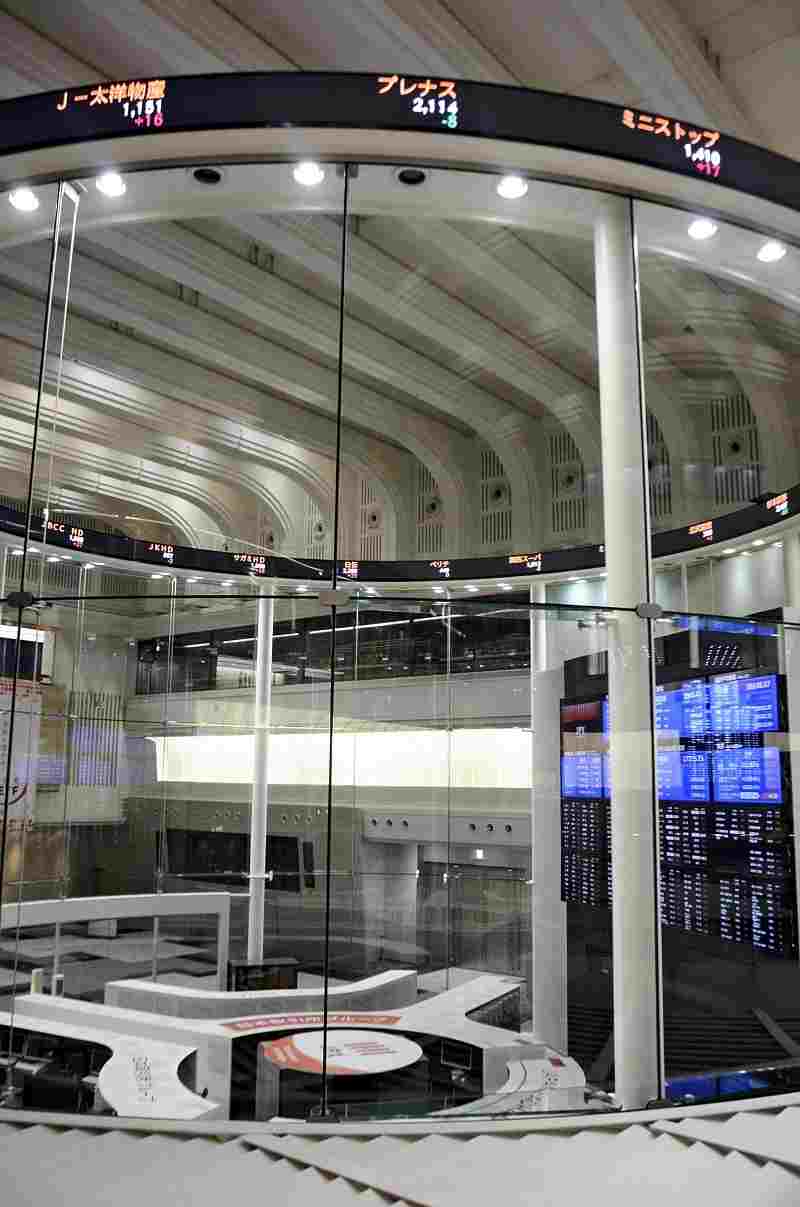

The Tokyo Stock Exchange

15:46 JST, October 29, 2021

The Tokyo Stock Exchange has decided to extend trading hours for the first time in 70 years as part of efforts to boost trading volume and strengthen international competitiveness.

The Tokyo bourse plans to extend the period for spot-trading by 30 minutes to 3.30 p.m. in the second half of fiscal 2024, which starts in October.

The period was last changed in 1954 when the close was extended from 2 p.m. to 3 p.m.

All eyes will be focused on whether the extra 30 minutes will enable the TSE to attract more investment and increase its international presence.

Akira Kiyota, the chief executive officer of TSE’s parent company Japan Exchange Group Inc., stressed the significance of the decision at a press conference on Wednesday.

“We were able to gain understanding because we had a clear objective regarding how to secure enough trading hours [in the event of a system failure],” Kiyota said. “[The extension] will also help strengthen the TSE’s international competitiveness.”

The decision was made following a system glitch in 2020 that halted trading of all stocks listed on the exchange for a whole day, which hadn’t happened since trading was fully computerized in 1999.

The TSE set up a task force in May consisting of members from securities companies, institutional investors and system-related firms, to mull an extension to trading hours.

Although concerns were voiced about possible overhead costs such as operating expenses for sales staff and system operations, caution receded partly because of the “willingness of the Financial Services Agency,” according to an executive of a major securities firm.

The TSE had made three unsuccessful attempts to extend trading hours in 2000, 2010, and 2014. The decision to extend the trading hours in 2024 was reached in early September on the fourth attempt.

Time difference

There is an 18-hour wait between the close of trading at 3 p.m. and the start of trading on the following morning at 9 .a.m.

The extension will be beneficial not only to Japanese investors, but also to overseas investors, who are responsible for 70% of trading volume.

The TSE hopes the extension will make it easier for foreign investors in different time zones to trade Japanese stocks by bringing the trading hours closer to those of European and U.S. exchanges.

Prior to the extension, the TSE plans to restructure the stock market from April 2022, reorganizing the current four market segments — First Section, Second Section, Mothers and JASDAQ — into three new market segments, Prime, Standard and Growth markets, with plans to raise the bar for listing on the highest tier to attract blue-chip companies and foreign investment.

In terms of the market capitalization of listed companies, the TSE has been outpaced by the New York Stock Exchange and the Shanghai Stock Exchange.

“In addition to the improvement in the investment environment as a result of extending trading hours, to revitalize the market Japanese firms must demonstrate their potential for growth,” said Takuya Nomura, a senior researcher at the Japan Research Institute Ltd.

The extended trading hours are likely to affect the timing of company announcements, regarding such matters as financial results and personnel changes.

At present, many companies release such information after the close of trading at 3 p.m.

Toyota Motor Corp. switched to announcing its consolidated financial results during trading hours a few years ago, but it is in the minority.

“When the trading hours are extended, we will delay announcements,” an official of a company listed on the TSE’s First Section said.

However, the firm is wary of the risk of an increase in insider trading. “The later the announcement, the greater the risk of important information being leaked,” the official said.

Top Articles in Business

-

Prudential Life Insurance Plans to Fully Compensate for Damages Caused by Fraudulent Actions Without Waiting for Third-Party Committee Review

-

Narita Airport, Startup in Japan Demonstrate Machine to Compress Clothes for Tourists to Prevent People from Abandoning Suitcases

-

Japan, U.S. Name 3 Inaugural Investment Projects; Reached Agreement After Considerable Difficulty

-

JR Tokai, Shizuoka Pref. Agree on Water Resources for Maglev Train Construction

-

Toyota Motor Group Firm to Sell Clean Energy Greenhouses for Strawberries

JN ACCESS RANKING

-

Japan PM Takaichi’s Cabinet Resigns en Masse

-

Japan Institute to Use Domestic Commercial Optical Lattice Clock to Set Japan Standard Time

-

Israeli Ambassador to Japan Speaks about Japan’s Role in the Reconstruction of Gaza

-

Man Infected with Measles Reportedly Dined at Restaurant in Tokyo Station

-

Videos Plagiarized, Reposted with False Subtitles Claiming ‘Ryukyu Belongs to China’; Anti-China False Information Also Posted in Japan