15:52 JST, February 16, 2021

After 30½ years, the Nikkei Stock Average regained a key threshold, closing above 30,000 on Monday. Stock prices have been propped up by the flow of investment into Japan due to the massive monetary easing policies carried out by central banks around the world, including the Bank of Japan.

With the employment and income environment severe amid the novel coronavirus pandemic, however, the benefits of higher stock prices have not spread to a wide range of sectors.

While concerns about an overheated market persists, there is also the risk that a tightening of monetary policy will reverse the flow of investment.

BOJ props up shares

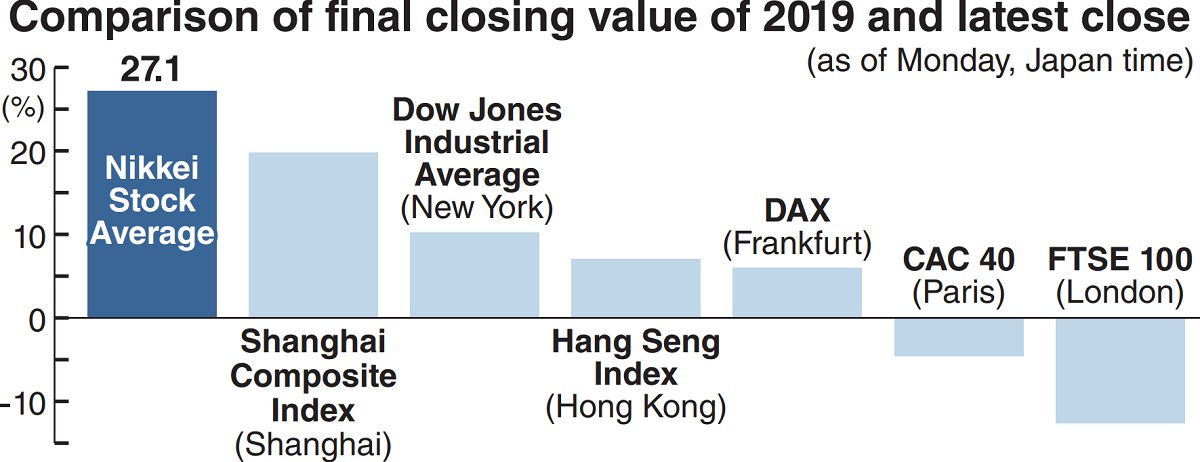

Central banks around the world have stepped up monetary easing to support their economies due to the effects of the pandemic. Although stock indexes have also risen in the United States and China, the Nikkei Stock Average ended Monday up a whopping 27.1% compared to its final closing value of 2019.

The Bank of Japan is one of the reasons for this rise, as it is the only major central bank in the world to purchase massive amounts of exchange-traded funds (ETFs). Throughout all of 2020, the BOJ purchased a record ¥7.1 trillion worth of ETFs.

The stock market now regularly expects a certain level of purchases from the BOJ.

With long-term interest rates near zero, investors are focusing on riskier stocks rather than bonds for the chance to make a profit.

According to Makoto Sengoku, a senior equity market analyst at Tokai Tokyo Research Institute Co., stock prices are unlikely to fall unless the Bank of Japan sells its holdings. This sense of security has led to an increase in purchases of stocks.

Another major factor is a change in the conventional wisdom that a stronger yen leads to lower stock prices. The dollar is currently at ¥105, meaning that the yen has gotten stronger by ¥20 from six years ago.

Japanese companies that have a high export ratio face a disadvantage with a stronger yen. As more factories are moved overseas, however, the cost structure is less sensitive to exchange rates than in the past, instead supporting Japanese firms’ performance.

Gap with real economy

The real economy is in a slump, however, as many people don’t receive any benefit from higher stock prices.

Individual investors hold less than 20% of all shares.

Also, the number of people unemployed in 2020 increased for the first time in 11 years to 1.91 million.

Furthermore, household consumption plunged, leaving a huge gap between stock prices and the real economy.

This situation where stock indexes rise amid a recession continued even after the government declared another pandemic-related state of emergency in January this year.

There is lingering public discontent that only a few wealthy people are benefiting from the higher stock prices.

“Stimulating personal consumption is indispensable for lifting up the real economy,” Yoshinori Isozaki, the president of Kirin Holdings Co., said at a press conference on Monday. “Consumer spending was strong 30 years ago, but now the opposite is true, and consumers are inclined to save money.”

Shingo Ide, chief financial engineer at the NLI Research Institute, said: “Industries that have been hit hard by the novel coronavirus crisis, such as restaurants and leisure, have many workers, but few of the companies in these industries are listed on the stock exchange. So even if stock prices rise, there won’t be much enthusiasm.”

Top Articles in Business

-

Prudential Life Insurance Plans to Fully Compensate for Damages Caused by Fraudulent Actions Without Waiting for Third-Party Committee Review

-

Narita Airport, Startup in Japan Demonstrate Machine to Compress Clothes for Tourists to Prevent People from Abandoning Suitcases

-

Japan, U.S. Name 3 Inaugural Investment Projects; Reached Agreement After Considerable Difficulty

-

JR Tokai, Shizuoka Pref. Agree on Water Resources for Maglev Train Construction

-

Toyota Motor Group Firm to Sell Clean Energy Greenhouses for Strawberries

JN ACCESS RANKING

-

Japan PM Takaichi’s Cabinet Resigns en Masse

-

Japan Institute to Use Domestic Commercial Optical Lattice Clock to Set Japan Standard Time

-

Israeli Ambassador to Japan Speaks about Japan’s Role in the Reconstruction of Gaza

-

Man Infected with Measles Reportedly Dined at Restaurant in Tokyo Station

-

Videos Plagiarized, Reposted with False Subtitles Claiming ‘Ryukyu Belongs to China’; Anti-China False Information Also Posted in Japan