BOJ Looks to U.S. Tariffs as It Times Rate Hikes; Inflation Target Likely to Be ‘Slightly Delayed’

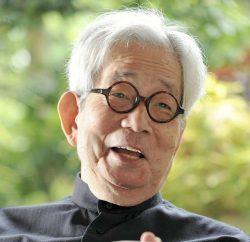

Bank of Japan Gov. Kazuo Ueda, center, and other BOJ policymakers attend a meeting at the Bank of Japan in Tokyo on Thursday.

20:00 JST, May 2, 2025

The Bank of Japan is closely monitoring U.S. tariff policy, as it could impact the timing of Japan’s rate hikes given the significant uncertainty the tariffs inject into the economic and price outlook.

At a press conference on Thursday, BOJ Gov. Kazuo Ueda reaffirmed that the bank would consider raising interest rates once it believes that its economic and price outlook will be realized.

However, given the major turmoil stirred up by U.S. tariffs, market observers have expressed divergent views about when interest rates will be hiked.

Outlook uncertain

The BOJ’s Outlook Report, released on Thursday, presented revised projections of inflation: 2.2% for fiscal 2025, 1.7% for fiscal 2026 and 1.9% for fiscal 2027. Notably, these forecasts have been revised downward for fiscal years 2025 and 2026 compared to the report issued in January.

During the press conference, Ueda said that the BOJ would be “slightly delayed” in reaching its target of stable 2% inflation, with that result now being expected between late fiscal 2026 and the end of fiscal 2027.

However, Ueda did not clarify whether rate hikes would be put off. This lack of clarity stems from the uncertainty associated with U.S. tariffs, which could prompt significant changes to the economic and price outlook.

“Considering the somewhat limited certainty of the [economic and price] outlook, there is a substantial probability that changes in conditions, such as tariffs, will require revisions to the outlook,” said Ueda.

Divided views

At its latest policy board meeting, the BOJ remained firm on raising the policy interest rate if “underlying inflation,” which excludes temporary factors such as rising rice prices, approaches 2%.

According to Shinichiro Kobayashi of Mitsubishi UFJ Research and Consulting Co., the prospect of a rate hike this year has almost vanished. He believes an economic slowdown is inevitable, regardless of whether tariff negotiations between the United States and other countries produce results.

“I think the Bank of Japan will likely hike rates no earlier than the start of next year. A rate hike will be more likely if wage increases are expected to remain elevated in the 2026 spring labor negotiations,” he said.

Takeshi Minami, of Norinchukin Research Institute Co., noted that there was a risk of inflation slowing down, and saw the BOJ possibly considering a raise in rates around autumn.

Related Tags

Top Articles in Business

-

Prudential Life Insurance Plans to Fully Compensate for Damages Caused by Fraudulent Actions Without Waiting for Third-Party Committee Review

-

Japan, U.S. Name 3 Inaugural Investment Projects; Reached Agreement After Considerable Difficulty

-

Japan’s Major Real Estate Firms Expanding Overseas Businesses to Secure Future Growth, Focusing on Europe, U.S., Asia

-

SoftBank Launches AI Service for Call Centers That Converts Harsh Customer Voices into Softer Voices

-

Transport Companies See Opportunity in Narita Expansion; Airlines, Railways Prepare to Meet Expected Growth in Demand

JN ACCESS RANKING

-

Producer Behind Pop Group XG Arrested for Cocaine Possession

-

Japan PM Takaichi’s Cabinet Resigns en Masse

-

Man Infected with Measles Reportedly Dined at Restaurant in Tokyo Station

-

Israeli Ambassador to Japan Speaks about Japan’s Role in the Reconstruction of Gaza

-

Videos Plagiarized, Reposted with False Subtitles Claiming ‘Ryukyu Belongs to China’; Anti-China False Information Also Posted in Japan