Japanese Automakers Losing Market Share in Southeast Asia; Increased Competition from Chinese Brands Creates Difficult Business Environment

A new model from Toyota Motor Corp.’s Hilux line of trucks is seen in Bangkok on Nov. 28.

14:00 JST, January 6, 2026

BANGKOK — Japanese automakers are losing market share in Southeast Asia as Chinese rivals ramp up local production to drive electric vehicle sales in the region.

In response, Japanese car companies have been scaling back production in Thailand one after another. This could deal a blow to supply chains in the Southeast Asia region, which is home to more than 2,700 Japanese parts manufacturers.

Market share could fall below 70%

At the Thailand International Motor Expo, which was held in Bangkok in November and December, Toyota Motor Corp. unveiled the latest edition of its Hilux line of pickup trucks, which recently underwent a full overhaul for the first time in a decade. In addition to improving the fuel efficiency of the diesel engine models, the company has added an EV model to the lineup. It has already begun accepting orders.

You may also like to read

Japanese Automakers Try to Regain Ground Lost to Chinese Car Firms in Thailand with Low-Priced HvsIn Thailand, pickup trucks are regarded as the “national car,” and the Hilux, which is mainly produced in the country, has enjoyed robust popularity there.

However, during a press conference, Noriaki Yamashita, president of Toyota Motor Thailand Co., said with a stern expression, “We want to protect our supply chains by increasing sales.”

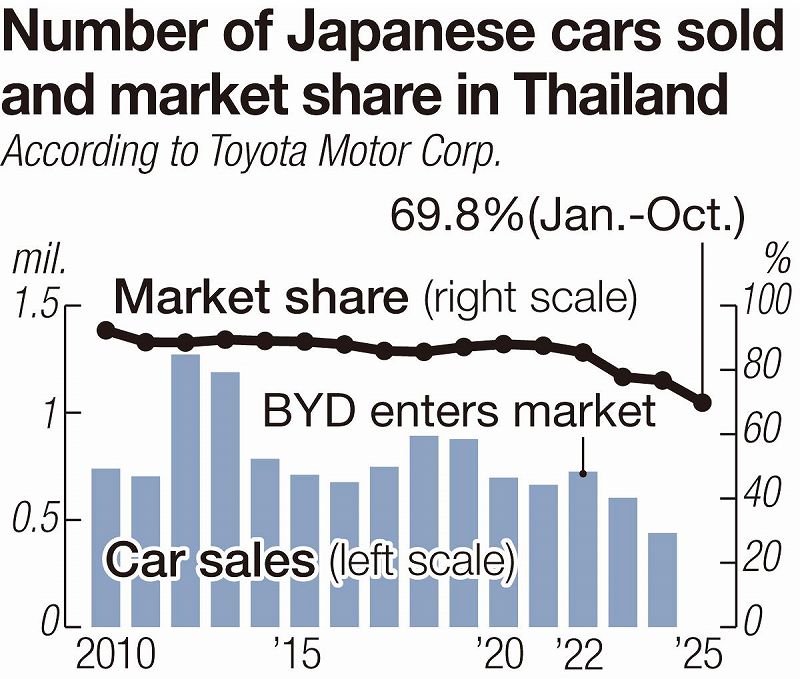

Thailand accounts for nearly 20% of the Southeast Asian auto market. However, the combined share of the Thai market held by nine Japanese automakers dropped to 69.8% for the first 10 months of 2025, 6.6 percentage points down from the same period in 2024.

These companies maintained a market share in the high 80% range to 90% throughout the 2010s, but this plunged to 77.8% in 2023. It is even possible that it will be below 70% for the entirety of 2025.

In Indonesia, which accounts for about 30% of the Southeast Asian auto market, Japanese automakers also saw their market share fall below 90% in 2024 and drop even further, to 82.9%, for the first 10 months of 2025.

Competition between Japanese and local automakers is intensifying in Vietnam.

Impact on supply chains

The aggressive expansion of Chinese automakers, such as BYD, into Southeast Asian countries, including Thailand and Indonesia, since 2022 has been a major factor in Japanese automakers’ sudden loss of ground.

By greatly bringing down the price of EVs, Chinese car companies have broken into what was once a Japanese stronghold, taking market share of over 20% in Thailand. Chinese automakers have also ramped up EV production at new plants in Thailand and are fiercely competing with Japanese firms even in Indonesia.

Under the pressure of this Chinese assault, Japanese automakers are scaling back their output in Thailand. Honda Motor Co. will consolidate its two finished-vehicle plants in the country into a single location in 2026 at the earliest. Mitsubishi Motor Corp. also plans to suspend production at one of three plants in 2027.

According to data analysis firm MarkLines Co., of 2,792 Japanese parts manufacturers operating in Southeast Asia, nearly half are based in Thailand. More Japanese firms operate in Southeast Asia than in China or North America, and they have leveraged strong sales networks to build robust regional supply chains.

Thailand serves as a hub from which these Japanese firms can export goods to other Southeast Asian nations. However, some subcontractors have begun finding it more difficult to maintain their local production bases as orders have decreased due to finished-vehicle plants operating at lower rates, a source from a Japanese bank said.

Japanese automakers are beginning to boost sales by expanding their lineups of hybrid vehicles, a segment where they excel. However, if Chinese automakers continue their offensive, the impact on the parts suppliers could spread further.

Top Articles in Business

-

Prudential Life Insurance Plans to Fully Compensate for Damages Caused by Fraudulent Actions Without Waiting for Third-Party Committee Review

-

Narita Airport, Startup in Japan Demonstrate Machine to Compress Clothes for Tourists to Prevent People from Abandoning Suitcases

-

JR Tokai, Shizuoka Pref. Agree on Water Resources for Maglev Train Construction

-

Toyota Motor Group Firm to Sell Clean Energy Greenhouses for Strawberries

-

KDDI Opens AI Data Center at Former Sharp Plant in Osaka Prefecture; Facility Will Provide Google’s Gemini AI Model for Domestic Users

JN ACCESS RANKING

-

Japan Institute to Use Domestic Commercial Optical Lattice Clock to Set Japan Standard Time

-

Japan PM Takaichi’s Cabinet Resigns en Masse

-

Israeli Ambassador to Japan Speaks about Japan’s Role in the Reconstruction of Gaza

-

Man Infected with Measles May Have Come in Contact with Many People in Tokyo, Went to Store, Restaurant Around When Symptoms Emerged

-

Prudential Life Insurance Plans to Fully Compensate for Damages Caused by Fraudulent Actions Without Waiting for Third-Party Committee Review