1:00 JST, May 31, 2023

MUFG Bank, Ltd. will introduce new, no-frills automated teller machines in certain areas starting in June, it has been learned.

The new ATMs can be used with cash cards but do not accept bankbooks or handle coins, according to informed sources. Maintaining a network of ATMs and updating the machines has been a financial burden on the bank’s management, so the company will cut costs by reducing the functions of its ATMs. For now, the new ATMs will be installed in areas where there are fewer elderly users, who often use bankbooks.

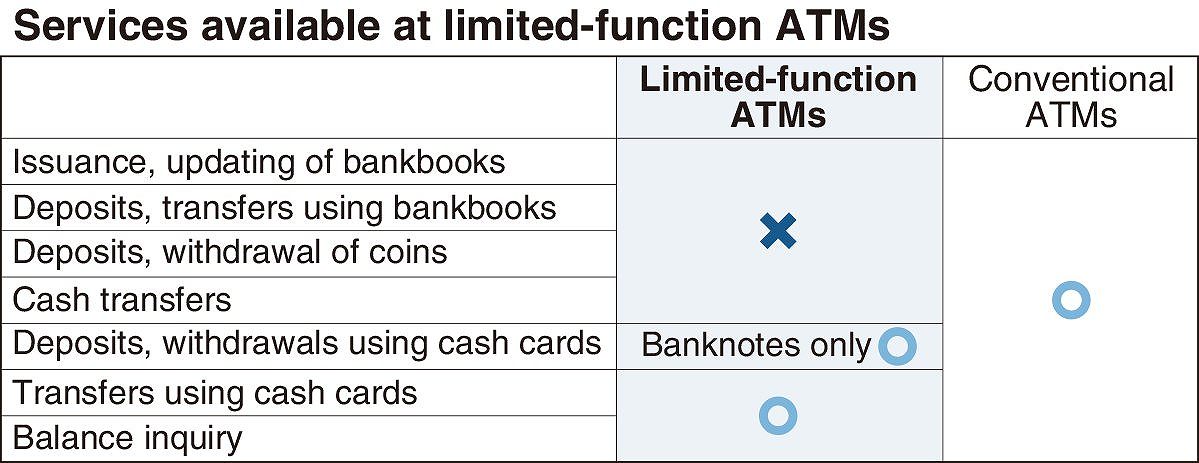

The new limited-function ATMs are called “fast ATMs.” Cash cards can be used for transfers, deposits, withdrawals and balance inquiries at these ATMs. However, users will not be able to update their bankbooks at fast ATMs, nor can they use their bankbooks to deposit or transfer money there.

MUFG Bank will introduce the new ATMs in locations other than its branches. The bank currently operates a total of about 3,300 ATMs in about 1,400 non-branch locations. Of those, about 220 ATMs in about 130 locations will be replaced with the new ATMs within this fiscal year.

While MUFG Bank plans to consider fully rolling out the new ATMs in the future, some other banks also operate ATMs for which transactions using bankbooks or coins are limited or eliminated.

At Sumitomo Mitsui Banking Corp., customers can use their bankbooks at all of the bank’s ATMs, but only for certain transactions such as depositing cash.

Bankbooks can be used at most of Mizuho Bank, Ltd.’s ATMs, but some of them do not accept bankbooks or coins.

Banks face an increased cost burden associated with the updating and maintenance of ATMs, partly due to the need to respond to new banknotes to be issued in the first half of fiscal 2024. According to sources, each conventional ATM costs several million yen to install and approximately ¥300,000 per month to maintain. Since the new ATMs only have limited functions, these costs can be reduced, according to the sources.

The issuance and management of bankbooks also poses a burden on banks, so MUFG Bank charges some customers to issue paper-based bankbooks and encourages them to shift to digital bankbooks that can be checked via smartphone. The introduction of the new ATMs is also aimed at expanding the use of internet banking.

Top Articles in Business

-

Prudential Life Insurance Plans to Fully Compensate for Damages Caused by Fraudulent Actions Without Waiting for Third-Party Committee Review

-

Narita Airport, Startup in Japan Demonstrate Machine to Compress Clothes for Tourists to Prevent People from Abandoning Suitcases

-

Japan, U.S. Name 3 Inaugural Investment Projects; Reached Agreement After Considerable Difficulty

-

Toyota Motor Group Firm to Sell Clean Energy Greenhouses for Strawberries

-

SoftBank Launches AI Service for Call Centers That Converts Harsh Customer Voices into Softer Voices

JN ACCESS RANKING

-

Japan PM Takaichi’s Cabinet Resigns en Masse

-

Japan Institute to Use Domestic Commercial Optical Lattice Clock to Set Japan Standard Time

-

Israeli Ambassador to Japan Speaks about Japan’s Role in the Reconstruction of Gaza

-

Man Infected with Measles Reportedly Dined at Restaurant in Tokyo Station

-

Videos Plagiarized, Reposted with False Subtitles Claiming ‘Ryukyu Belongs to China’; Anti-China False Information Also Posted in Japan