An employee layers sheets of ceramic material at NGK Spark Plug Co.’s plant in Komaki, Aichi Prefecture.

November 24, 2021

With the accelerating global shift from gasoline to electric vehicles, Japan’s auto parts manufacturers are expediting their efforts to develop new substitutes for engines and other conventional parts.

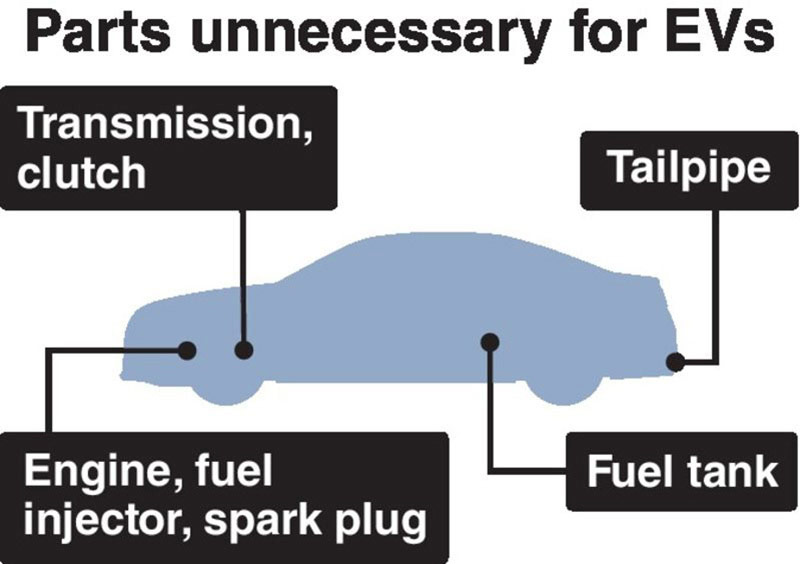

Many components used in gasoline-powered cars will become unnecessary with the expansion of EV production, bringing changes to the domestic auto parts industry and its workforce of nearly 700,000 people.

From engine to space

NGK Spark Plug Co., which has the world’s highest market share in engine spark plugs, has a confidential control area in a research development building at its plant in Komaki, Aichi Prefecture. Here, an employee used tweezers to layer sheets of ceramic material — each less than one millimeter thick — inside a large laboratory device.

This process is part of the development of next-generation batteries with improved heat resistance and greatly increased storage capacity. The company is aiming to develop a new business by utilizing its knowledge of ceramics used in spark plugs.

The next-generation battery is still in the prototype phase, but NGK Spark Plug plans to participate next autumn in a private lunar landing mission led by a Tokyo startup company to test the battery’s performance in space. The company hopes the battery will be used as a power source for lunar explorers and the International Space Station in the future.

EVs powered by batteries and motors do not require spark plugs in the engine. The company predicts that the demand for spark plugs will decline after peaking in 2030. Given these circumstances, the manufacturer is working on the research and development of a variety of new products, including medical devices.

“If we don’t make a move now, there will be no future for us,” said NGK Spark Plug President Takeshi Kawai. “We’re searching for new businesses in all directions that can be the pillar of our future.”

Increasingly alarmed

Aoki Symtech Co., a Tochigi Prefecture-based producer of manufacturing equipment for car parts, is also aiming to survive through products unrelated to automobiles, such as a processing device for beer cans.

A major automaker has drastically reduced its orders with Aoki Symtech for engine-related products. Automotive-related sales used to account for nearly 90% of the company’s total five years ago, but it now plans to reduce the amount to 30% next year.

A gasoline-powered vehicle is composed of about 30,000 parts. EVs, on the other hand, do not require complex mechanisms such as engines and transmissions, thus reducing the number of parts to about 20,000.

In a survey conducted by Teikoku Databank, Ltd., roughly 40% of about 300 parts manufacturers said that the shift to EVs would negatively affect their business.

Toyota Motor Corp. has set a goal of achieving combined annual sales of 2 million EVs and fuel cell vehicles (FCVs) by 2030.

“Tens of thousands of jobs related to the production of transmissions will be lost in Japan,” a Toyota executive said, indicating that the automaker will need to reallocate its workforce.

According to a census of manufacturers by the Economy, Trade and Industry Ministry, as of June last year there were 6,460 plants related to automobile parts and accessories production that had at least four employees. That brings the total workforce in this field to about 670,000 people.

Support from government

Automakers are also reviewing their production methods with an eye on the widespread use of EVs.

Nissan Motor Co. has invested ¥33 billion to renovate the production line at its plant in Tochigi Prefecture. For the manufacture of EVs, which involves assembling heavy batteries and motors, the company introduced robots to reduce the burden on workers.

The government is also lending its support. Starting next fiscal year, the industry ministry plans to financially support manufacturers of car parts that will become unnecessary for EVs, to help them switch their products and to research and develop weight reduction technologies that are important in producing EVs.

The ministry has set a goal of aiding about 1,000 companies in the first year of the assistance program.

Of the passenger vehicles sold in Japan last year, EVs accounted for only about 0.6%. Japan lags behind Europe and China — more than 5% of vehicles sold in Europe last year were EVs, as were 4% of those sold in China.

Technologies and product development for EVs will have a powerful impact on the future of the automobile industry, making it urgent for both the government and companies to take action.

Top Articles in Business

-

Prudential Life Insurance Plans to Fully Compensate for Damages Caused by Fraudulent Actions Without Waiting for Third-Party Committee Review

-

Narita Airport, Startup in Japan Demonstrate Machine to Compress Clothes for Tourists to Prevent People from Abandoning Suitcases

-

Japan, U.S. Name 3 Inaugural Investment Projects; Reached Agreement After Considerable Difficulty

-

Toyota Motor Group Firm to Sell Clean Energy Greenhouses for Strawberries

-

SoftBank Launches AI Service for Call Centers That Converts Harsh Customer Voices into Softer Voices

JN ACCESS RANKING

-

Japan PM Takaichi’s Cabinet Resigns en Masse

-

Japan Institute to Use Domestic Commercial Optical Lattice Clock to Set Japan Standard Time

-

Israeli Ambassador to Japan Speaks about Japan’s Role in the Reconstruction of Gaza

-

Man Infected with Measles Reportedly Dined at Restaurant in Tokyo Station

-

Videos Plagiarized, Reposted with False Subtitles Claiming ‘Ryukyu Belongs to China’; Anti-China False Information Also Posted in Japan