The main office of Shinsei Bank in Tokyo

November 23, 2021

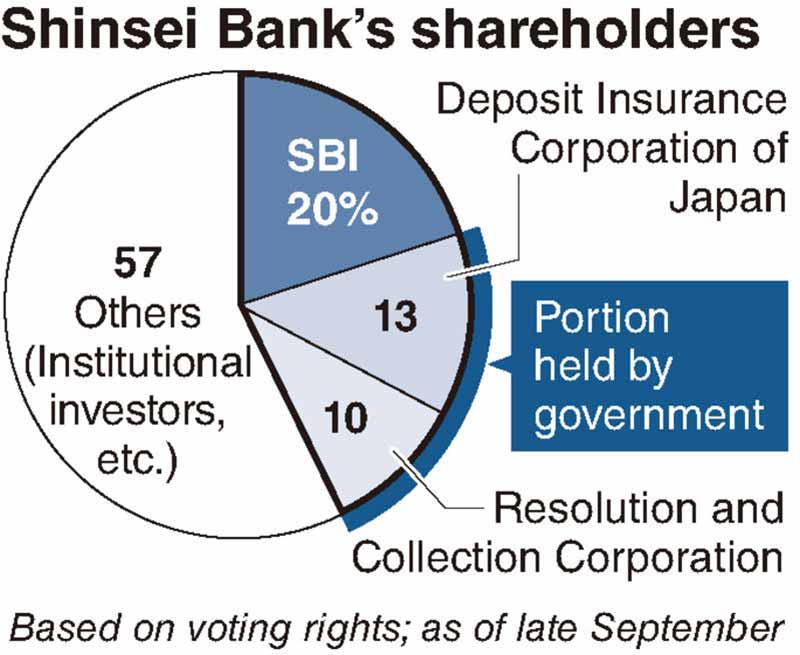

Shinsei Bank’s attempt to fend off a takeover bid by major online financial services provider SBI Holdings Inc. is likely to be opposed by the government, which holds shares in the bank.

At an extraordinary shareholders meeting scheduled for Thursday, the government is expected to vote against the bank’s takeover defense, The Yomiuri Shimbun has learned.

Shinsei Bank needs to secure the backing of a majority of shareholders at the meeting. However, some investment funds oppose the firm’s moves to block the takeover bid.

The government owns a stake exceeding 20% through the government-affiliated Deposit Insurance Corporation of Japan and its subsidiary Resolution and Collection Corporation. The combined stake held by SBI and the government exceeds 40%, so it is highly likely the bank’s attempt will be rejected at the shareholders meeting.

According to sources, those related to the issue in the government discussed it on Monday, with some expressing caution about the government becoming deeply involved in a corporate takeover by exercising its voting rights. However, many of them support SBI’s strategy, which will involve putting Shinsei Bank under its umbrella.

Shinsei Bank might withdraw its defense as the government is now considering voting against the moves.

The government’s stake dates back to a period from 1998 to 2000 when public funds were used to bail out the bank’s predecessor, the Long-Term Credit Bank of Japan. The bank has yet to repay ¥350 billion in public funds.

Shinsei Bank’s share price would have to be ¥7,450 for the government to recoup the funds. Before SBI announced its takeover bid, the share prices were hovering around ¥1,500.

SBI launched the takeover bid on Sept. 10, aiming to raise its stake to up to 48% of all Shinsei shares with a tender offer of ¥2,000 per share.

SBI wants regional banks it is affiliated with to benefit from Shinsei’s know-how on consumer finance and corporate lending, aiming to enhance profitability. However, Shinsei Bank has insisted that the price offered by SBI does not reflect the value of the bank.

Top Articles in Business

-

Prudential Life Insurance Plans to Fully Compensate for Damages Caused by Fraudulent Actions Without Waiting for Third-Party Committee Review

-

Narita Airport, Startup in Japan Demonstrate Machine to Compress Clothes for Tourists to Prevent People from Abandoning Suitcases

-

Japan, U.S. Name 3 Inaugural Investment Projects; Reached Agreement After Considerable Difficulty

-

Toyota Motor Group Firm to Sell Clean Energy Greenhouses for Strawberries

-

SoftBank Launches AI Service for Call Centers That Converts Harsh Customer Voices into Softer Voices

JN ACCESS RANKING

-

Japan PM Takaichi’s Cabinet Resigns en Masse

-

Japan Institute to Use Domestic Commercial Optical Lattice Clock to Set Japan Standard Time

-

Israeli Ambassador to Japan Speaks about Japan’s Role in the Reconstruction of Gaza

-

Man Infected with Measles Reportedly Dined at Restaurant in Tokyo Station

-

Videos Plagiarized, Reposted with False Subtitles Claiming ‘Ryukyu Belongs to China’; Anti-China False Information Also Posted in Japan