Toshiba Corp. shareholders enter the venue of the regular general shareholders’ meeting in Shinjuku Ward, Tokyo, on Friday morning.

16:36 JST, June 26, 2021

Turmoil appeared certain to continue at Toshiba Corp. following the rejected reappointment of board chairman Osamu Nagayama, who had spearheaded corporate rebuilding at the firm, at a regular general shareholders’ meeting on Friday.

Proposals regarding the appointments of 11 director candidates, including company President and CEO Satoshi Tsunakawa and Nagayama were put to vote at the annual meeting.

All of the candidates were approved except for Nagayama and Nobuyuki Kobayashi, an audit committee member. At a board of directors meeting held after the general shareholders’ meeting, a decision was made to have Tsunakawa also serve as interim board chairman.

George Olcott, who was approved as an outside director, resigned on the same day. Olcott reportedly asked to step down over the rejected reappointment of Nagayama, saying that the corporate environment would be different from what he had expected.

Criticism among shareholders has grown following the release of an external investigation report on June 10.

According to the report, at the time of the general shareholders’ meeting last summer, Toshiba, in cooperation with the Economy, Trade and Industry Ministry, tried to block foreign investment funds from wielding their shareholders’ rights.

Shareholders’ discontent had grown over the lack of oversight by Nagayama and Kobayashi, who was an audit committee member at the time.

At the general shareholders’ meeting, which started at 10 a.m., the about 120-page report was distributed among shareholders, prompting roars of anger from some of them.

“We, as the board of directors, take [your criticism] sincerely,” Tsunakawa said.

The backlash was stronger than expected. Shareholders directed the brunt of their criticism at Nagayama, indicating a miscalculation on the part of the Toshiba management.

Nagayama was appointed to the post of Toshiba board chairman last July, on the basis of achievements he had made helping Sony Group Corp. rebuild as chairman of its board of directors.

He was not involved with Toshiba during the period when the alleged irregularities disclosed in the report occurred.

The reaction “was tougher than I had expected,” Nagayama reportedly said to people close to him following the rejection of his reappointment.

Toshiba has had struggled relations with its shareholders because of the financial difficulties it has been in since accounting improprieties came to light in 2015.

When a massive loss incurred by Toshiba’s U.S. nuclear subsidiary pushed its liabilities beyond its assets, the Japanese conglomerate raised about ¥600 billion in a capital increase, with foreign investment funds dubbed “activist shareholders” becoming its major shareholders.

Presently, half of Toshiba’s shares are held by foreign investors. Of the directors appointed this time, four are said to be candidates put forward based on the considerations of foreign investment funds. As the funds have already been wielding a strong presence at board meetings, their clout will increase further if their proposals for additional director appointments are approved at an extraordinary general shareholders’ meeting.

Toshiba plans to announce its interim corporate management plan in October.

Calls from shareholders seeking more returns, including increased dividends, and the sale of less profitable businesses, are expected to intensify. It is also likely to rekindle calls for Toshiba shares to be delisted through an acquisition, which a private British equity firm proposed but backed away from in April.

Some believe investment funds were behind the removal of Nagayama, who wanted to keep the shares listed.

Toshiba will hold an extraordinary general shareholders’ meeting as early as this autumn, with a proposal for appointing new board directors to be put to vote.

In a statement issued on Friday night, the board of directors said: “We will proceed with the appointment of Tsunakawa’s successor. In a bid to appoint someone of the finest capability, we will consider candidates from both inside and outside the company.”

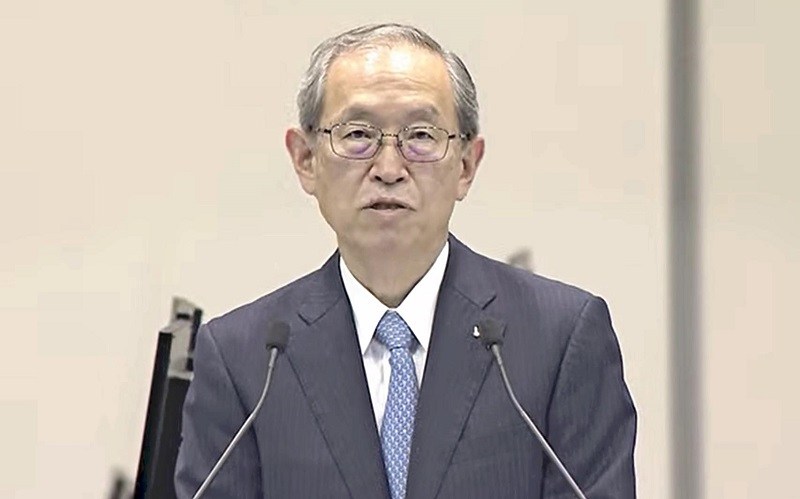

Satoshi Tsunakawa, president and CEO of Toshiba Corp., attends the regular general shareholders’ meeting of Toshiba in Shinjuku Ward, Tokyo, on Friday.

Govt mulls curbs

The government is considering tightening regulations in light of Toshiba’s current confrontation with foreign investors.

“We will consider whether there is a way to enable a certain level of deterrence so as not to harm businesses and technologies that are important to the nation,” Economy, Trade and Industry Minister Hiroshi Kajiyama said at a press conference Friday.

Under the Foreign Exchange and Foreign Trade Law, foreign investors who own 1% or more of the outstanding shares of such companies are required to notify the government.

Governments of the United States and European countries have been granted even stronger powers due to security concerns.

Top Articles in Business

-

Prudential Life Insurance Plans to Fully Compensate for Damages Caused by Fraudulent Actions Without Waiting for Third-Party Committee Review

-

Narita Airport, Startup in Japan Demonstrate Machine to Compress Clothes for Tourists to Prevent People from Abandoning Suitcases

-

Japan, U.S. Name 3 Inaugural Investment Projects; Reached Agreement After Considerable Difficulty

-

Toyota Motor Group Firm to Sell Clean Energy Greenhouses for Strawberries

-

SoftBank Launches AI Service for Call Centers That Converts Harsh Customer Voices into Softer Voices

JN ACCESS RANKING

-

Japan PM Takaichi’s Cabinet Resigns en Masse

-

Japan Institute to Use Domestic Commercial Optical Lattice Clock to Set Japan Standard Time

-

Israeli Ambassador to Japan Speaks about Japan’s Role in the Reconstruction of Gaza

-

Man Infected with Measles Reportedly Dined at Restaurant in Tokyo Station

-

Videos Plagiarized, Reposted with False Subtitles Claiming ‘Ryukyu Belongs to China’; Anti-China False Information Also Posted in Japan