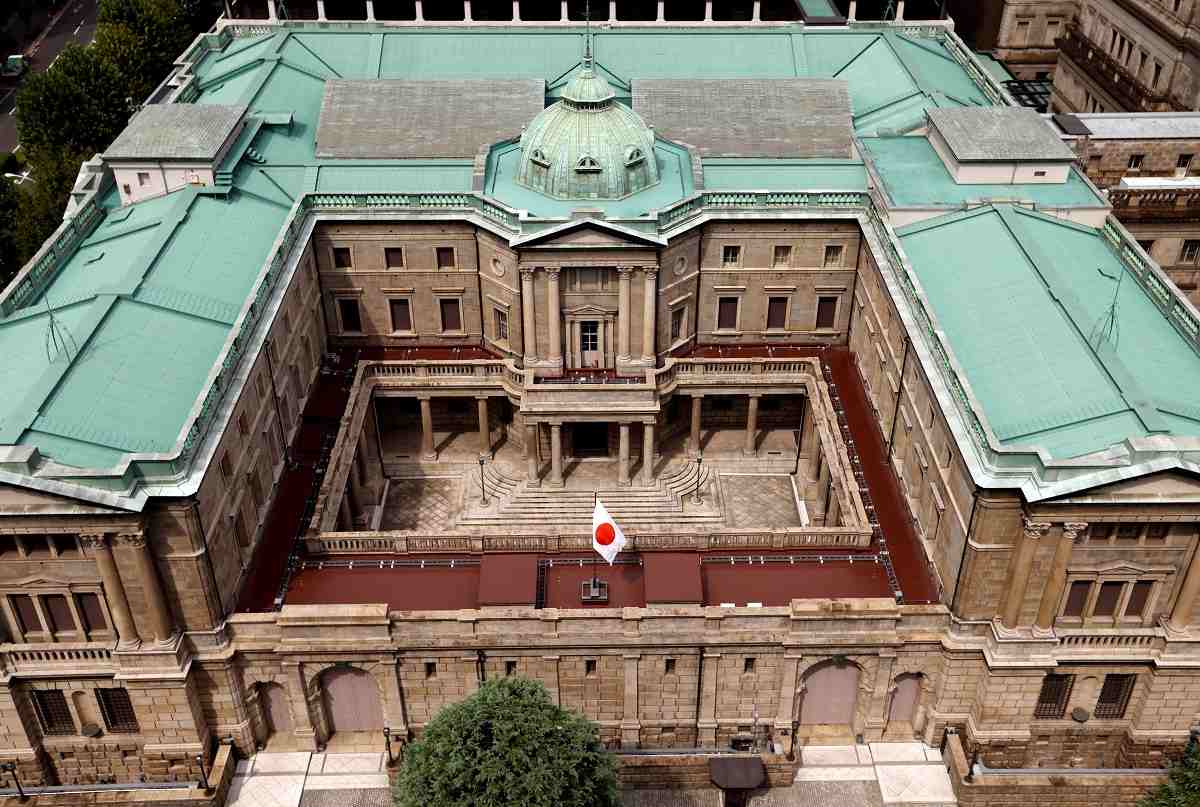

The Bank of Japan is seen in Tokyo

16:55 JST, July 16, 2024

TOKYO (Jiji Press) — Bank of Japan policymakers were largely optimistic in the first half of 2014 about the impact of a consumption tax hike, failing to forecast subsequent economic and price developments accurately, transcripts from BOJ policy meetings showed Tuesday.

The consumption tax rate was raised from 5 pct to 8 pct in April 2014, about a year after the central bank introduced its quantitative and qualitative monetary easing policy featuring a twofold increase in its Japanese government bond buying to achieve its 2 pct inflation target in about two years.

The BOJ Policy Board held seven monetary policy meetings in January-June 2014, for which transcripts of remarks by participants were disclosed this time. At one such meeting, then Governor Haruhiko Kuroda said that the impact of the tax hike was “within expectations.”

At all seven meetings, BOJ policymakers unanimously decided to keep intact the main elements of the monetary policy.

The new policy framework had sent Japanese stocks higher and the yen lower and improved business sentiment. Even the core consumer price index had turned around from its protracted decline, logging a year-on-year rise of 1.5 pct in April 2014 excluding the impact of the tax hike as estimated by the BOJ at that time.

In its Outlook for Economic Activity and Prices report adopted at a policy meeting April 30 that year, the BOJ predicted that the core CPI rate excluding the tax hike impact would move under 1.5 pct and then rise from the latter half of fiscal 2014 to reach 1.9 pct in fiscal 2015 and 2.1 pct in fiscal 2016. The certainty of achieving the inflation target was “increasing,” then Deputy Governor Kikuo Iwata said.

At a meeting June 13, 2014, then Deputy Governor Hiroshi Nakaso said he recognized declines after a demand rush that preceded the tax hike, but that the development was within the expected range.

Many other policymakers including Iwata agreed that prices were moving in line with the BOJ’s main scenario. Showing confidence in achieving the inflation target, Kuroda concluded that there had been “no change in the underlying trend of prices even after the consumption tax hike.”

Meanwhile, some Policy Board member were cautious about the outlook for prices. Member Sayuri Shirai mentioned a risk that a decline in real income would affect the underlying trend of consumption.

At the April 30 meeting, Takahide Kiuchi, another policymaker, said that it was highly likely that the positive effect of the yen’s depreciation on prices would gradually fade away, arguing that the inflation rate would fall below 1 pct in or after summer. Member Takehiro Sato said he saw significant uncertainties about the achievability of the inflation target around fiscal 2015.

Following the tax hike, consumption turned sluggish. The growth in the core CPI rate excluding the tax hike impact also shrank to around 1 pct in August and September 2014, weighed down also by lower crude oil prices and the decreasing effect of the yen’s depreciation.

The BOJ’s scenario collapsed, forcing it to implement additional easing including a boost to its JGB buying in October that year.

Top Articles in Business

-

Prudential Life Insurance Plans to Fully Compensate for Damages Caused by Fraudulent Actions Without Waiting for Third-Party Committee Review

-

Narita Airport, Startup in Japan Demonstrate Machine to Compress Clothes for Tourists to Prevent People from Abandoning Suitcases

-

Japan, U.S. Name 3 Inaugural Investment Projects; Reached Agreement After Considerable Difficulty

-

Toyota Motor Group Firm to Sell Clean Energy Greenhouses for Strawberries

-

SoftBank Launches AI Service for Call Centers That Converts Harsh Customer Voices into Softer Voices

JN ACCESS RANKING

-

Japan PM Takaichi’s Cabinet Resigns en Masse

-

Japan Institute to Use Domestic Commercial Optical Lattice Clock to Set Japan Standard Time

-

Israeli Ambassador to Japan Speaks about Japan’s Role in the Reconstruction of Gaza

-

Man Infected with Measles Reportedly Dined at Restaurant in Tokyo Station

-

Videos Plagiarized, Reposted with False Subtitles Claiming ‘Ryukyu Belongs to China’; Anti-China False Information Also Posted in Japan