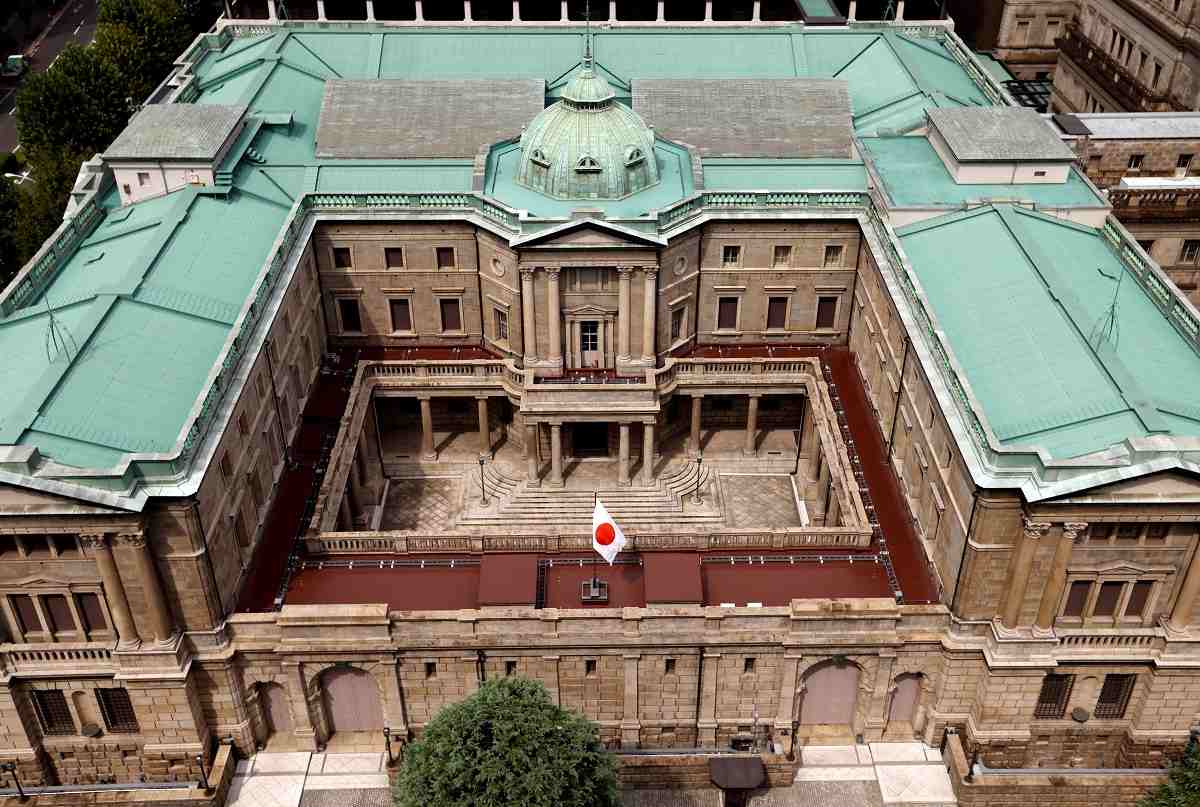

The Bank of Japan is seen in Tokyo in September 20, 2023.

12:15 JST, March 18, 2024

TOKYO (Reuters) – Japanese government bond yields declined on Monday, ahead of a key Bank of Japan policy decision the following day when the central bank is widely expected to exit ultra-easy stimulus.

The Nikkei newspaper reported on Saturday that the BOJ would exit negative short-term interest rate policy (NIRP) on Tuesday, following substantial pay hikes by big firms in this year’s wage negotiations.

Several other local and international media have also reported over the past week of the likelihood of an imminent stimulus exit. Reuters reported that the central bank was likely to remove its long-term yield curve control policy (YCC) at the same time as ending NIRP.

The 10-year JGB yield JP10YTN=JBTC lost 2 basis points (bps) to 0.765% as of 0230 GMT, while benchmark 10-year JGB futures 2JGBv1 rose 0.21 yen to 145.31. Bond yields fall when prices rise.

“It’s kind of buy the fact,” said Shoki Omori, chief Japan desk strategist at Mizuho Securities. “All the information is basically out, so people are no longer scared about what the BOJ will do tomorrow.”

While the 10-year yield may jump above 0.8% initially following the BOJ policy decision, demand for bonds from life insurers and other long-term investors into Japan’s fiscal year-end this month could push it as low as 0.7% ultimately, Omori said.

Yields may also have been helped lower on Monday by the BOJ’s announcement of an unscheduled 3 trillion yen ($20.1 billion)bond repurchase agreement, which analysts said was aimed at providing liquidity during the period covering the bank’s own and the U.S. Federal Reserve’s policy decisions, with the latter coming on a Japanese public holiday on Wednesday.

The 20-year JGB yield JP20YTN=JBTC fell 2.5 bps to 1.535% on Monday, and the 30-year JP30YTN=JBTC slid 3.5 bps to 1.815%. Two-year JP2YTN=JBTC and five-year JP5YTN=JBTC JGB yields, however, were flat at 0.185% and 0.380%, respectively.

“A surge in yields is kind of unlikely now” on Tuesday, with an exit from NIRP and YCC “basically a done deal,” said Naka Matsuzawa, chief Japan macro strategist at Nomura.

The only uncertainty is whether the central bank keeps its commitment to expanding the monetary base, Matsuzawa added.

“A lot of people expect that to be dropped, myself included,” he said. “If they keep it, it will be a dovish surprise.”

$1 = 149.1800 yen

"News Services" POPULAR ARTICLE

-

American Playwright Jeremy O. Harris Arrested in Japan on Alleged Drug Smuggling

-

Japan’s Nikkei Stock Average as JGB Yields, Yen Rise on Rate-Hike Bets

-

Japan’s Nikkei Stock Average Licks Wounds after Selloff Sparked by BOJ Hike Bets (UPDATE 1)

-

Japan’s Nikkei Stock Average Buoyed by Stable Yen; SoftBank’s Slide Caps Gains (UPDATE 1)

-

Japanese Bond Yields Zoom, Stocks Slide as Rate Hike Looms

JN ACCESS RANKING

-

Keidanren Chairman Yoshinobu Tsutsui Visits Kashiwazaki-Kariwa Nuclear Power Plant; Inspects New Emergency Safety System

-

Imports of Rare Earths from China Facing Delays, May Be Caused by Deterioration of Japan-China Relations

-

Tokyo Economic Security Forum to Hold Inaugural Meeting Amid Tense Global Environment

-

University of Tokyo Professor Discusses Japanese Economic Security in Interview Ahead of Forum

-

Japan Pulls out of Vietnam Nuclear Project, Complicating Hanoi’s Power Plans