Chubu Centrair International Airport staffers welcome passengers who arrived Monday on the first flight from Tianjin, China, in more than three years.

19:20 JST, April 13, 2023

Six months after the government significantly eased entry restrictions into Japan, the number of international visitors coming here is quickly rebounding.

The number of travelers arriving from overseas in February reached more than half of the figure from the same month in the year before the COVID-19 pandemic started. The expected increase in tourists from China in the months ahead will put more wind in the tourism industry’s sails, but many accommodation businesses are grappling with a severe labor shortage.

At around noon on Monday, a Tianjin Airlines passenger jet touched down at Chubu Centrair International Airport. This was the first flight from Tianjin, China, to the airport serving the Nagoya area since the route was mothballed about three years and two months ago as the pandemic erupted. Airport staff warmly welcomed the passengers after they got off the plane.

“I want to visit Takayama in Gifu Prefecture, and buy cosmetics and a watch in Nagoya,” said a beaming 43-year-old temporary staffing company employee from Shanghai.

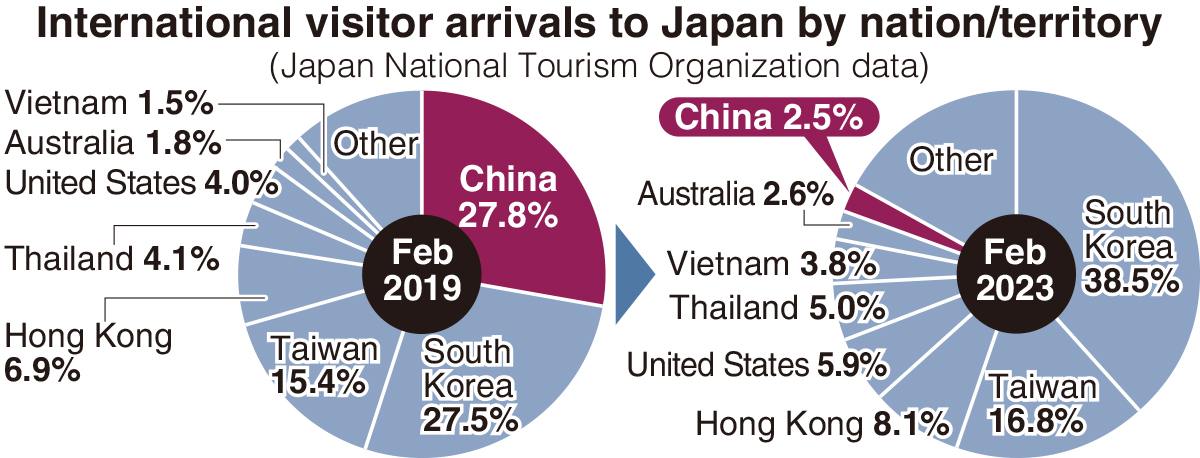

International travelers to Japan plummeted after the government imposed strict border controls during the pandemic. In 2021, the number of visitors sank to a record low of 240,000 as the tourism industry “evaporated.” The situation has changed drastically since the entry restrictions were relaxed in October 2022. According to the Japan National Tourism Organization, about 1.475 million international visitors came to Japan in February, which was 56% of the figure for the same month in 2019.

Visitor numbers seem to have continued to steadily increase since March. All Nippon Airways’ summer flight schedule starting on March 26 included the resumption of two routes to Europe, including flights between Haneda Airport in Tokyo and Munich. ANA this month also has gradually restarted flights to China, including its Haneda-Beijing and Haneda-Shanghai routes. Although ANA is operating only about 20% as many flights to China as it did before the pandemic, the airline aims to lift this proportion to about 60% during the current business year, which runs until March 2024.

In January, JTB Corp. estimated 21.1 million international inbound visitors would come to Japan in 2023. This would be more than a fivefold increase from the 3.83 million tourists that visited in 2022. “It’s also possible this number could increase further,” a JTB spokesperson said.

Cash registers ringing again

Hotels and department stores, which were hit hard when tourists — and their money — suddenly dried up, are getting back on their feet.

What was once a business hotel in Kyoto has been refurbished to become the luxurious accommodation facility Fauchon L’Hotel Kyoto. The number of guest rooms has been reduced by about 60%, and they are now more spacious and the interiors have an elegant feel thanks to a partnership with a high-end French brand. Room rates were increased from about ¥5,000 per night to more than ¥40,000 for some rooms, but the hotel has proved popular among overseas visitors. It was often fully booked in March.

“When the borders were opened up, the sudden influx of international visitors was greater than we expected,” said Kazutoshi Senno, representative director of Tokyo-based Wealth Management Group, which operates Fauchon L’Hotel Kyoto. Wealth Management also plans to build an upmarket resort hotel in Toba, Mie Prefecture.

Tax-free sales to foreign customers at the Isetan Shinjuku department store in Tokyo in March were about 30% higher than in the same month in 2019, before the pandemic started. Wealthy visitors from Taiwan, Hong Kong, Thailand and elsewhere are eager to splurge while in Japan. “Sales of brand-name jewelry pieces costing several million yen have been rising,” a representative of the store told The Yomiuri Shimbun.

Tax-free sales at Daimaru Matsuzakaya department stores in March were up 5.4-fold from the same month in 2022, while such sales were up 3.8-fold at Takashimaya department stores.

Labor shortage biting

The labor shortage at accommodation facilities and other businesses could cast a shadow over the sharp rebound in international visitors.

According to Teikoku Databank Ltd., about 80% of hotels and traditional ryokan inns reported feeling a labor shortage as of January. In a survey conducted by the Japan Hotel Association, 88.7% of respondents said the shortage of workers had affected their business operations. Some hotels had shortened the business hours of their in-house restaurants and bars, and others put a cap on their customer occupancy rates.

“Many younger employees drifted away to jobs in other industries during the pandemic,” a senior official of the association said. “The perception that jobs are fickle in the hotel business has taken root, so finding new employees has been difficult.”

Some businesses in the accommodation industry have tried new approaches to bolstering their workforce, such as by turning to so-called gig workers — people who find one-off jobs through smartphone apps.

Wealthy visitors targeted

The government, which has designated tourism as a major pillar of its economic growth strategy, will step up efforts to attract more travelers to Japan. But rather than just focusing on sheer numbers of inbound tourists, the government will lean more toward attracting visitors with more money to spend.

The government’s tourism promotion basic plan covering the period through fiscal 2025, which the Cabinet approved in late March, set a target of boosting per capita consumption by tourists from ¥159,000 to ¥200,000. Achieving this goal will involve a greater emphasis on wealthy visitors. According to the Japan Tourism Agency, inbound travelers to Japan in 2019 spent ¥4.8 trillion, with wealthy visitors accounting for at least 10% of it.

Well-heeled visitors spend most of their money while shopping in major urban areas. Encouraging these tourists to also travel to regional areas and stay longer could be considered effective ways to nudge them spend even more money. The basic plan also includes a goal of having foreign tourists stay for an average of two nights at locations outside Japan’s three main metropolitan areas of Tokyo, Osaka and Aichi Prefecture, up from an average of 1.4 nights in 2019.

In March, the tourism agency designated eleven locations across Japan as “model tourism destinations,” where visitors could experience nature, history and culture unique to Japan. These locations included the Setouchi area around the Seto Inland Sea, the Hokuriku region and the Sanin region. With wealthy travelers as the target market, the government will support projects in these areas including the construction of upscale accommodation facilities, the development of hands-on tour packages, and the training of guides and interpreters.

“Even aside from its World Heritage sites, Japan has some of the best tourist attractions in the world,” said Fumiko Watanabe, an associate senior researcher at NLI Research Institute.

Top Articles in Society

-

Producer Behind Pop Group XG Arrested for Cocaine Possession

-

Man Infected with Measles Reportedly Dined at Restaurant in Tokyo Station

-

Man Infected with Measles May Have Come in Contact with Many People in Tokyo, Went to Store, Restaurant Around When Symptoms Emerged

-

Woman with Measles Visited Hospital in Tokyo Multiple Times Before Being Diagnosed with Disease

-

Australian Woman Dies After Mishap on Ski Lift in Nagano Prefecture

JN ACCESS RANKING

-

Producer Behind Pop Group XG Arrested for Cocaine Possession

-

Japan PM Takaichi’s Cabinet Resigns en Masse

-

Man Infected with Measles Reportedly Dined at Restaurant in Tokyo Station

-

Israeli Ambassador to Japan Speaks about Japan’s Role in the Reconstruction of Gaza

-

Videos Plagiarized, Reposted with False Subtitles Claiming ‘Ryukyu Belongs to China’; Anti-China False Information Also Posted in Japan