Japan to Tackle ‘¥100 Million Wall’ with Lower Threshold for Tax Surcharge on Ultra-High Earners

The Finance Ministry

16:01 JST, December 11, 2025

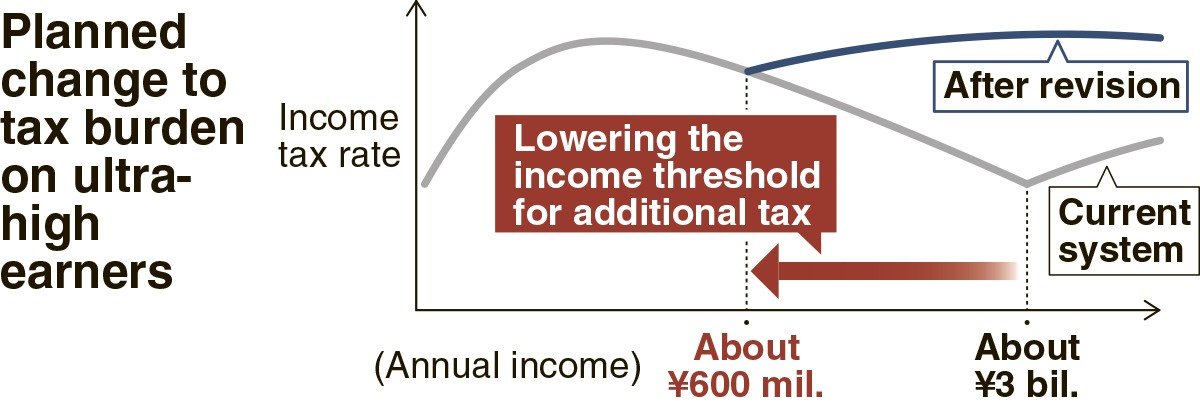

The government and the ruling coalition have entered final-stage deliberations over fiscal 2026 tax reforms, and one aim is to lower the income level from which an additional tax burden is imposed from about ¥3 billion a year to about ¥600 million.

The measure is planned to be included in the annual tax reform outline to be compiled by the end of the year, with implementation targeted for 2027. The objective is to further address the “¥100 million wall,” a widely criticized phenomenon in which a person’s effective income-tax burden begins to fall once their annual income exceeds ¥100 million.

For earned income such as wages, the combined income tax and local inhabitant tax rate rises with income, peaking at 55%. By contrast, financial income from sources such as capital gains from stock sales is taxed at a flat 20%. As a result, the greater the share of financial income among ultra-high earners, the lower their overall effective tax burden tends to be.

According to the Finance Ministry, the average income tax rate for people with total annual income of ¥50 million to ¥100 million — across wages, financial income and other sources — is 25.9%. For those earning ¥1 billion to ¥2 billion, however, the average falls to 20.1%. The ¥100 million wall has long been flagged as a policy problem.

To increase income tax payments by ultra-high earners, a system requiring additional payments from those with sufficiently high incomes was introduced this year. Under the system’s formula, the reference amount is calculated by subtracting ¥330 million from annual income and multiplying the remainder by 22.5%. Income tax is also calculated in the usual way on wage income and financial income. If the tax due under the formula is larger, the taxpayer is required to pay the difference as an additional tax.

In practice, this affects those with annual incomes of roughly ¥3 billion or more.

Under the new proposal, the deduction used in the special formula would be halved to ¥165 million, and the rate would be raised to 30%. This would lower the income threshold to be subject to the additional tax to about ¥600 million.

Changes to NISA, housing loans

Another reform involves the Nippon Individual Savings Account (NISA), which is a tax-exempt investment program. The government would eliminate the age restriction for the “tsumitate” (installment-type) investment category, which had been limited to those 18 and older. For those aged 0 to 17, the annual investment allowance would be set at ¥600,000, with a tax-exempt holding limit of ¥6 million.

Additionally, the housing loan tax deduction, set to expire at the end of this year, would be extended for five years. Support for buyers of preexisting homes would also be expanded. Currently, loans of up to ¥30 million qualify for the deduction, but that ceiling would be raised to ¥45 million. The deduction period would also be extended from the current 10 years to a maximum of 13 years, matching the treatment for newly built homes.

For households with a combined annual income of ¥10 million or less, the minimum floor-area requirement for existing homes to be eligible for a deduction would be changed. To fall in line with the rules for new homes, the threshold would be lowered from 50 square meters to 40 square meters.

Top Articles in Politics

-

Japan PM Takaichi’s Cabinet Resigns en Masse

-

Sanae Takaichi Elected 105th Prime Minister of Japan; Keeps All Cabinet Appointees from Previous Term

-

Japan’s Govt to Submit Road Map for Growth Strategy in March, PM Takaichi to Announce in Upcoming Policy Speech

-

LDP Wins Historic Landslide Victory

-

LDP Wins Landslide Victory, Secures Single-party Majority; Ruling Coalition with JIP Poised to Secure Over 300 seats (UPDATE 1)

JN ACCESS RANKING

-

Japan PM Takaichi’s Cabinet Resigns en Masse

-

Japan Institute to Use Domestic Commercial Optical Lattice Clock to Set Japan Standard Time

-

Israeli Ambassador to Japan Speaks about Japan’s Role in the Reconstruction of Gaza

-

Man Infected with Measles Reportedly Dined at Restaurant in Tokyo Station

-

Man Infected with Measles May Have Come in Contact with Many People in Tokyo, Went to Store, Restaurant Around When Symptoms Emerged