Biden Prioritized Labor Unions in U.S. Steel Decision; Opinion Divided Within U.S. Government on Security Risks

This is a portion of US Steel’s Edgar Thomson Works in Braddock, Pa., on April 28, 2024.

16:35 JST, January 5, 2025

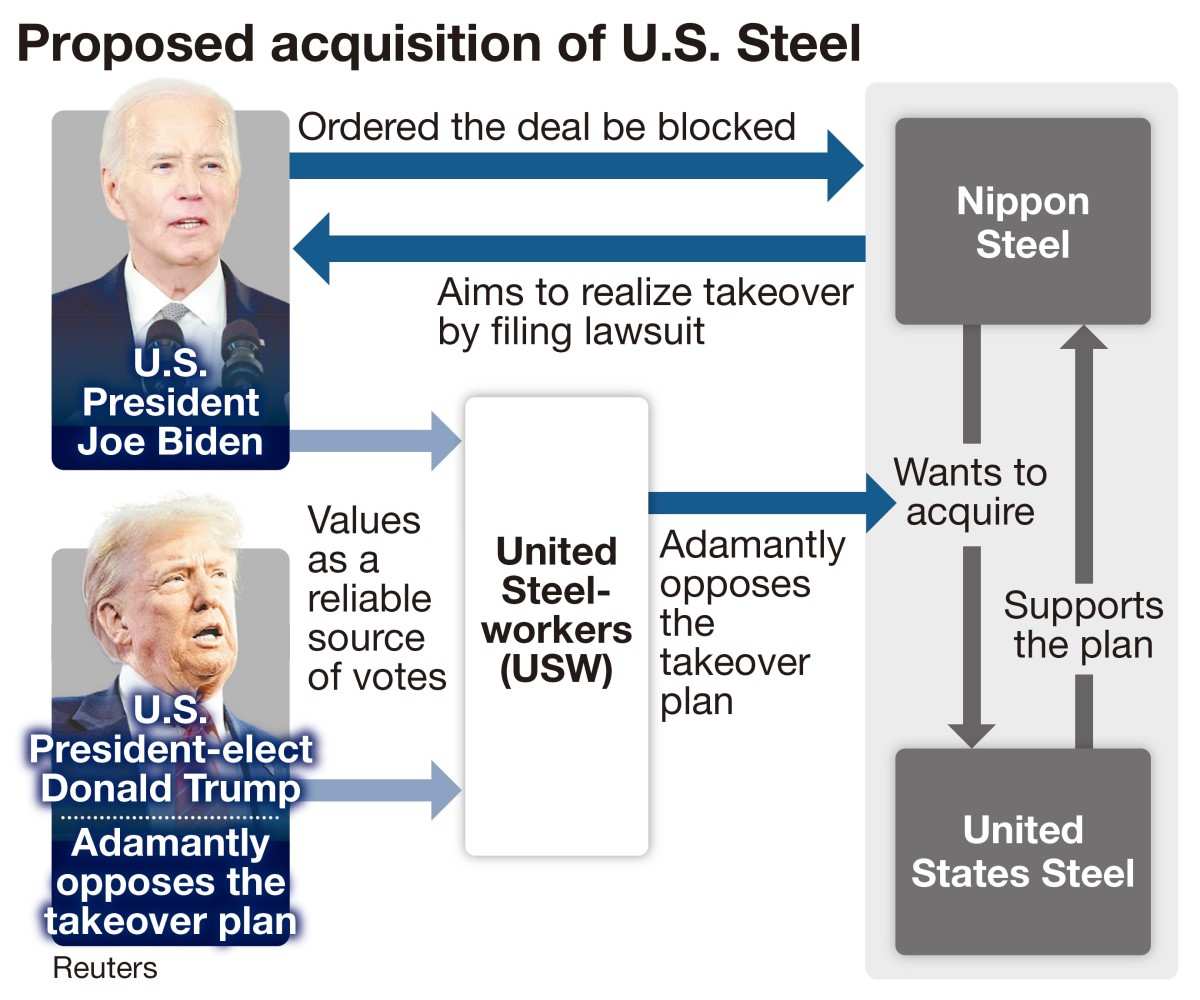

The proposed deal for Nippon Steel Corp. to purchase United States Steel Corp. has been blocked by U.S. President Joe Biden, after it was tossed about by U.S. politics for approximately a year.

Many experts believe that the president’s decision prioritized the wishes of labor unions, which are part of Democrats’ support base, rather than economic rationality. The failed large-scale reorganization of the Japan-U.S. steel industry could cast a dark shadow on the close alliance between the two countries and their investment strategies.

Does Biden want to take credit?

“U.S. Steel will remain a proud American company — one that’s American-owned, American-operated, by American union steelworkers — the best in the world,” Biden said in his statement issued on Friday. The president, who is from a middle-class family and calls himself “the most pro-union, pro-worker president in history,” clearly reflected his consideration for labor unions in the statement.

Biden was apparently thinking of United Steelworkers (USW) International President David McCall, who has consistently opposed the proposed acquisition. Backed by the voting power of about 850,000 union members, McCall has political influence in the U.S. Rust Belt, which is home to many working-class people.

Following their defeat in the presidential election in November, the Democrats and the Biden administration decided to block the planned deal to keep union members on their side in future elections.

And even if Biden were to allow the acquisition, President-elect Donald Trump, who will take office later this month, would undoubtedly reverse that decision. Biden is therefore believed to be seeking to prevent his political opponent from taking credit.

U.S. Steel is a symbolic presence that once supported the country as the world’s largest steelmaker. The acquisition deal, which could give U.S. citizens the impression that the company is being sold to a foreign country, involves huge political risks. Therefore, many analysts believe that the president had no other option.

Opinion divided within U.S. govt

According to reports by U.S. and European media outlets, members of the Committee on Foreign Investment in the United States (CFIUS), which is tasked with reviewing acquisitions of U.S. businesses by foreign buyers for potential national security risks, were divided over the danger that U.S. steel-making capacity would decline after the takeover.

The U.S. Trade Representative argued that Nippon Steel might prioritize its production bases in India and reduce U.S. production in the future. In contrast, the Treasure, State and Defense departments reportedly concluded that the takeover would pose no risks.

William Chou of the Hudson Institute in the United States criticized how the review was performed. Chou said the concerns expressed by the committee were based on extremely weak grounds, adding that it was obvious that there were political directives and interference involved.

U.S. Steel likely to struggle to restructure

Nippon Steel pledged at the end of August to invest a total of $2.7 billion, or about ¥420 billion, and increasingly reached out to people concerned at local meetings. As a result, it managed to steadily win growing support from some USW members and heads of local governments.

Twenty people, including the heads of administrative districts where U.S. Steel has production and other facilities, sent a letter to President Biden on Dec. 23 seeking his approval for Nippon Steel’s acquisition plan. The letter said that they “overwhelmingly support the vision and commitments that Nippon Steel has introduced to ensure that their jobs are protected and that their local facilities stay open.”

But Biden did not change his mind. The stalled plan made it unlikely for Nippon Steel to invest in U.S. Steel, which will certainly make it even more difficult to restructure the company.

In the past eight cases in which U.S. presidents prohibited acquisition plans after CFIUS reviews, the buyers were Chinese companies in seven cases and a Singapore firm in one case. No acquisition proposals by businesses from U.S. allies had been blocked in the past.

The latest decision runs strongly counter to the philosophy of the Biden administration, which has emphasized strengthening supply networks with allied countries to reduce the United States’ dependence on China. This may affect not only the U.S. alliance with other countries but also the credibility of CFIUS reviews and the country’s reputation as a destination for foreign investment.

Top Articles in Politics

-

Japan PM Takaichi’s Cabinet Resigns en Masse

-

Sanae Takaichi Elected Prime Minister of Japan; Keeps All Cabinet Appointees from Previous Term

-

Japan’s Govt to Submit Road Map for Growth Strategy in March, PM Takaichi to Announce in Upcoming Policy Speech

-

LDP Wins Historic Landslide Victory

-

LDP Wins Landslide Victory, Secures Single-party Majority; Ruling Coalition with JIP Poised to Secure Over 300 seats (UPDATE 1)

JN ACCESS RANKING

-

Producer Behind Pop Group XG Arrested for Cocaine Possession

-

Japan PM Takaichi’s Cabinet Resigns en Masse

-

Japan Institute to Use Domestic Commercial Optical Lattice Clock to Set Japan Standard Time

-

Man Infected with Measles Reportedly Dined at Restaurant in Tokyo Station

-

Israeli Ambassador to Japan Speaks about Japan’s Role in the Reconstruction of Gaza