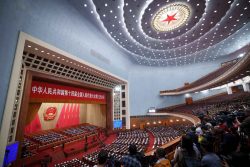

A sign for SLB, formerly Schlumberger, is displayed at the building on Tuesday, March 21, 2023, in Houston.

12:01 JST, July 19, 2023

Major American providers of oilfield services supplied Russia with millions of dollars in equipment for months after its invasion of Ukraine, helping to sustain a critical part of its economy even as Western nations launched sanctions aimed at starving the Russian war effort.

The largest – SLB, formerly Schlumberger – maintained and even slightly grew its business after others eventually departed. It announced on Friday it would stop exporting equipment there as The Associated Press prepared to publish a report on the companies’ Russian operations.

Russia imported more than 5,500 items worth more than $200 million from the top five U.S. firms in the sector — led by SLB, Baker Hughes and Halliburton — in the year following the invasion that began in February 2022. That’s according to customs data obtained by B4Ukraine and vetted by The AP.

The technology helped keep some of the world’s most challenging oilfields operating in a sector that provided nearly half of Russia’s federal revenues in 2021. Baker Hughes and Halliburton wound down their Russian operations several months after the invasion, but until last week, SLB still sold technology there.

It was “deeply shocking to find a U.S. company continuing to supply equipment to Russia’s oil and gas sector,” said Eleanor Nichol, executive director of B4Ukraine, a coalition of more than 80 nonprofits calling for multinationals to leave the Russian market.

The AP corresponded with SLB about the exports over several months beginning in February and asked the company for final comment on Wednesday. SLB announced two days later it would halt shipments of technology and equipment to Russia from all SLB facilities worldwide. The company said it was “in response to the continued expansion of international sanctions,” including new EU ones at the end of June.

In April, Ukraine categorized SLB as a “sponsor of the war,” a label aimed at deterring banks, investors and customers from doing business with companies still operating in Russia. Agiya Zagrebelska, Ukraine’s sanctions chief, told AP that SLB had benefited financially by remaining in Russia as competitors left.

SLB spokeswoman Moira Duff rejected the idea that SLB’s operations effectively support the Russian war effort. She said SLB voluntarily curtailed some activity starting the month after the invasion.

“Where permitted by evolving international sanctions, we have continued to provide certain products,” Duff said before last week’s announcement.

On Monday, Duff said SLB still has employees in Russia even though it will no longer send equipment there.

Halliburton wound down its Russia operations less than six months after the invasion “while prioritizing safety,” spokesman Brad Leone said. Baker Hughes announced the sale of its oilfield services business in Russia last August, six months after the invasion, and completed the deal three months later.

By contrast, oil majors including Exxon, Shell and BP scrambled to quit Russia after the invasion, announcing their decision to leave within days or weeks and writing off billions in assets. Their operations wound down over the following months, though some assets remain stranded. BP wrote off $24.4 billion, Shell $4.2 billion and Exxon $4 billion, they said in public statements.

Oilfield services companies carry out drilling and well construction, but don’t typically produce fossil fuels themselves. SLB is by far the biggest, with a market cap of about $81 billion.

The customs data show Russia imported 3,279 items from SLB in the year after the invasion, valued at almost $60 million. The most expensive was a $3.5 million oil well monitoring system, which feeds operators data to optimize production.

Russia imported 712 items valued at almost $121 million from Baker Hughes, and 1,399 objects valued at almost $20 million from Halliburton, according to the data. The fourth-largest U.S. oilfield services provider, NOV, was far back with 153 items worth $831,000, and the fifth-largest, Noble Corp., didn’t ship any items after the invasion, according to the research.

The figures may capture some items that were in transit before the war broke out. It doesn’t include the value of work done by the companies’ employees or contractors in Russia. SLB, for example, had 9,000 employees there as of February.

Jeffrey Sonnenfeld, a professor of management at Yale and leader of an effort to track whether companies have left Russia since the invasion, praised the big oil producers — BP, Exxon and Shell — for moving with “remarkable speed” to withdraw.

“By contrast, the oil services companies, kicking and screaming, had to feel the sting of public exhortations to gradually move out,” he said, though he added Halliburton’s sale took a reasonable amount of time.

The Yale list rated all the oil majors and top U.S. oilfield services companies that were trading with Russia when the invasion began as having undertaken “Suspension” or “Withdrawal” except for SLB and France’s TotalEnergies, which are rated as “Buying Time.” Yale’s Steven Tian said there are no plans to change SLB’s rating at present because the company is still doing business in Russia, though not sending in new products or technology.

Just days after the invasion, the U.S. Department of Commerce banned companies from exporting critical oil extraction equipment, including items that could be used in deep water, the Arctic or shale formations, without a special license. A notice in the Federal Register said the move was aimed at restricting Russia’s access to items to “support its military capabilities.” Allies including the UK and EU followed suit.

AP’s review found hundreds of items imported from SLB and Baker Hughes carrying codes that matched Commerce’s restricted list, but there’s no evidence the items violated the ban, which says licenses are needed except under specific circumstances. Asked about a sample of the products, SLB said their items didn’t need licenses; Baker Hughes said they got all required licenses. A Commerce spokesman declined to comment on specific companies.

Whether the equipment was on restricted lists or not, oil experts said it would have been vital to Russia. Many of its oilfields are almost exhausted, offshore or under deep ice, requiring specialized equipment and expertise that American firms are known for.

Adnan Vatansever, a specialist in Russian political economy at King’s College London and a former consultant for the U.S. Department of Energy, said Russia doesn’t have the technology or expertise to fully exploit old fields or challenging ones that lie offshore or in Siberia. Nor does China, which might have been a potential source if it did, Vatansever said.

If all oilfield service companies had left, he said, it would have hurt Russian production more than the departure of oil producers. Russian oil firms can still find a market for their crude without the majors to buy it. But Vatansever estimated production would have fallen significantly without the American companies’ equipment and expertise.

Zagrebelska said SLB benefited from departing rivals, with revenue up 25% in the third quarter of 2022 compared to the prior quarter and the company taking on 70 new employees by late in the year, including on accounts for Russian fossil fuel giants Gazprom and Rosneft. Corporate filings show Russian business rose slightly for SLB through 2022, to 6% of overall revenue compared to 5% in 2021.

SLB’s Bliss said the company’s workforce has actually declined 10% since the invasion, and that the rise in Russian revenue was due to normal market fluctuations.

Top Articles in News Services

-

Survey Shows False Election Info Perceived as True

-

Hong Kong Ex-Publisher Jimmy Lai’s Sentence Raises International Outcry as China Defends It

-

Japan’s Nikkei Stock Average Falls as US-Iran Tensions Unsettle Investors (UPDATE 1)

-

Japan’s Nikkei Stock Average Touches 58,000 as Yen, Jgbs Rally on Election Fallout (UPDATE 1)

-

Japan’s Nikkei Stock Average Rises on Tech Rally and Takaichi’s Spending Hopes (UPDATE 1)

JN ACCESS RANKING

-

Producer Behind Pop Group XG Arrested for Cocaine Possession

-

Japan PM Takaichi’s Cabinet Resigns en Masse

-

Man Infected with Measles Reportedly Dined at Restaurant in Tokyo Station

-

Israeli Ambassador to Japan Speaks about Japan’s Role in the Reconstruction of Gaza

-

Videos Plagiarized, Reposted with False Subtitles Claiming ‘Ryukyu Belongs to China’; Anti-China False Information Also Posted in Japan