Japan’s Nikkei Stock Average Rebound from Epic Drop with Record Rise on Tuesday; Nikkei, Topix See Biggest Point Gains in History

Tokyo stock market

17:29 JST, August 6, 2024

The Tokyo stock market was on an all-out rise Tuesday in reaction to its largest-ever decline on the previous day.

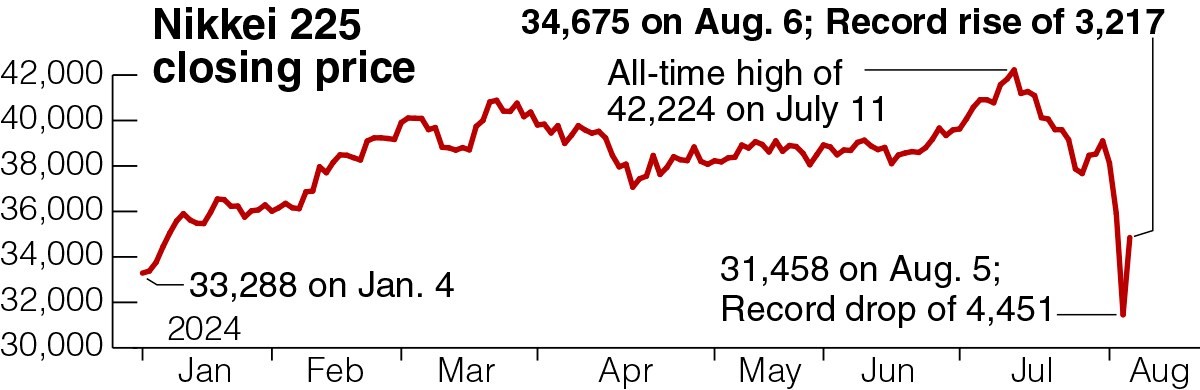

The benchmark Nikkei 225 closed at 34,675.46, up 3,217.04 points from Monday’s close, setting a new record for an increase from one closing to the next. The previous record increase was 2,676.55, logged on Oct. 2, 1990. Moreover, at one point on Tuesday, the index was up by more than 3,400 points.

The broader TOPIX stock index was also up 207.06 to close at 2,434.21. This too was a record rise, surpassing the 168.51 rise recorded on Oct. 21, 1987.

The market was buoyed by a rush of buy orders the day after the Nikkei 225 plunged a record 4,451.28, a drop exceeding the infamous “Black Monday” stock market crash on Oct. 20, 1987, when there was a 3,836.48 drop. The sharp drop caused a sense of undervaluation in a wide range of stocks.

On Tuesday, more than 98% of the 1,600 or so companies listed on Tokyo Stock Exchange’s top-tier Prime section rose in value at some point. Semiconductor-related stocks led the way, with Tokyo Electron Ltd. rising about 19% and SoftBank Group Corp., which owns a major British semiconductor design company, rising about 14%.

Export-related stocks such as automobiles and machinery were also buoyed by the yen’s depreciation against the dollar on the Tokyo foreign exchange market. The yen had surged to the ¥141 level against the dollar on Monday but weakened to the ¥146 level on Tuesday morning.

The Osaka Exchange, the leading market for futures and other derivatives trading, applied circuit breakers Tuesday morning to temporarily halt trading in Nikkei 225 and TOPIX futures to calm sharp fluctuations.

Top Articles in Business

-

Prudential Life Insurance Plans to Fully Compensate for Damages Caused by Fraudulent Actions Without Waiting for Third-Party Committee Review

-

Narita Airport, Startup in Japan Demonstrate Machine to Compress Clothes for Tourists to Prevent People from Abandoning Suitcases

-

Japan, U.S. Name 3 Inaugural Investment Projects; Reached Agreement After Considerable Difficulty

-

JR Tokai, Shizuoka Pref. Agree on Water Resources for Maglev Train Construction

-

Toyota Motor Group Firm to Sell Clean Energy Greenhouses for Strawberries

JN ACCESS RANKING

-

Japan PM Takaichi’s Cabinet Resigns en Masse

-

Japan Institute to Use Domestic Commercial Optical Lattice Clock to Set Japan Standard Time

-

Israeli Ambassador to Japan Speaks about Japan’s Role in the Reconstruction of Gaza

-

Man Infected with Measles Reportedly Dined at Restaurant in Tokyo Station

-

Videos Plagiarized, Reposted with False Subtitles Claiming ‘Ryukyu Belongs to China’; Anti-China False Information Also Posted in Japan