LDP Proposes Lowering NISA Age Limit; Aims to Leverage Funds Gifted from Grandparents to Younger Generation

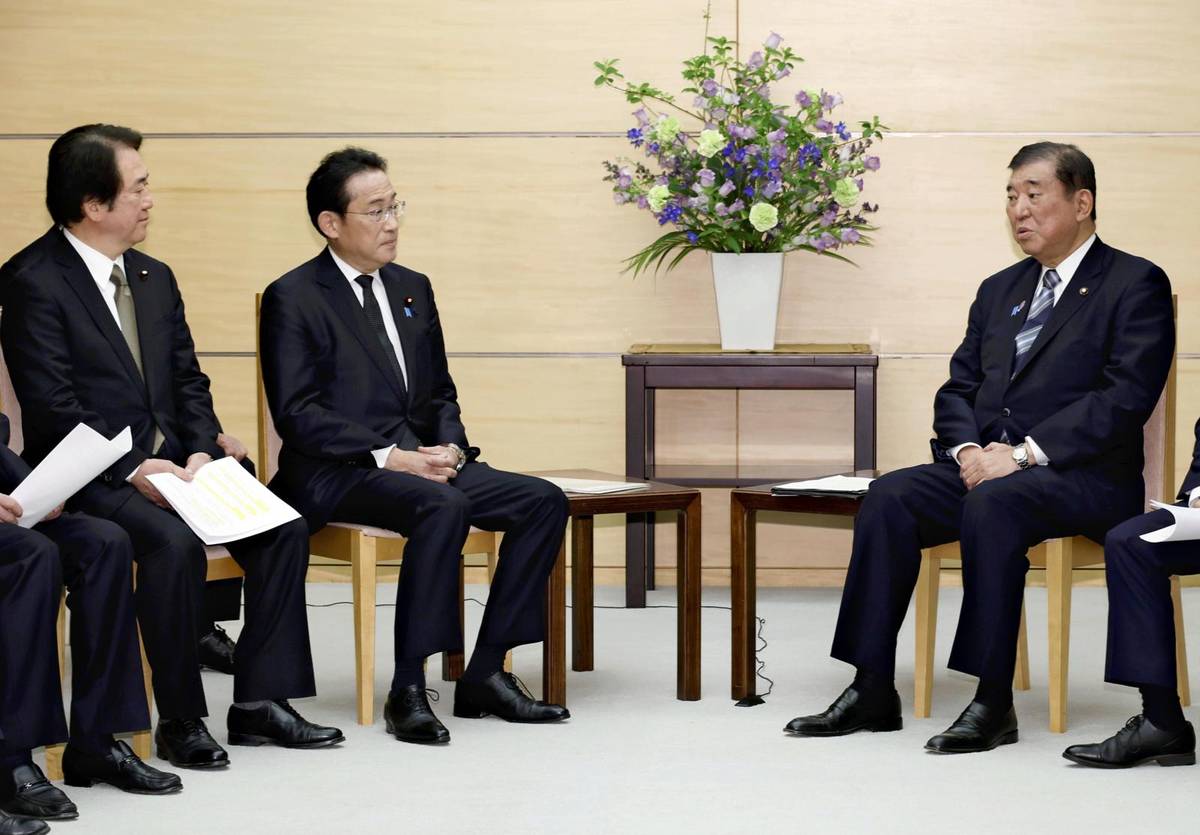

Former Prime Minister Fumio Kishida, the head of the Liberal Democratic Party’s parliamentary league on promoting investment, second from left, speaks with Prime Minister Shigeru Ishiba, right, at the Prime Minister’s Office in Tokyo on Wednesday.

15:06 JST, April 24, 2025

The Liberal Democratic Party’s parliamentary league on promoting investment has submitted a proposal to Prime Minister Shigeru Ishiba that calls for expanding the Nippon Individual Savings Account (NISA) system to allow minors to open accounts.

With a focus on expanding NISA accounts to minors and seniors, the league, which is led by former Prime Minister Fumio Kishida, urged the government on Wednesday to formulate the Policy Plan for Promoting Japan as a Leading Asset Management Center 2.0.

Kishida developed the Policy Plan for Promoting Japan as a Leading Asset Management Center when he was prime minister. Its flagship policy was the new NISA, which was launched in January 2024, that increased investment allowances over the previous NISA.

The proposal includes the introduction of the “supporting children NISA,” which would abolish the current minimum age of 18 for the “Tsumitate NISA” (installment-type NISA), which allows monthly investments into certain trusts and holds them tax-free for 20 years.

The support children NISA envisions leveraging funds gifted from grandparents to promote asset formation among younger generations. This initiative aims to channel the significant savings of the elderly toward growth investments in Japanese companies, while also addressing the declining birth rate and supporting child-rearing.

Targeting seniors, the proposal introduces the “platinum NISA,” which is designed to facilitate the purchase of investment trusts offering monthly income from their investment gains.

These types of investment trusts are typically not recommended for long-term wealth accumulation and are therefore currently ineligible under NISA. However, this proposal was put forth in response to requests from people who want to utilize their accumulated assets as a regular income stream, similar to a pension, to cover living costs.

Considering that individuals’ desired investment products can shift around the time of retirement, the proposal further advocates for the deregulation of switching, thus allowing investors to move the funds from their original investments into alternative products.

The proposal also aims to enhance the selection of products available under NISA’s Tsumitate investment framework. Taking into account the emergence of new indices like the Yomiuri Stock Index (Yomiuri 333) and their linked products, the secretariat of the parliamentary league said this will create more investment options and has the potential to increase domestic investment.

Top Articles in Business

-

Prudential Life Insurance Plans to Fully Compensate for Damages Caused by Fraudulent Actions Without Waiting for Third-Party Committee Review

-

Narita Airport, Startup in Japan Demonstrate Machine to Compress Clothes for Tourists to Prevent People from Abandoning Suitcases

-

Japan, U.S. Name 3 Inaugural Investment Projects; Reached Agreement After Considerable Difficulty

-

Toyota Motor Group Firm to Sell Clean Energy Greenhouses for Strawberries

-

SoftBank Launches AI Service for Call Centers That Converts Harsh Customer Voices into Softer Voices

JN ACCESS RANKING

-

Japan PM Takaichi’s Cabinet Resigns en Masse

-

Japan Institute to Use Domestic Commercial Optical Lattice Clock to Set Japan Standard Time

-

Israeli Ambassador to Japan Speaks about Japan’s Role in the Reconstruction of Gaza

-

Man Infected with Measles Reportedly Dined at Restaurant in Tokyo Station

-

Videos Plagiarized, Reposted with False Subtitles Claiming ‘Ryukyu Belongs to China’; Anti-China False Information Also Posted in Japan