Panasonic Corp. President Kazuhiro Tsuga, right, and Tesla Inc. CEO Elon Musk, center, at a battery plant in Nevada in 2017

16:02 JST, June 15, 2021

Panasonic Corp. is endeavoring to switch its core business from home appliances to electric vehicle batteries, riding the steadily expanding EV market wave as society shifts gears in an attempt to reduce carbon dioxide emissions. However, the undertaking has, so far, not gone as expected in realigning the company’s balance sheets.

Tesla Inc. CEO Elon Musk, 49, popped in on an online meeting in March between Panasonic’s outgoing president, Kazuhiro Tsuga, 64, its incoming president, Yuki Kusumi, 56, and several senior Tesla executives.

Musk on the call reportedly referred to Panasonic as a partner, but also asked the company to lower its battery prices.

Shortly after becoming president in 2012, Tsuga decided to expand Panasonic’s relationship with Tesla, which was just a fledgling start-up at the time. Panasonic spent more than ¥200 billion in 2017 to help build one of the world’s largest factories in the state of Nevada.

Initially plagued with production problems, the plant’s mass production system came together with the help of about 400 employees sent from Japan.

Since then, sales in the struggling EV market have gradually grown, and Tesla logged its first net profit in fiscal 2020.

“I was often asked if it was smart to invest in such an unusual company,” Tsuga said. “We’ve finally made it this far,” he added emotionally.

Still, friction between the companies appears to be increasing, as evidenced by the recent battle over prices.

A Tesla Inc. Model 3 electric vehicle in Minato Ward, Tokyo

Balancing act

When Tesla completed a factory in China in 2019, it suddenly switched to a local company to supply batteries.

Asked about losing its monopoly with Tesla, Panasonic Vice President Mototsugu Sato, 64, said, “In China, the focus is on how to make batteries cheaper. That’s not our strength.”

Sato said the decision was based on profitability considerations and that Panasonic sees Tesla as a “business partner, not a company we share a common destiny with.” He added that Panasonic aims to supply batteries to the plant Tesla is planning to build in Germany.

In September 2020, Musk announced that Tesla would release a new EV priced at $25,000 (¥2.7 million) within three years, to fulfill what he said was a dream of selling reasonably priced EVs. If achieved, this would be almost 30% less than Tesla’s current most affordable model.

The key behind such a low price is the new “4680” battery that is currently under development. Batteries are said to account for 30% or more of an EV’s manufacturing costs. Tesla wants to reduce costs by up to 12% and make the batteries more than 10% smaller.

While Musk has asked Panasonic to develop the new battery, he has also instructed Tesla’s in-house engineers to take up the challenge. He apparently wants to choose the one with the best performance.

Such determination is no doubt behind Tesla’s striking growth.

Panasonic remains positive. “Tesla doesn’t have mass production technology,” one executive said. “In the end, they’ll have to rely on us.”

However, not everyone in the automotive industry believes Tesla will choose Panasonic’s battery.

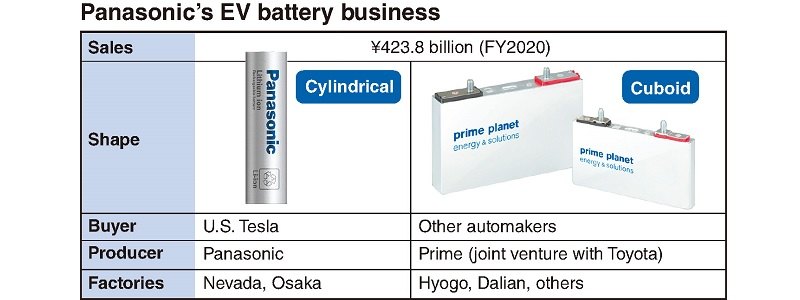

The batteries installed in electric-powered vehicles such as EVs are usually cuboid shaped. Tesla is the only company that uses large quantities of cylindrical batteries. Losing the deal with Tesla could cause Panasonic’s huge investment to disappear in a flash.

Hesitating to invest

Success or failure ultimately depends on the car manufacturers, and it is also true for cuboid batteries which is mainstream in the industry.

Panasonic in April 2018 transferred its development and production of cuboid batteries to Prime Planet Energy & Solutions Inc., a joint venture with Toyota Motor Corp.

About 80% of the company’s roughly 2,800 employees in Japan are from Panasonic, and the production bases will remain the same. Nevertheless, Panasonic’s stake is 49%, while Toyota holds 51%.

According to Tsuga, Panasonic handed majority ownership to Toyota because “production lines take large investments, and the responsibility for recouping the investment needs to be borne by the automakers.”

Did Panasonic make the right call?

“Toyota’s majority stake makes it difficult to supply other [automobile] manufacturers. There are few gains to be had if they don’t make their own investments” said Toru Amazutsumi, 63, a battery technology consultant who advises domestic and foreign car companies on electrification. “I don’t feel they’re really approaching this as a growth business.”

The automotive battery business has annual sales of over ¥400 billion. It’s difficult to be optimistic about the field’s future.

Top Articles in Business

-

Prudential Life Insurance Plans to Fully Compensate for Damages Caused by Fraudulent Actions Without Waiting for Third-Party Committee Review

-

Narita Airport, Startup in Japan Demonstrate Machine to Compress Clothes for Tourists to Prevent People from Abandoning Suitcases

-

Japan, U.S. Name 3 Inaugural Investment Projects; Reached Agreement After Considerable Difficulty

-

Toyota Motor Group Firm to Sell Clean Energy Greenhouses for Strawberries

-

SoftBank Launches AI Service for Call Centers That Converts Harsh Customer Voices into Softer Voices

JN ACCESS RANKING

-

Japan PM Takaichi’s Cabinet Resigns en Masse

-

Japan Institute to Use Domestic Commercial Optical Lattice Clock to Set Japan Standard Time

-

Israeli Ambassador to Japan Speaks about Japan’s Role in the Reconstruction of Gaza

-

Man Infected with Measles Reportedly Dined at Restaurant in Tokyo Station

-

Videos Plagiarized, Reposted with False Subtitles Claiming ‘Ryukyu Belongs to China’; Anti-China False Information Also Posted in Japan