Leaders from around the world discuss carbon dioxide emission reduction targets at the 26th U.N. Climate Change Conference of the Parties (COP26) in Glasgow on Nov. 4.

November 21, 2021

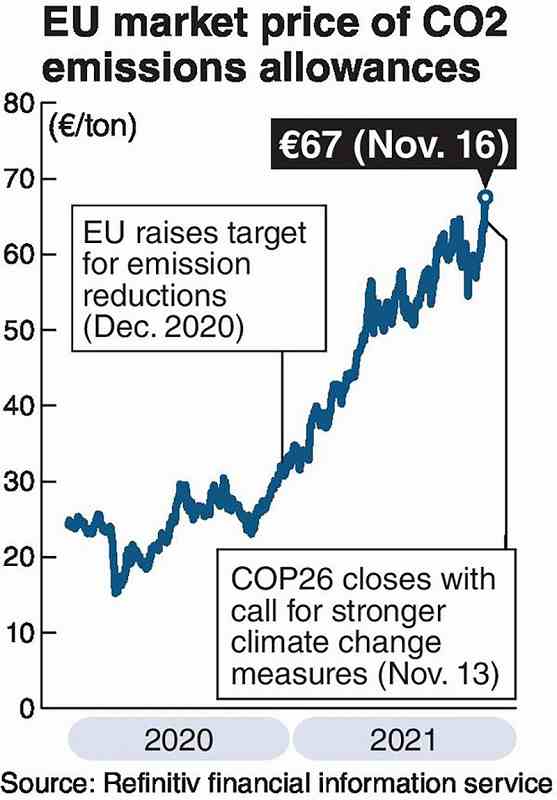

The European Union’s emissions trading market, which covers more than 10,000 facilities including power plants and factories, hit a record high of €67 (about ¥8,700) per ton of carbon dioxide on Tuesday after more than a year of rising prices. The price has doubled from earlier this year.

The emissions trading market is a system in which companies that are unable to keep their CO2 and other emissions within a set limit can buy emission allowances from other companies. Companies with emissions lower than their quota can earn income by selling off unused allowances. In the EU, the scheme was introduced in 2005.

Europe appears to be in for a cold winter, which will increase demand for heating — and thus for fuel. A new pipeline is meant to bring Russian natural gas to Europe, but it will be difficult to start operating it quickly. All of this means that the use of coal, which emits more CO2, is likely to increase instead of natural gas.

In the market, it was widely believed that facilities unable to meet their emission reduction obligations would increase their purchases of emission allowances. An influx of speculative money from funds and asset management companies, anticipating future price increases, is also pushing up prices.

The increase in transaction prices will be a burden for companies. If they think that it is cheaper to reduce their emissions by installing energy-saving equipment on their own, they do not need to buy emission allowances. At the same time, the existence of a market makes it easier to convert emissions reductions into money and encourages companies to reduce their emissions.

Hans Grunfeld of Dutch energy lobby group VEMW said, “In a difficult environment like this, where prices are skyrocketing, there needs to be support at the government level to encourage the purchase of allowances.” The EU will discuss emissions trading and how to deal with soaring energy prices at a summit next month.

In July, the “world’s largest” CO2 emissions trading market was launched in Shanghai. About 2,200 Chinese electric power companies participated in the market. The average price of the first day’s trading reached 51.23 yuan (about ¥940) per ton of CO2, and the total trading value reached 210 million yuan (about ¥3.8 billion). Four months later, Wednesday’s highest trading price was 46 yuan (about ¥830), and total trading value was about one-tenth of what it was on the first day.

In order for China to revitalize its market and reduce its overall emissions, it is necessary to expand eligibility, which is limited to electric power companies, to include other industries such as steel and chemicals. When the number of participants increases, the market will be tested as to whether it can stabilize the trading price.

A decarbonized society will likely bring more distortions like the price surge in the European emissions trading market. Wisdom is required to make steady progress in reducing emissions while minimizing negative effects.

Japan reluctant to tax companies

Carbon pricing is a system in which companies must pay money based on the quantities of greenhouse gases they emit. Carbon taxes, like emissions trading, are a typical method of incentivizing emissions reductions. The tax rate is set in advance, and it has been noted that the amount of the burden is easier to understand compared to emissions trading, in which the price fluctuates.

As a type of carbon tax, Japan introduced a global warming countermeasure tax in 2012 to tax importers of fossil fuels such as crude oil, liquefied natural gas and coal in proportion to their CO2 emissions. The tax rate is ¥289 per ton of CO2, much lower than in Europe, where similar taxes have been introduced in many countries. For example, the rate in Sweden is equivalent to ¥15,700 and the rate in France is equivalent to ¥6,000.

The Environment Ministry is aiming to either increase the rate of the global warming countermeasure tax or introduce a new carbon tax to finance technological innovations to reduce emissions and decarbonize the planet.

The business community, hitherto seen as reluctant to act, is also changing. The Japan Business Federation (Keidanren), in its request for tax reform for fiscal 2022, has changed its stance to allow discussion of a carbon tax. This is because the government has raised its emissions reduction target for fiscal 2030 and Keidanren’s member companies include finance, tech and trading companies, whose stance on decarbonization is under scrutiny by investors.

However, there are several existing energy-related taxes, such as the petroleum coal tax and the oil and gas tax. Keidanren has pointed out that the combined rate of these taxes already effectively exceeds ¥4,000 per ton of CO2.

On Wednesday, representatives of oil dealers from across the country gathered at the Parliamentary Museum across from the Diet Building and raised their voices, saying that they are firmly opposed to the introduction of a carbon tax. More than 80 members of the ruling party also attended the meeting, including Yoichi Miyazawa, chairperson of the Liberal Democratic Party’s Research Commission on the Tax System. He said, “Some government agencies are making a lot of noise, but we have no plans to discuss the carbon tax at this year’s tax commission.”

The outlook for carbon pricing in Japan remains unclear.

Top Articles in Business

-

Prudential Life Insurance Plans to Fully Compensate for Damages Caused by Fraudulent Actions Without Waiting for Third-Party Committee Review

-

Narita Airport, Startup in Japan Demonstrate Machine to Compress Clothes for Tourists to Prevent People from Abandoning Suitcases

-

Japan, U.S. Name 3 Inaugural Investment Projects; Reached Agreement After Considerable Difficulty

-

Toyota Motor Group Firm to Sell Clean Energy Greenhouses for Strawberries

-

SoftBank Launches AI Service for Call Centers That Converts Harsh Customer Voices into Softer Voices

JN ACCESS RANKING

-

Japan PM Takaichi’s Cabinet Resigns en Masse

-

Japan Institute to Use Domestic Commercial Optical Lattice Clock to Set Japan Standard Time

-

Israeli Ambassador to Japan Speaks about Japan’s Role in the Reconstruction of Gaza

-

Man Infected with Measles Reportedly Dined at Restaurant in Tokyo Station

-

Videos Plagiarized, Reposted with False Subtitles Claiming ‘Ryukyu Belongs to China’; Anti-China False Information Also Posted in Japan