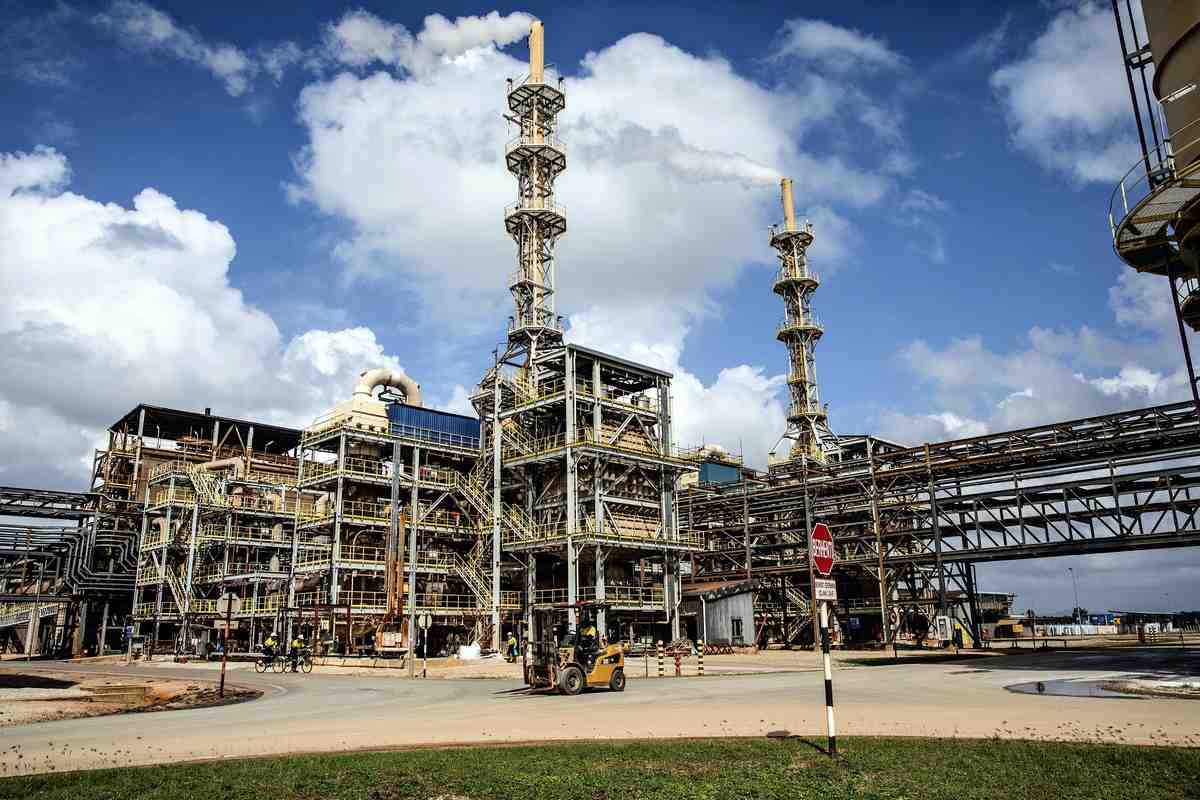

A rare earth refining facility in Kuantan, eastern Malaysia

12:56 JST, January 19, 2026

BANGKOK — China is poised to increase its involvement in rare earth production and refining in Malaysia, a move seen as an attempt to counter efforts by Japan and the United States to strengthen their ties with the country.

China commands a dominant 90% share of the global rare earth refining market, Japan, and the United States and other nations are working to bolster cooperation with Malaysia to reduce their reliance on Beijing.

According to Malaysian media, Chinese President Xi Jinping proposed technical assistance in the rare earth industry during his visit to Malaysia in April.

Reuters reported in October that a Chinese state firm and a Malaysian government-linked fund are discussing a partnership on establishing a rare earth processing facility in Malaysia. China thus appears to be aiming to expand its rare earth production within Malaysia.

The Malaysian government estimates its domestic rare earth reserves at about 16.1 million tons. Although these figures are not directly comparable with the U.S. Geological Survey estimate of 44 million tons for China — roughly half of the estimate global reserves —, Malaysia has the potential to achieve a scale roughly one-third of China.

However, Malaysia has yet to engage in full-scale production due to a lack of advanced mining technology. According to the International Energy Agency, data from 2024 showed that Malaysia’s share of global rare earth refining stood at only 4%, compared to China’s share of 91%.

Reducing dependence

China has been intensifying economic coercion by leveraging its dominant position and tightening controls on rare earth exports. This has prompted the Group of Seven and other nations, at the group’s finance ministers’ meeting on Jan. 12, to reach a consensus on de-risking and reducing their dependence on Chinese supplies.

Japan and the United States are also ramping up their engagement with Malaysia. U.S. President Donald Trump, in an October summit with Malaysian Prime Minister Anwar Ibrahim, signed a memorandum of understanding on cooperation in securing critical minerals, ensuring that no restrictions would be placed on rare earth exports to the United States.

Australia’s Lynas Rare Earths Ltd., which operates a rare earth refining base in Malaysia, has received investment from major Japanese trading house Sojitz Corp. and the Japan Organization for Metals and Energy Security.

Lynas separates and refines highly sought-after heavy rare earths mined in Australia. The company plans to expand its production capacity, aiming to meet the growing demand for supplies from non-Chinese sources.

Sojitz began imports of Lynas-refined heavy rare earths in October — the first such shipment to Japan from a non-Chinese source. Looking ahead, Sojitz aims to cover about 30% of Japan’s total demand, reinforcing the nation’s resource security.

In response to these moves, China appears to be aiming to drive a wedge between Malaysia and its partners, Japan and the United States, by offering to share its advanced mining technology.

“Should Malaysia prioritize economic growth, it could lean more toward its relationship with China,” said Toru Nishihama, chief economist at the Dai-ichi Life Research Institute Inc. “Japan must leverage free trade agreements that include Malaysia, creating a framework that precludes export and import restrictions to safeguard its economic security.”

"World" POPULAR ARTICLE

-

China Confirmed to Be Operating Drilling Vessel Near Japan-China Median Line

-

Chinese Foreign Ministry Criticizes Japan’s Largest Ever Defense Budget in Draft Budget for Fiscal 2026

-

Japan, Qatar Ministers Agree on Need for Stable Energy Supplies; Motegi, Qatari Prime Minister Al-Thani Affirm Commitment to Cooperation

-

China Appears to Warn Japan, U.S. with Drills Around Taiwan

-

China Conducts Landing Drills with Foldable Piers, Likely Readying for Taiwan Invasion (Update 1)

JN ACCESS RANKING

-

Japan Govt Adopts Measures to Curb Mega Solar Power Plant Projects Amid Environmental Concerns

-

Core Inflation in Tokyo Slows in December but Stays above BOJ Target

-

Major Japan Firms’ Average Winter Bonus Tops ¥1 Mil.

-

Tokyo Zoo Wolf Believed to Have Used Vegetation Growing on Wall to Climb, Escape; Animal Living Happily after Recapture

-

JAL, ANA Cancel Flights During 3-day Holiday Weekend due to Blizzard