The Tokyo Stock Exchange

13:22 JST, April 17, 2025 (updated at 16:30 JST)

TOKYO, April 17 (Reuters) – Japan’s Nikkei share average bounced back on Thursday from the previous session’s declines, helped by a weaker yen after the first round of closely watched trade negotiations between Tokyo and Washington were lauded by President Donald Trump.

The equity benchmark also staged a late, tech-led push higher in the final hour after Taiwanese chip major TSMC posted first-quarter profit that topped analyst estimates.

The Nikkei ended the day up 1.35% at 34,377.60, just off the session’s high, as it took back the ground it lost in Wednesday’s 1% slide.

The broader Topix added 1.29%.

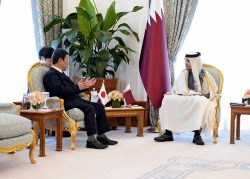

Japan’s chief negotiator, economy minister Ryosei Akazawa, met U.S. Treasury Secretary Scott Bessent and Trade Representative Jamieson on Wednesday, with President Donald Trump also making a surprise appearance.

Speaking to reporters after the discussions, which Trump had lauded on social media as making “big progress,” Akazawa said Washington wants a deal with Tokyo as a “top priority.”

He also revealed that currencies had not figured in the first round of negotiations, spurring a rebound in the dollar-yen exchange rate after it had earlier slipped to the lowest since September.

A weaker yen generally provides a tailwind for Japanese equities because it increases the value of exporters’ overseas revenues.

Last month, Trump had accused Tokyo of pursuing a policy to devalue the yen, giving Japan an unfair trade advantage.

Mazda Motor and Subaru, which are heavily reliant on the U.S. market, jumped 2.72% and 1.84%, respectively. Toyota, by contrast, shed earlier modest gains to end flat.

Elsewhere, stocks that suffered selling on Wednesday were bought back, including chip-sector shares, which got an additional lift from TSMC’s strong financial results.

Chip-testing equipment maker and Nvidia supplier Advantest climbed 3.5%, following a 6.6% tumble on Wednesday.

The best performer among the Tokyo Stock Exchange’s 33 industry groups was oil and coal producers, which advanced 3.6% on firmer crude prices.

However, Jefferies analysts warn that Japanese stocks will struggle to make much more headway amid Trump’s global trade battles, with a 12-month target of 35,500 for the Nikkei.

“We expect mixed messaging to induce steep volatility in the near term and heightened uncertainty over the medium/long term,” the analysts said in a report.

“The supply chain disruptions and capex delays could hurt global growth in the near term and have a disproportionate impact on Japan’s earnings, given the high operating leverage.”

Top Articles in News Services

-

Prudential Life Expected to Face Inspection over Fraud

-

Arctic Sees Unprecedented Heat as Climate Impacts Cascade

-

South Korea Prosecutor Seeks Death Penalty for Ex-President Yoon over Martial Law (Update)

-

Trump Names Former Federal Reserve Governor Warsh as the Next Fed Chair, Replacing Powell

-

Suzuki Overtakes Nissan as Japan’s Third‑Largest Automaker in 2025

JN ACCESS RANKING

-

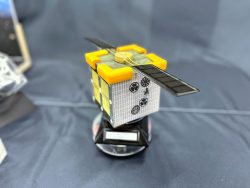

Univ. in Japan, Tokyo-Based Startup to Develop Satellite for Disaster Prevention Measures, Bears

-

JAL, ANA Cancel Flights During 3-day Holiday Weekend due to Blizzard

-

China Confirmed to Be Operating Drilling Vessel Near Japan-China Median Line

-

China Eyes Rare Earth Foothold in Malaysia to Maintain Dominance, Counter Japan, U.S.

-

Japan Institute to Use Domestic Commercial Optical Lattice Clock to Set Japan Standard Time