App icons are seen on a smartphone.

15:21 JST, December 26, 2024

More and more companies are turning out “super apps,” which allow people to make payments, shop online and more through a single app. The aim is to attract customers by consolidating different services and increasing the amount of time they spend using the app. As companies try to expand their services, they are focused on often-used financial services.

LY Corp. announced last week that it would transfer all of its shares in PayPay Bank Corp. to PayPay Corp., an LY group company and the largest smartphone payment service provider in Japan, as early as next spring. Paypay Bank will become a subsidiary of Paypay, which is aiming to expand banking-related services on its app. PayPay wants to build a “super app” that lets users meet all their daily needs with just a smartphone.

LY President Takeshi Idezawa said the reorganization within the group is aimed at freeing PayPay users from “stress” when they move between different services. The PayPay app already has “mini app” functions, which allow users to use food delivery services and shop online.

The rush to expand services has caught on in a wide range of industries. Rakuten Group Inc.’s smartphone payment app Rakuten Pay on Dec. 10 added a function that allows users to check payment amounts and statements for the group’s Rakuten Card credit cards. More than 31 million Rakuten Cards have been issued. The company hopes to position the app as a gateway to the “Rakuten economic zone” and lure users to other services.

In March last year, Sumitomo Mitsui Financial Group Inc. launched a financial service for individuals called Olive. By providing credit card and asset management services in an integrated manner such as through an app by Sumitomo Mitsui Banking Corp., the group hopes to attract deposits. And since the service is linked to the V Point system, Olive users can earn points for credit card and other payments.

East Japan Railway Co. (JR East) also plans to develop an app based on its Suica smart card service by fiscal 2028.

By providing many services on a single app, companies can capture the spending trends of users and provide online advertising and services that are more tailored to user preferences. There is no clear definition of a “super app,” but examples include the WeChat app from the Chinese tech giant Tencent. In the United States, Elon Musk, who acquired Twitter (now X), has stated publicly that he wants to make X into a super app.

Top Articles in Business

-

Japan, Italy to Boost LNG Cooperation; Aimed at Diversifying Japan’s LNG Sources

-

Honda to Launch New Electric Motorbike in Vietnam

-

Asics Opens Factory for Onitsuka Tiger Brand in Western Japan

-

Narita Airport, Startup in Japan Demonstrate Machine to Compress Clothes for Tourists to Prevent People from Abandoning Suitcases

-

Japan’s ANA to Introduce Nationwide Logistics Service Using Drones, Will Be Used to Deliver Supplies in Remote Areas

JN ACCESS RANKING

-

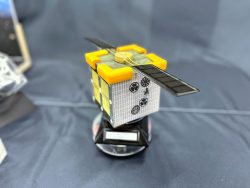

Univ. in Japan, Tokyo-Based Startup to Develop Satellite for Disaster Prevention Measures, Bears

-

JAL, ANA Cancel Flights During 3-day Holiday Weekend due to Blizzard

-

Japan Institute to Use Domestic Commercial Optical Lattice Clock to Set Japan Standard Time

-

China Eyes Rare Earth Foothold in Malaysia to Maintain Dominance, Counter Japan, U.S.

-

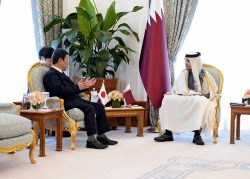

Japan, Qatar Ministers Agree on Need for Stable Energy Supplies; Motegi, Qatari Prime Minister Al-Thani Affirm Commitment to Cooperation