The Japanese national flag waves at the Bank of Japan building in Tokyo, Japan March 18, 2024.

11:05 JST, June 21, 2024

TOKYO, June 21 (Reuters) – Japan’s core inflation accelerated in May due to energy levies but an index that strips away the effect of fuel slowed for the ninth straight month, data showed on Friday, complicating the central bank’s decision on how soon to raise interest rates.

The slowdown in so-called “core core” inflation, which is closely watched by the Bank of Japan as a key gauge of demand-driven price moves, casts doubt on the bank’s view that rising wages will underpin consumption and keep inflation on track to durably hit its 2% target.

The core consumer price index (CPI), which excludes volatile fresh food, rose 2.5% in May from a year earlier, government data showed, accelerating from the previous month’s 2.2% gain due largely to a hike in the renewable energy levy. It was roughly in line with a median market forecast for a 2.6% gain.

But inflation as measured by an index stripping away both fresh food and fuel slowed to 2.1% in May from 2.4% in April, marking the lowest year-on-year increase since September 2022.

Private-sector service inflation slowed to 2.2% in May from 2.4% in the previous month, suggesting companies remained cautious about passing on labor costs.

“The Bank of Japan has been arguing that the strong pay hikes agreed upon in this year’s spring wage negotiations will eventually provide a boost to services inflation, but so far there’s little evidence of that happening,” said Marcel Thieliant, head of Asia-Pacific at Capital Economics.

A renewed rise in crude oil prices and the boost to import costs from a weak yen muddle the outlook for inflation.

Analysts expect core CPI to accelerate near 3% later this month due to rising raw material costs. But such pressure could hurt consumption and discourage firms from hiking prices, hampering the BOJ’s efforts to keep underlying, demand-driven inflation durably around its 2% target.

“Real wage growth remains weak in Japan and there’s no data confirming that demand-driven inflation is accelerating,” said Takeshi Minami, chief economist at Norinchukin Research.

“The BOJ probably won’t raise rates again at least until October-December this year,” he said.

The BOJ exited negative rates and bond yield control in March in a landmark shift away from a decade-long, radical stimulus program.

With inflation exceeding its 2% target for two years, it has also dropped hints that it will raise short-term rates to levels that neither cool nor overheat the economy – seen by analysts as somewhere between 1-2%.

Many economists expect the BOJ to raise interest rates to 0.25% this year, though they are divided on whether it will come in July or later in the year.

BOJ Governor Kazuo Ueda has said the central bank will raise rates if it becomes more convinced that inflation will durably hit 2% backed by robust domestic demand and higher wages.

Recent weak signs in consumption remain a concern. Japan’s economy contracted in the first quarter due in part to a 0.7% drop in consumption as rising living costs discourage households from boosting spending.

Top Articles in News Services

-

Prudential Life Expected to Face Inspection over Fraud

-

South Korea Prosecutor Seeks Death Penalty for Ex-President Yoon over Martial Law (Update)

-

Trump Names Former Federal Reserve Governor Warsh as the Next Fed Chair, Replacing Powell

-

Suzuki Overtakes Nissan as Japan’s Third‑Largest Automaker in 2025

-

Japan’s Nikkei Stock Average Alls from Record as Tech Shares Retreat; Topix Rises (UPDATE 1)

JN ACCESS RANKING

-

Japan Institute to Use Domestic Commercial Optical Lattice Clock to Set Japan Standard Time

-

China Eyes Rare Earth Foothold in Malaysia to Maintain Dominance, Counter Japan, U.S.

-

Man Infected with Measles May Have Come in Contact with Many People in Tokyo, Went to Store, Restaurant Around When Symptoms Emerged

-

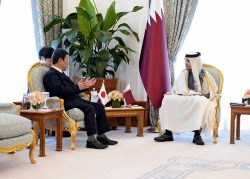

Japan, Qatar Ministers Agree on Need for Stable Energy Supplies; Motegi, Qatari Prime Minister Al-Thani Affirm Commitment to Cooperation

-

Australian Woman Dies After Mishap on Ski Lift in Nagano Prefecture