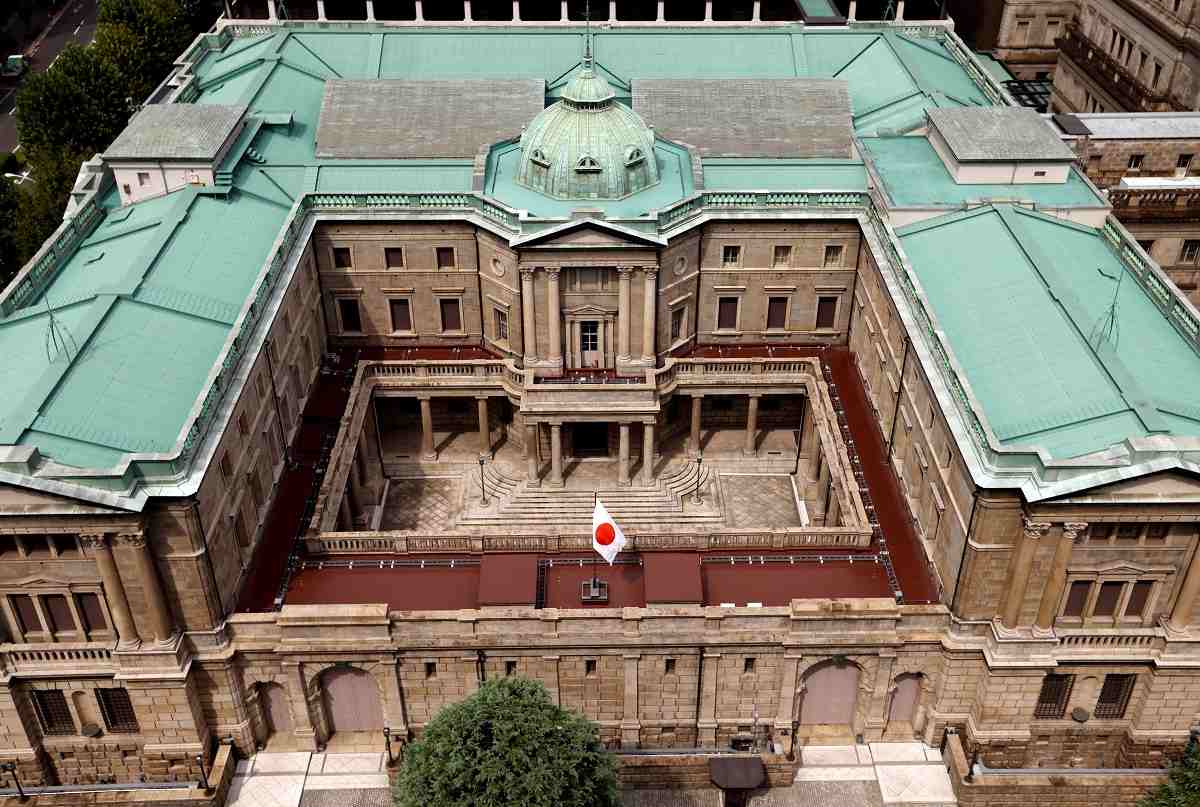

Japanese national flag is hoisted atop the headquarters of Bank of Japan in Tokyo, Japan September 20, 2023.

17:46 JST, December 7, 2023

TOKYO (Reuters) – Japanese government bond (JGB) yields rose on Thursday, pulling further away from multi-month lows touched the previous day, as an auction for the 30-year bond saw some of the weakest demand in years.

The 10-year JGB yield JP10YTN=JBTC jumped 10.5 basis points to 0.750%, a day after touching a three-and-a-half month low of 0.620%.

Benchmark 10-year JGB futures fell as much as 1.00 yen to 145.89 yen. Futures were last up slightly at 145.92 yen.

The 30-year JGB yield JP30YTN=JBTC rose 9.5 bps to 1.690%, ticking up from 1.610% after the auction results for the bond were announced.

“The results were quite weak,” said Okasan Securities Senior Bond Strategist Makoto Suzuki.

The bid-to-cover ratio, which compares total bids to the amount of securities sold, was the lowest since 2015 at 2.62.

The tail – the difference between the lowest bid and the average bid – was 1.2 yen, the longest on record.

After yields have dropped as sharply as they have, investors were likely taking a wait-and-see attitude, with 30-year JGB yields around the 1.7% level a more appealing range, Suzuki said.

The 20-year JGB yield JP20YTN=JBTC jumped 11.5 bps to 1.490%.

On the short end, the two-year JGB yield JP2YTN=JBTC ticked up 5 bps to 0.085%, while the five-year yield JP5YTN=JBTC was 9.5 bps higher at 0.340%.

There is a sense of caution about whether the Bank of Japan (BOJ) could potentially make an early exit from its ultra-easy monetary policy if the Federal Reserve were to begin cutting rates early next year, contributing to the rise in yields, Suzuki said.

Markets were currently pricing in about a 50% chance of a Fed rate cut as early as March, according to the CME’s FedWatch tool.

BOJ Governor Kazuo Ueda said on Thursday the central bank will face an “even more challenging” situation in the year-end and the start of next year, when asked about the economy and monetary policy guidance.

The 40-year JGB yield JP40YTN=JBTC rose 9 bps to 1.925%.

Top Articles in News Services

-

Survey Shows False Election Info Perceived as True

-

Japan’s Nikkei Stock Average Falls as US-Iran Tensions Unsettle Investors (UPDATE 1)

-

Japan’s Nikkei Stock Average Touches 58,000 as Yen, Jgbs Rally on Election Fallout (UPDATE 1)

-

Japan’s Nikkei Stock Average Rises on Tech Rally and Takaichi’s Spending Hopes (UPDATE 1)

-

Japan to Ban Use of Power Banks on Airplanes

JN ACCESS RANKING

-

Producer Behind Pop Group XG Arrested for Cocaine Possession

-

Japan PM Takaichi’s Cabinet Resigns en Masse

-

Man Infected with Measles Reportedly Dined at Restaurant in Tokyo Station

-

Videos Plagiarized, Reposted with False Subtitles Claiming ‘Ryukyu Belongs to China’; Anti-China False Information Also Posted in Japan

-

iPS Treatments Pass Key Milestone, but Broader Applications Far from Guaranteed