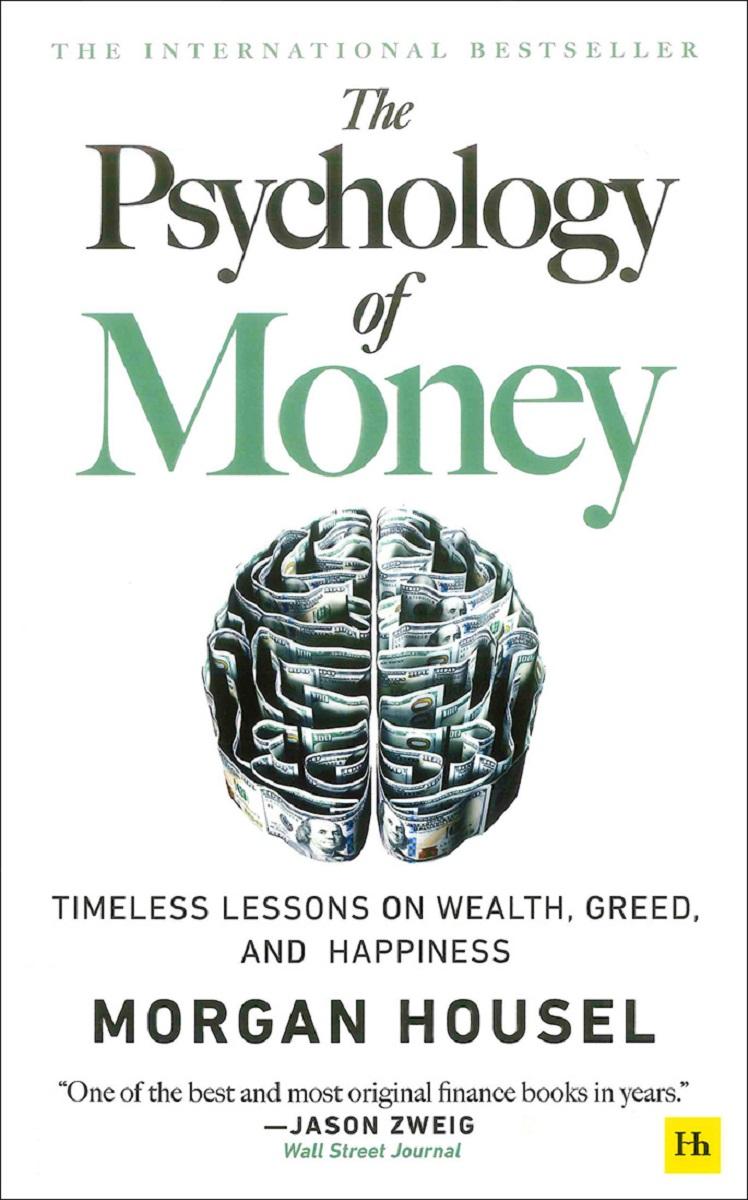

Harriman House, 242pp. Maruzen price: ¥3,190 plus tax

17:50 JST, February 20, 2021

“No one’s crazy.” That’s a key takeaway from Morgan Housel’s book “The Psychology of Money,” a collection of short essays about how people think and feel about their personal finances.

The recent GameStop stock mania in the United States seems to indicate that at least a few people are crazy when it comes to handling money, but Housel makes a valid point if we assume that his comment applies to most people, most of the time.

The author, a former columnist for The Wall Street Journal and The Motley Fool website, explains: “If you were born in 1970, the S&P 500 [a U.S. stock index] increased almost 10-fold, adjusted for inflation, during your teens and 20s. That’s an amazing return. If you were born in 1950, the market went literally nowhere in your teens and 20s adjusted for inflation. Two groups of people, separated by [the] chance of their birth year, go through life with a completely different view on how the stock market works.”

Similarly, he says that those born in 1960 are starkly divided from those born in 1990 in their experience of and views on inflation. And of course the immediate postwar generation in Japan had very different expectations than their contemporaries in the United States.

This got me thinking about how Japanese who entered the workforce during the “employment ice age” must view their career prospects differently than those a bit older or younger. And people coming of age right now, amid the coronavirus pandemic, are going to have an especially distinct economic perspective in the years to come.

Housel says such differences mean that “a view about money that one group of people thinks is outrageous can make perfect sense to another.” No one’s crazy.

The end of each essay segues into the beginning of the next, as Housel hops among topics such as bubble psychology, the power of compounding, the role of luck in one’s financial fate, and the idea that “getting money and keeping money are two different skills.”

He also makes an interesting and useful distinction between being rational and being reasonable in your approach to managing money. He and his wife decided to pay off their very low-interest mortgage with money that they could have put into high-return investments instead — which would have been the mathematically rational thing to do. But getting their house paid off was psychologically comforting, and therefore reasonable. So that’s what they did.

“On paper it’s defenseless. But it works for us. We like it. That’s what matters.”

As the late Hans Rosling and his coauthors did in their best-selling “Factfulness,” Housel steps back and tries to offer a broad perspective on big-picture issues that affect everybody. He notes that money, like health, will have an impact on your life whether you are interested in it or not.

The advice he offers in this book is very general, but it’s hard to argue with any of it. Some familiar generalities, such as the importance of living below your means, are always worth hearing again. Less familiar, but possibly at least as valuable, is Housel’s admonition that “you have to take risks to get ahead, but no risk that can wipe you out is ever worth taking.”

In other words, don’t bet your life savings on GameStop.

“The Psychology of Money” will get you thinking, and some of those thoughts may be valuable. But however you think about money now, the good news is that you’re probably not crazy.

Top Articles in Culture

-

BTS to Hold Comeback Concert in Seoul on March 21; Popular Boy Band Releases New Album to Signal Return

-

Director Naomi Kawase’s New Film Explores Heart Transplants in Japan, Production Involved Real Patients, Families

-

Tokyo Exhibition Offers Inside Look at Impressionism; 70 of 100 Works on ‘Interiors’ by Monet, Others on Loan from Paris

-

Traditional Japanese Silk Hakama Tradition Preserved by Sole Weaver in Sendai

-

Exhibition Featuring Yoshiharu Tsuge’s Manga World Underway in Chofu, Tokyo; Unique, Surreal Works Draw Steady Crowds

JN ACCESS RANKING

-

Producer Behind Pop Group XG Arrested for Cocaine Possession

-

Japan PM Takaichi’s Cabinet Resigns en Masse

-

Man Infected with Measles Reportedly Dined at Restaurant in Tokyo Station

-

Israeli Ambassador to Japan Speaks about Japan’s Role in the Reconstruction of Gaza

-

Videos Plagiarized, Reposted with False Subtitles Claiming ‘Ryukyu Belongs to China’; Anti-China False Information Also Posted in Japan