The Finance Ministry’s headquarters building in Tokyo

Reuters

10:13 JST, October 22, 2022

TOKYO/LONDON/NEW YORK (Reuters) — Japanese authorities likely intervened in markets to stem the slide of the country’s battered currency on Friday, market participants said, following an unexpected jump in the yen against the dollar.

The yen rose as high as 144.50 per dollar JPY=EBS on Friday, up more than 7 yen from a 32-year low of 151.94 yen per dollar, touched earlier in the session. The dollar was last down 1.8% at 147.34 yen.

It’s very clearly the ministry of finance stepping in to sell dollar-yen, said Mazen Issa, senior FX strategist at TD Securities in New York.

Karl Schamotta, chief market strategist at Corpay in Toronto, concurred. “We are hearing large blocks are being traded,” he said. “That typically means either larger institutions are moving money or that a central bank is intervening in size. The clearest evidence is just the scale of dollar selling that is happening.”

Most Read

Popular articles in the past 24 hours

-

Japanese High School Student Aims to Share Kaiten History Through...

-

PM Takaichi Spells out Plans to Advance Bold Policy Shifts in Spe...

-

Chronic Issues Erode Thailand’s Economy as Political Confusion Pe...

-

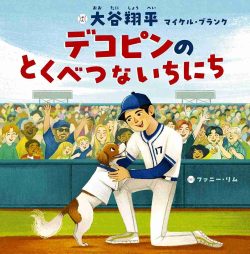

Japanese Version of Shohei Ohtani's Picture Book Published

-

Tottori: 95-Year-Old Japanese Descendent from Philippines Visits ...

-

Japan to Monitor Trump Administration's Response to U.S. Supreme ...

-

Milano Cortina 2026: Speed Skater Takagi Finishes 6th in the 1,50...

-

Osaka: 40 Ninjas Display Shuriken Throwing Skills at Japan Champi...

Popular articles in the past week

-

Japan PM Takaichi’s Cabinet Resigns en Masse

-

Man Infected with Measles Reportedly Dined at Restaurant in Tokyo...

-

Sanae Takaichi Elected Prime Minister of Japan; Keeps All Cabinet...

-

Japan's Govt to Submit Road Map for Growth Strategy in March, PM ...

-

Bus Carrying 40 Passengers Catches Fire on Chuo Expressway; All E...

-

Milano Cortina 2026: Figure Skaters Riku Miura, Ryuichi Kihara Pa...

-

Japan, U.S. Name 3 Inaugural Investment Projects; Reached Agreeme...

-

U.S. Firm to Build Training Hub in Fukushima N-plant for Debris R...

Popular articles in the past month

-

Japan PM Takaichi’s Cabinet Resigns en Masse

-

Japan Institute to Use Domestic Commercial Optical Lattice Clock ...

-

Israeli Ambassador to Japan Speaks about Japan’s Role in the Reco...

-

Man Infected with Measles Reportedly Dined at Restaurant in Tokyo...

-

Videos Plagiarized, Reposted with False Subtitles Claiming ‘Ryuky...

-

Man Infected with Measles May Have Come in Contact with Many Peop...

-

Prudential Life Insurance Plans to Fully Compensate for Damages C...

-

Woman with Measles Visited Hospital in Tokyo Multiple Times Befor...

Top Articles in Business

-

Prudential Life Insurance Plans to Fully Compensate for Damages Caused by Fraudulent Actions Without Waiting for Third-Party Committee Review

-

Narita Airport, Startup in Japan Demonstrate Machine to Compress Clothes for Tourists to Prevent People from Abandoning Suitcases

-

Japan, U.S. Name 3 Inaugural Investment Projects; Reached Agreement After Considerable Difficulty

-

JR Tokai, Shizuoka Pref. Agree on Water Resources for Maglev Train Construction

-

Toyota Motor Group Firm to Sell Clean Energy Greenhouses for Strawberries

JN ACCESS RANKING

-

Japan PM Takaichi’s Cabinet Resigns en Masse

-

Japan Institute to Use Domestic Commercial Optical Lattice Clock to Set Japan Standard Time

-

Israeli Ambassador to Japan Speaks about Japan’s Role in the Reconstruction of Gaza

-

Man Infected with Measles Reportedly Dined at Restaurant in Tokyo Station

-

Videos Plagiarized, Reposted with False Subtitles Claiming ‘Ryukyu Belongs to China’; Anti-China False Information Also Posted in Japan