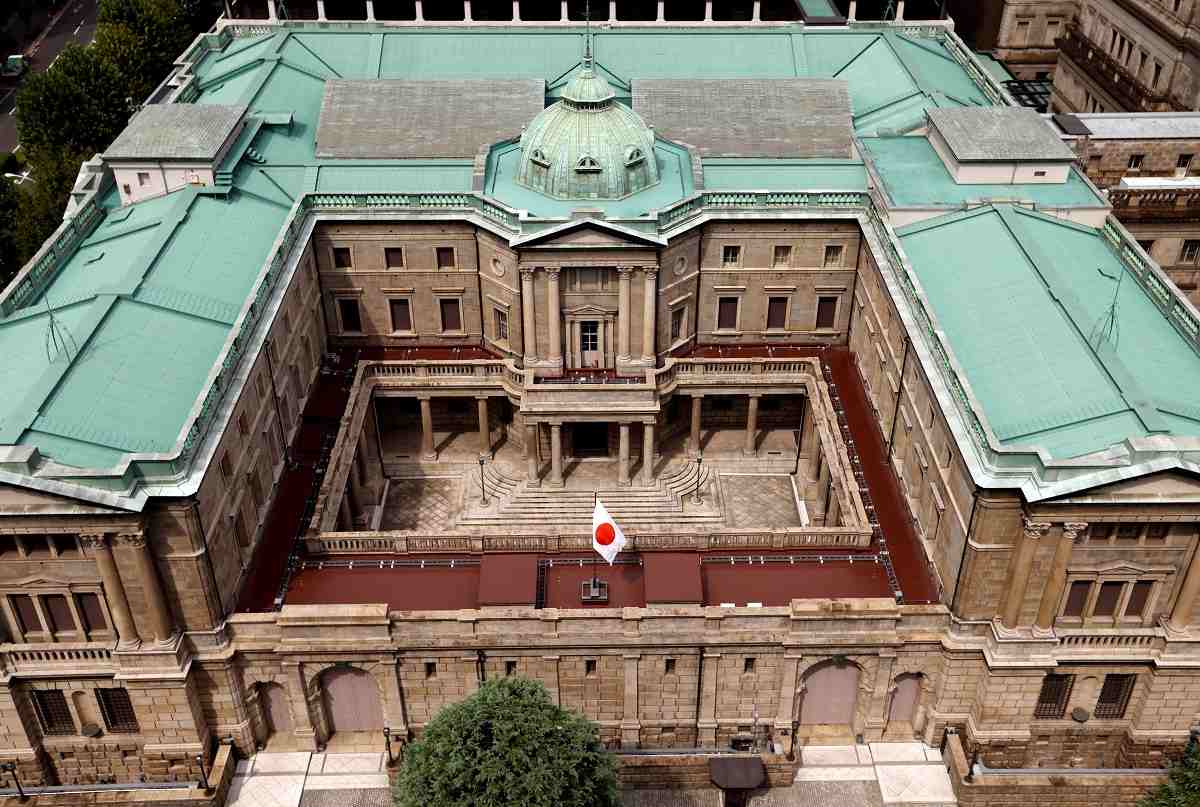

The Bank of Japan is seen in Tokyo in September 20, 2023.

12:19 JST, September 11, 2025

Tokyo, Sept. 10 (Jiji Press)—The Bank of Japan is expected to consider raising its policy interest rate to 0.75 pct in earnest from this autumn until early next year.

The central bank decided in January to hike the policy rate to 0.5 pct but has since kept the rate unchanged due partly to U.S. President Donald Trump’s high tariff policy.

Amid rising prices for food and other goods, the BOJ plans to determine the timing of a possible rate hike by assessing the impact of U.S. levies on Japanese and overseas economies as well as developments in domestic politics.

Trump signed on Thursday an executive order that reduced the rates of tariffs on imports from Japan, including an automobile levy cut from 27.5 pct to 15 pct. A senior BOJ official said that “uncertainty over tariffs has decreased to some extent.”

The BOJ is likely to maintain the current policy rate at its next policy meeting, scheduled to run for two days through Sept. 19.

After the meeting, the bank is seen analyzing data and information from its “tankan” quarterly survey of Japanese businesses, due out in October, and a meeting of BOJ branch managers the same month. Policymakers will then mull raising the interest rate at a meeting that month or later.

While some in the BOJ support an early rate hike, others urge caution over downside risks to the global economy, saying that the impact of U.S. levies will start to be felt in full soon.

The bank expects underlying prices, which exclude temporary variables such as rice price increases, to slow down for some time. “There’s no need to rush a decision on a rate hike,” another senior BOJ official said.

Prime Minister Shigeru Ishiba’s recent announcement that he will step down is also likely to affect the BOJ’s decision.

Japan is all but certain to undergo political instability for a while, and it may take time for the bank to establish communication with the next administration over an interest rate hike.

The BOJ has been unable to raise the policy rate above 0.5 pct for about three decades since it lowered the rate from 1 pct to 0.5 pct in 1995.

Top Articles in Business

-

Prudential Life Insurance Plans to Fully Compensate for Damages Caused by Fraudulent Actions Without Waiting for Third-Party Committee Review

-

Narita Airport, Startup in Japan Demonstrate Machine to Compress Clothes for Tourists to Prevent People from Abandoning Suitcases

-

Japan, U.S. Name 3 Inaugural Investment Projects; Reached Agreement After Considerable Difficulty

-

Toyota Motor Group Firm to Sell Clean Energy Greenhouses for Strawberries

-

Japan’s Major Real Estate Firms Expanding Overseas Businesses to Secure Future Growth, Focusing on Europe, U.S., Asia

JN ACCESS RANKING

-

Producer Behind Pop Group XG Arrested for Cocaine Possession

-

Japan PM Takaichi’s Cabinet Resigns en Masse

-

Man Infected with Measles Reportedly Dined at Restaurant in Tokyo Station

-

Israeli Ambassador to Japan Speaks about Japan’s Role in the Reconstruction of Gaza

-

Videos Plagiarized, Reposted with False Subtitles Claiming ‘Ryukyu Belongs to China’; Anti-China False Information Also Posted in Japan