Bruce Pascal houses his expansive Hot Wheels collection in a 4,000-square-foot warehouse in Maryland.

18:09 JST, December 14, 2024

As a boy, Bruce Pascal reveled in testing the limits of his Hot Wheels. He might squeeze a firecracker into one of the miniature metal cars and set it off, or flatten one with a hammer to see whether it still rolled.

Now 63, he wouldn’t dare rough up his toys. His collection is so prolific that it literally fills a warehouse in suburban Washington and includes the Pink Rear Load Beach Bomb prototype, the rarest Hot Wheels ever made.

Though Pascal’s 8,000-car fleet is singular, he is part of a growing contingent of enthusiasts fueling Hot Wheels dominance – it’s the best-selling toy in the world, according to market research firm Circana. Though purchases are still primarily made for children, adults are buying them at a faster clip, said Roberto Stanichi, who oversees Hot Wheels at Mattel. He estimates that adult collectors drive about one-third of global revenue.

Investors have been bracing for the eventual drop-off in sales, said Arpiné Kocharyan, an analyst with UBS Investment Bank. “And yet it still grows.”

“The demographic capture is incomparable,” Kocharyan said. “You can target a kid that’s 3 years old all the way to a collector that’s 60 years old. … It is almost like a universal play pattern that does not recognize borders and cultural barriers.”

The 56-year-old toy’s enduring appeal makes it an outlier in an industry with a shrinking audience. Though children today are quicker to shift from traditional toys and toward screens, engagement in Hot Wheels has only increased. It has been one of Mattel’s steadiest lines of business. In 2023, gross sales climbed 14 percent, to $1.43 billion, year over year, the company said.

Starting at $1.25 apiece, price is a draw, particularly for cost-conscious families that are cutting back on gift-giving this holiday season to afford inflation-tinged essentials. In fact, the toys cost less than they did in 1968, when they retailed for 69 to 89 cents; that’s roughly $6 to $8 in today’s dollars. But the company can hold that line, in part, because of volume: Mattel makes – and sells – 22.5 Hot Wheels toys per second, Stanichi said. That’s about 709 million cars a year.

Mattel, which has a market cap of nearly $6.5 billion, is also the maker of another legacy brand: Barbie. The connection is almost kismet; the late Hot Wheels creator Elliot Handler was married to the woman behind Barbie, Ruth Handler.

But Hot Wheels has more room to capitalize on and nurture its cross-generational appeal. Though car culture has transformed it into a lifestyle and media brand, the toy also evokes warm feelings of nostalgia, said James Zahn, editor in chief of the trade publication the Toy Book and senior editor at the Toy Insider.

Hot Wheels has been one of Mattel’s steadiest lines of business. It was the only one of the company’s “Power 3 Brands” – which include Barbie and Fisher-Price – to post double-digit growth last year in gross billings, with the 14 percent increase.

“What I think really makes Hot Wheels special is that it’s an affordable toy for kids that many generations have grown up on now,” Zahn said. And it continues into adulthood as the brand “makes this jump from the toy department into the real world.”

A vehicle for car culture

Hot Wheels’ connection to car culture dates to its inception, Zahn said. The toy came onto the market on the heels of a hot-rodding renaissance, in which car enthusiasts and gear heads gathered at expos and road shows to show off their rides, he said.

“If you’re a person that loves cars today, chances are that the first car you ever owned was a Hot Wheel,” Stanichi said.

That’s how Pascal’s fixation began. An enthusiasm for cars was a prerequisite in his family, he said during a recent tour of the 4,000-square-foot warehouse turned personal museum in a Maryland suburb of D.C., which houses 10,000 cars and pieces of memorabilia. It includes curated Hot Wheels displays, comic books, artwork, original blueprints, hand-carved wood molds and patents. Parked inside is a 1913 Ford Model T Roadster – a real one, in lavender – and dozens of the 1968 Hot Heap Hot Wheels it inspired. His collection is valued north of $2 million.

Pascal also has interviewed nearly 400 former Mattel employees and co-wrote “Hot Wheels Prototypes,” a history of the toy, with Michael Zarnock.

“I grew up with oil in my blood,” said Pascal, a commercial real estate agent. His grandfather oversaw the history of transportation at the National Archives, and his father collected antique cars. “It’s a lot cheaper for me to buy – for $1.19 – a Tesla X and have it sitting on my desk than to go buy a real Tesla X and putting it in my garage.”

The earliest Hot Wheels cars were 1:64-scale versions of such popular muscle cars as the Camaro, Firebird and Mustang. Since then, Mattel has rolled out everything from Honda Civics to the Batmobile to the rides in “Ghostbusters,” “The Simpsons” and “Scooby-Doo.” The company recently announced a partnership with Formula 1, the world’s most popular auto racing circuit.

“They’ve done a really smart job of evolving the brand,” said Chris Byrne, a toy expert and consultant. “They’ve stayed true to the speed and performance and collectibility and just adapted the decoration to reflect more of the culture today so it’s still relevant to kids.”

Stanichi sees adult car enthusiasts as a pool of potential customers. So, Mattel seeks out any opportunities to put the two in the same sentence: There are such live events as the Hot Wheels Legends Tour and Hot Wheels Monster Trucks Live, video games, and collaborations with fashion brands, artists, athletes and musicians. A Hot Wheels movie is in development with Warner Bros. and J.J. Abrams’s Bad Robot production company.

Pascal has seen how the partnerships create “a reason for a different adult segment to be excited about Hot Wheels.” Stanichi hopes the movie will be an extension of that, tapping into consumers’ latent nostalgia and goodwill toward the brand.

It also reaches customers by licensing its intellectual property to a wide swath of products, including board games, video games, apparel and furniture. It’s a tactic many popular brands – be it Barbie, Frozen or Star Wars – take because it’s an inexpensive and low-lift moneymaker, Kocharyan said. Barbie sales surged 16 percent in the quarter following the movie release in the summer of 2023.

“It’s a golden goose – it’s going to keep giving,” she said. “You’re getting paid for [licensing your IP] with almost very little cost associated with it.”

The company also feeds collectors’ appetite for new and exclusive cars. They can join the Red Line Club, where they get access to special collections. Mattel releases dozens of special collections a year, with about 10,000 to 50,000 cars available to buy. They’re sold out within minutes, Stanichi said. Many are often relisted on eBay at a premium. Pascal pays $99 for a yearly plan under which he can opt to have a car automatically sent and billed to him. There are also the treasure hunts, where enthusiasts hunt for Hot Wheels cars with rubber wheels that are randomly put into stores alongside traditional cars with plastic wheels.

But Pascal says nothing compares to finding a box of Hot Wheels cars at an estate sale and unpacking a high-value surprise inside.

“It’s hard to describe the feeling to non-collectors,” he said, noting that it’s like a chemical release in his body when he “fills a hole” in his collection.

There’s also the community in collecting, whether it’s baseball cards, coins or Squishmallows. It’s a way to connect with people, Byrne said. There are Hot Wheels-trading Facebook groups and in-person gatherings. Pascal goes to two collectors conventions a year, in which enthusiasts often bring Hot Wheels cars to sell, setting up what look like mini markets in their hotel rooms and trading through the night, he said.

Cross-generational nostalgia

Nostalgia has been a big draw in the toy industry in recent years, with insiders calling it “kidulting.” Millennial and Gen X consumers, in particular, are reengaging with toys, Zahn said.

“They want to get those warm feelings of nostalgia that remind them of simpler times,” he said.

They’re also back into Lego and coloring books. And many brands have adapted: Mattel’s American Girl stores now serve cocktails and sell adult-size merchandise and costumes of the dolls; Build-A-Bear has an “after dark” line with risqué outfits.

While it had been more than two decades since Colby D’Anieri had zoomed a Hot Wheels car round a racetrack, he couldn’t help but browse the toy aisle every time he was in a Target.

“It takes me back to when I was a kid,” said the 33-year-old of Pennsylvania’s Lehigh Valley.

He finally caved a few years ago and added some of the die-cast cars to his shopping cart. Now he has hundreds of them, including his first car, a Ford Focus ZX3, which was released at 1:64 scale in 2003.

Though he indulges in the hobby, in part, because he enjoys studying the details on the cars, it is also for his future children.

“Being able to hand them down to my kids and have them play with them is a cool thought,” he said.

Top Articles in News Services

-

Prudential Life Expected to Face Inspection over Fraud

-

South Korea Prosecutor Seeks Death Penalty for Ex-President Yoon over Martial Law (Update)

-

Trump Names Former Federal Reserve Governor Warsh as the Next Fed Chair, Replacing Powell

-

Suzuki Overtakes Nissan as Japan’s Third‑Largest Automaker in 2025

-

Japan’s Nikkei Stock Average Alls from Record as Tech Shares Retreat; Topix Rises (UPDATE 1)

JN ACCESS RANKING

-

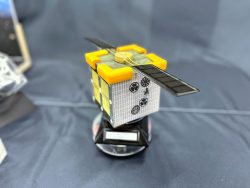

Univ. in Japan, Tokyo-Based Startup to Develop Satellite for Disaster Prevention Measures, Bears

-

JAL, ANA Cancel Flights During 3-day Holiday Weekend due to Blizzard

-

Japan Institute to Use Domestic Commercial Optical Lattice Clock to Set Japan Standard Time

-

China Eyes Rare Earth Foothold in Malaysia to Maintain Dominance, Counter Japan, U.S.

-

Japan, Qatar Ministers Agree on Need for Stable Energy Supplies; Motegi, Qatari Prime Minister Al-Thani Affirm Commitment to Cooperation