Biden Calls for Broad New Social Programs, Higher Taxes on Corporations and the Wealthy

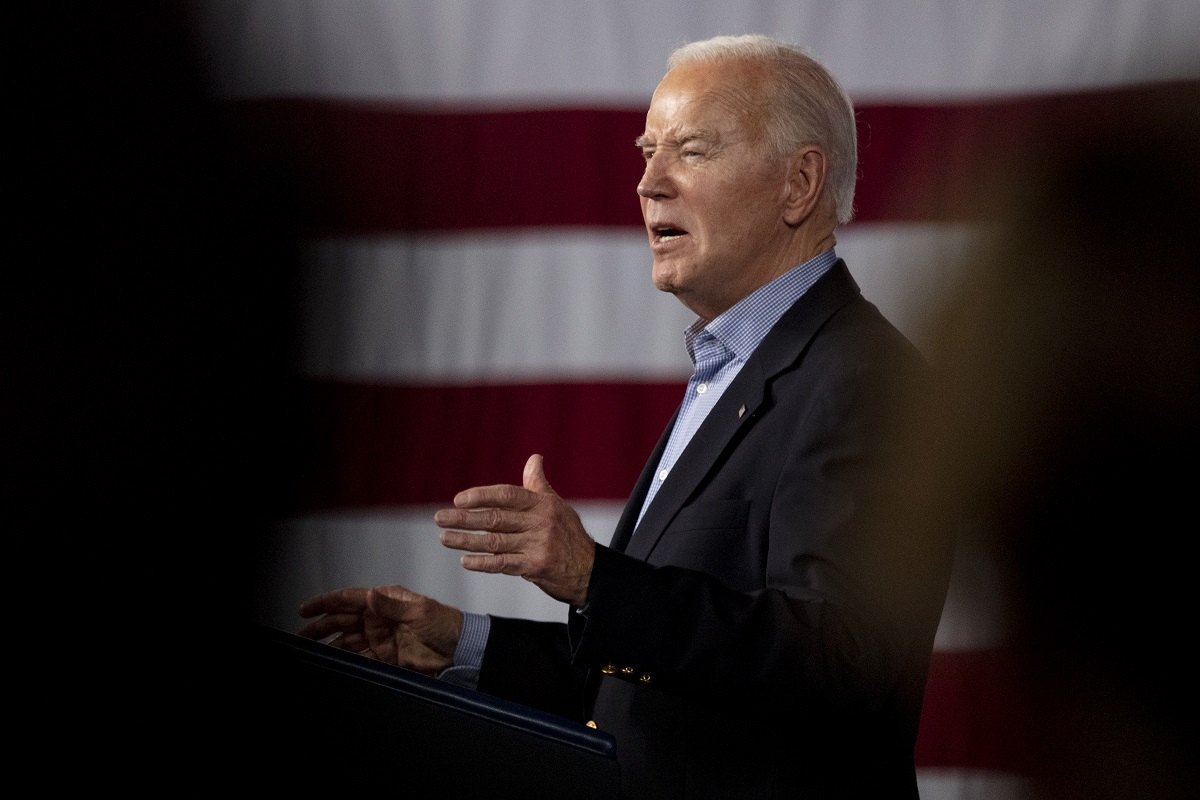

President Joe Biden speaks at a rally Saturday in Atlanta.

12:49 JST, March 12, 2024

President Biden laid out an election-year blueprint Monday for sweeping new federal spending to lower consumer costs for health care, child care and housing – and enough new taxes on the wealthy and major corporations to pay for those proposals and still shave $3 trillion off the national debt over the next decade.

Biden’s proposed $7.3 trillion budget for fiscal 2025 lays out the broad policy planks that many leading liberals have pushed him to embrace as he campaigns for another four years in the White House. With Republicans in control of the House, the proposals stand almost no chance of becoming law, but they set the stage for a likely rematch with former president Donald Trump this fall.

Biden would have Congress offer universal prekindergarten education, provide 12 weeks of paid family and medical leave, expand anti-poverty tax credits, and create a new tax break for first-time home buyers. The plan also reiterates U.S. support for Ukraine, with a $61 billion request to send arms and assistance to fight off Russia’s invasion.

The vast majority of the budget would cover mandatory programs, such as Medicare, Medicaid, Social Security and veterans’ benefits, which are not subject to annual spending legislation.

That spending would be more than offset by dramatically increasing taxes on the wealthiest individuals and corporations, the White House said. Biden’s budget would increase the minimum tax on billion-dollar corporations to 21 percent from 15 percent. It would raise taxes on U.S. multinationals’ foreign income to 21 percent from 10.5 percent, and eliminate some tax deductions for executive compensation.

It would also bolster funding for the Internal Revenue Service to train additional scrutiny on those same individuals and businesses. Biden’s budget would grant the agency an additional $104.3 billion – on top of an existing $60 billion expansion from the 2022 Inflation Reduction Act – over the next decade. Administration officials said that would generate $341 billion in net revenue, a nearly three-to-one return-on-investment ratio.

That proposal, in particular, might face long odds: Republicans have chafed at Biden’s expansion of the IRS, which he has used as the engine of much of his social programming and as a populist lever to discuss economic fairness and wealth concentration. GOP lawmakers already clawed back $20 billion of what was supposed to be $80 billion in funding for the tax service from the 2022 law in recent spending fights.

“I’m a capitalist,” Biden said in a speech Monday in Goffstown, N.H. “Make all the money you want. Just begin to pay your fair share of taxes.”

The administration has demonstrated its willingness to negotiate with Republicans over that extra money already, before even asking for the additional $104 billion.

The budget follows up the president’s State of the Union address, which fired up Democrats and ignited the Biden campaign’s largest fundraising hauls, in the strongest signal yet of Biden’s ambitions should he win another four years in the White House.

“Imagine what we could do,” Biden said Monday, “from cutting the deficit, to providing child care, to providing health care, to continuing to provide our military with all they need. Folks, look, this is not beyond our capacity.”

The budget is similar to the proposal Biden made last year and echoes pushes he made during negotiations on his defunct Build Back Better Act. But in some cases, Biden wasn’t able to win policies the budget calls for, even when Democrats controlled both chambers of Congress. Instead, the party scaled back some of its ambitions to pass the 2022 Inflation Reduction Act, one of the president’s chief legislative victories.

“President Biden’s 2025 budget lays out a sound approach to key decisions that need to be made next year, regardless of the outcomes of the elections,” Sharon Parrott, president of the left-leaning Center on Budget and Policy Priorities, said in a statement. “A fairer tax code that raises more revenues from wealthy people and profitable corporations to invest in people, communities, and the economy and to improve our fiscal outlook.”

Biden’s budget calls for expanding the IRA’s $35-per-month price cap for insulin paid for by Medicare to the commercial market, and allowing Medicare to negotiate more aggressively to bring down the cost of other drugs, though manufacturers have sued to block such price negotiations.

Biden would also restore expansions of the child tax credit, part of his 2021 American Rescue Plan Act. That measure sent monthly checks to working families to offset the cost of child care and kept 3 million children out of poverty, according to research conducted by Columbia University’s Center on Poverty and Social Policy. The provisions expired at the end of 2021, and Congress is considering a modest new expansion of the credit that would broaden eligibility for the lowest-income families with multiple children.

Biden instead would reinstate larger monthly payments to more participants, at a cost of $310 billion from 2025 through 2034.

Republicans in Washington have shot down some of Biden’s proposals.

House Speaker Mike Johnson (R-La.) said in a statement Monday that Biden’s budget was “yet another glaring reminder of this Administration’s insatiable appetite for reckless spending.”

The House GOP’s proposed budget would trim the deficit by $14 trillion over the next decade – more than three times as much as Biden’s would – and includes cuts to spending on mandatory programs such as Medicare and Medicaid.

“There has never been a clearer and starker contrast between Democrats’ big tax and spend policies and Republicans’ fiscal framework for economic growth and prosperity,” Rep. Jodey Arrington (R-Tex.), chair of the House Budget Committee, said in a statement Monday.

Congress has yet to finish passing spending laws to deal with the current fiscal year, which began Oct. 1, 2023, and runs until Sept. 30. Biden’s budget would cover the next year, starting Oct. 1.

Biden’s administration has been dogged by persistent inflation, though that has begun to cool in recent months. A report on price increases is due to be released Tuesday, with analysts and economists watching closely to see whether hotter-than-expected inflation in January was a one-time blip.

Conservatives argue that more government spending, and more social programs, will drive up inflation even more by injecting money into the economy.

Biden’s top economic advisers rejected that claim Wednesday, saying instead that investments in affordable child care and elder care would give more individuals an opportunity to join the workforce. That would drive up wages and give consumers more buying, relieving inflation.

“We’re very confident that if more caregivers could afford to pay for child care … that would increase labor force,” Jared Bernstein, chair of Biden’s Council of Economic Advisers, told reporters. “Higher labor force is very much a pro-growth development. It’s also helpful in dampening inflationary pressures.”

The White House also unveiled new or revamped tax policy changes to generate additional revenue.

Biden would mandate that wealthy taxpayers with individual retirement accounts, or IRAs, take annual distributions each year when the value of the account exceeds $10 million. Those distributions would be taxed like ordinary income. Biden’s budget would also prohibit taxpayers earning more than $400,000 – or $450,000 for married couples filing jointly – from rolling over funds from a traditional IRA into a Roth IRA, where it would not be taxable.

The White House also asked Congress to increase the taxes on capital gains and dividends for households earning more than $1 million each year to a 39.6 percent marginal rate. And the administration proposed increasing the corporate tax on stock buybacks – a key funding provision in the Inflation Reduction Act – from 1 percent to 4 percent.

As he did during his State of the Union, Biden on Monday reaffirmed his plan to strengthen social safety net and health-care programs, such as the Affordable Care Act. Liberal supporters, including Sen. Bernie Sanders (I-Vt.), have pushed the White House to draw sharper contrasts with Republicans on economic policy as the campaign heats up.

“Americans can no longer be denied health insurance because of preexisting conditions,” Biden said Monday. “My predecessor and many Republicans want to take that away.”

Biden never mentioned Trump by name on Monday, referring only to “my predecessor,” as he had done during the State of the Union, but he stressed that his opponents wanted to extend tax cuts for the wealthy by cutting social programs: “My Republican friends want to put Social Security and Medicare back on the chopping block again. If anyone wants to cut Social security and Medicare or raise the retirement age again, I will stop them.”

At the Transportation Department, the administration’s $109.3 billion budget request includes $21.8 billion for the Federal Aviation Administration – a portion of which will be used to hire 2,000 new air traffic controller to fill staffing shortages at a time of increased concern over close calls and near misses involving passenger aircraft on the ground and in the air.

The administration also outlined a plan to raise fuel taxes for private and business aircraft from roughly 22 cents per gallon to $1.06 per gallon, a proposal Transportation Secretary Pete Buttigieg said would raise more than $1.1 billion over five years to fund the national airspace system.

Biden in the budget also renewed his plan to fund Ukraine’s defense against Russia as well as Israel’s defense against Hamas, counter Chinese aggression in the Indo-Pacific, provide humanitarian assistance for civilians in Gaza, and upgrade security at the U.S.-Mexico border. His administration asked for $92 billion package for those priorities in the fall, but Johnson, the House speaker, has not seriously considered the proposal.

Top Articles in News Services

-

Survey Shows False Election Info Perceived as True

-

Hong Kong Ex-Publisher Jimmy Lai’s Sentence Raises International Outcry as China Defends It

-

Japan’s Nikkei Stock Average Touches 58,000 as Yen, Jgbs Rally on Election Fallout (UPDATE 1)

-

Japan’s Nikkei Stock Average Falls as US-Iran Tensions Unsettle Investors (UPDATE 1)

-

Trump Names Former Federal Reserve Governor Warsh as the Next Fed Chair, Replacing Powell

JN ACCESS RANKING

-

Producer Behind Pop Group XG Arrested for Cocaine Possession

-

Japan PM Takaichi’s Cabinet Resigns en Masse

-

Man Infected with Measles Reportedly Dined at Restaurant in Tokyo Station

-

Israeli Ambassador to Japan Speaks about Japan’s Role in the Reconstruction of Gaza

-

Videos Plagiarized, Reposted with False Subtitles Claiming ‘Ryukyu Belongs to China’; Anti-China False Information Also Posted in Japan