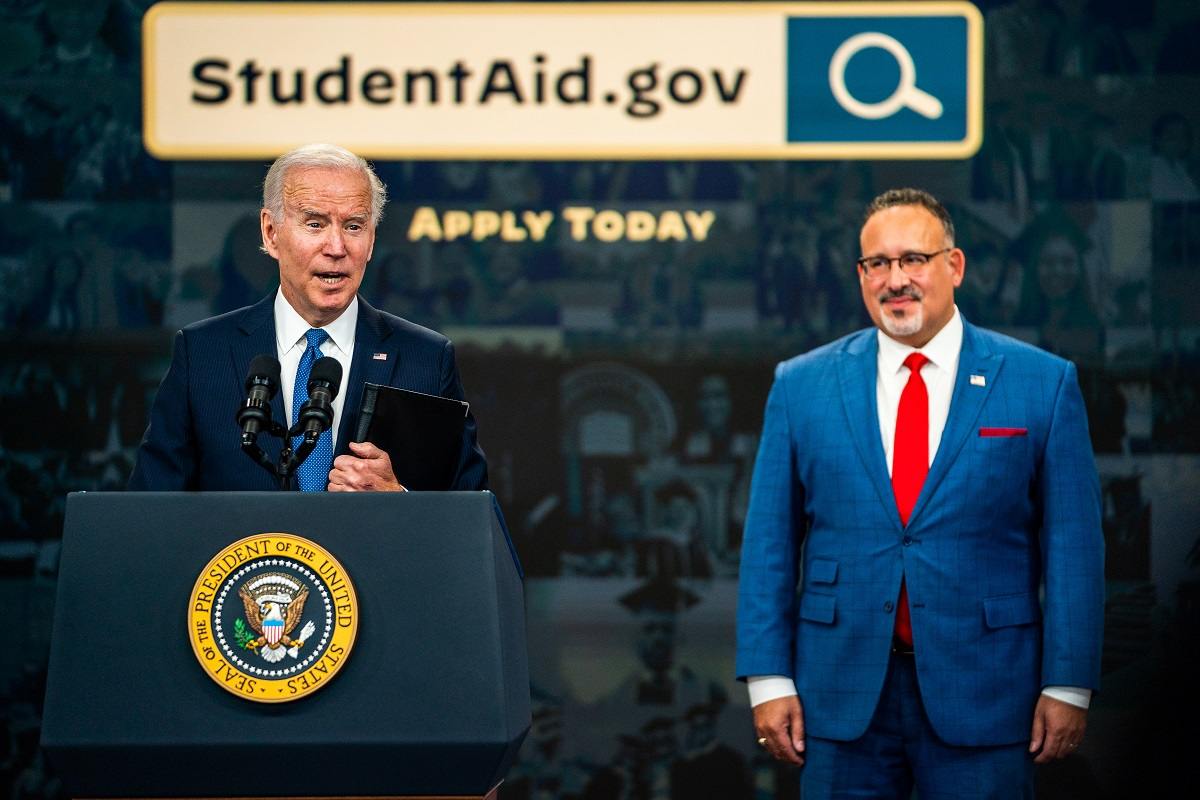

President Biden discusses student loan relief alongside Education Secretary Miguel Cardona in October 2022.

15:13 JST, February 22, 2024

President Biden on Wednesday began emailing more than 150,000 student loan borrowers enrolled in his signature repayment plan that their debts – $1.2 billion in total – have been canceled, the latest effort by the administration to tout its success in providing debt relief as the campaign season heats up.

The president’s debt relief policies have been met with a mix of praise and frustration. Activists have applauded his targeted approach; the administration has forgiven about $138 billion in student loans for 3.9 million people, largely using existing relief programs. But they also continue to implore Biden to do more, despite the crushing defeat of a more sweeping loan forgiveness plan before the Supreme Court. Meanwhile, conservatives remain ardent critics of debt policies they say come at the expense of other taxpayers, many of whom never attended college.

The latest debt relief targets people enrolled in the Saving on a Valuable Education (Save) plan, and makes good on the administration’s promise to accelerate forgiveness for people who borrowed lower amounts of money to attend college. Rather than wait 20 to 25 years for relief through other income-driven repayment plans, enrollees in the Save plan who borrowed less than $12,000 can have their debt wiped clean after 10 years of payments. The Education Department had originally planned to begin forgiveness in July but started identifying eligible borrowers this month.

“From day one of my Administration, I vowed to fix student loan programs so higher education can be a ticket to the middle class – not a barrier to opportunity,” Biden wrote in the email. He also described other efforts taken by the administration to help students and borrowers, including expanding Pell grants, and promised to “never stop fighting for hard-working American families.”

The email effort recalls then-President Donald Trump’s 2020 push to send letters to taxpayers alerting them to stimulus checks his administration processed by the millions during the early months of the coronavirus pandemic.

Ahead of his own reelection bid, Biden has privately expressed frustration that his administration has not received enough credit from voters for its actions to help consumers and bolster the economy. Some of Biden’s allies, including Rep. James E. Clyburn (D-S.C.), have warned that the president could face electoral problems if he does not convince voters that he has kept his promises on a wide range of issues. Clyburn has specifically raised the president’s student loan relief pledge as one area where a significant gap exists between what Biden has accomplished and what voters believe he has done.

Biden also has been wary of the blowback student debt relief efforts have received from people who did not go to college. During a speech at a library in Culver City, Calif., on Wednesday, he made the case that his loan forgiveness “helps everyone” by strengthening the economy.

“When people have student debt relief, they buy homes, they start businesses, they contribute, they engage in the community in ways they weren’t able to before,” he said. “And that actually grows the economy.”

Under Biden, the Education Department has focused on lowering the debt burden of those who borrowed money for college, by expanding or easing rules for existing relief programs. It is also crafting another plan to offer relief to more borrowers after a loan forgiveness plan that Biden introduced in 2022 was struck down by the Supreme Court last year.

After the court’s decision, the Biden administration finalized the Save plan.

So far, about 7.5 million people of the more than 40 million with federal student loan debt are enrolled in Save. The plan pegs monthly student loan payments to earnings and family size, just like other income-driven plans. One big difference is that the new plan increases the amount of income protected from the calculation of debt payments from 150 percent to 225 percent of the federal poverty line.

That means a single borrower earning less than $15 an hour will be spared from payments. Those earning more would save an estimated $1,000 a year, according to the department. Even if borrowers’ monthly payment is $0, they will still get credit toward forgiveness. According to the Education Department, 4.3 million people enrolled in the plan have a $0 monthly payment.

The department began introducing some features of the Save plan last year. This summer, the federal agency will start capping payments for undergraduate loans at 5 percent – down from 10 percent – of income above the 225 percent federal poverty threshold. Borrowers with debt from undergraduate and graduate studies will pay a weighted average between 5 and 10 percent toward their debts.

The faster path to cancellation could have a meaningful impact on people who attended community college, dropped out of college or are at risk of defaulting. The Education Department estimates that 85 percent of future community college borrowers, who typically take out small loans, could be debt-free within 10 years under the Save plan.

“Every borrower that the Biden administration delivers full student debt relief for is a win,” Braxton Brewington, spokesperson for the Debt Collective, said in a statement. “Despite the Supreme Court’s ruling last year, Biden continues to prove he has tools at his disposal to enact relief for borrowers crushed by student debt – but there’s no reason to stop here. Nearly four million Americans have received relief, but forty million more are desperately waiting.”

To create Save, the administration updated an existing loan repayment program that was long authorized by Congress through the Higher Education Act, giving it firmer legal ground than the debt relief program struck down by the Supreme Court.

But conservative groups and Republican lawmakers question the president’s authority to wipe away billions of dollars in money owed to the federal government.

“His drip, drip, drip student loan forgiveness workarounds are lawless and make a mockery of the separation of powers,” Elaine Parker, president of the Job Creators Network Foundation, said in a statement. The small-business advocacy group filed one of the suits against Biden’s 2022 plan to forgive up to $20,000 in loans for some borrowers.

Parker said the administration’s actions “set a dangerous precedent that consolidates more power in the executive branch. College students themselves are the biggest losers of Biden’s college debt forgiveness workarounds because colleges are given a blank check to continue overcharging and saddling them with debt.”

Borrowers who receive emails notifying them that they will receive debt relief through the Save program do not need to take any further action to receive loan forgiveness. Student loan servicers, the intermediaries that collect payments on the federal government’s behalf, will begin discharging the debt in coming days, according to the department. Next week, the agency plans to directly contact borrowers who would be eligible for early cancellation under the Save plan but are not enrolled.

After his remarks, Biden gave a succinct answer when asked whether he was worried that his latest debt relief program would be struck down in court.

“I don’t have a worry at all,” he said.

Top Articles in News Services

-

Survey Shows False Election Info Perceived as True

-

Hong Kong Ex-Publisher Jimmy Lai’s Sentence Raises International Outcry as China Defends It

-

Japan’s Nikkei Stock Average Touches 58,000 as Yen, Jgbs Rally on Election Fallout (UPDATE 1)

-

Japan’s Nikkei Stock Average Falls as US-Iran Tensions Unsettle Investors (UPDATE 1)

-

Trump Names Former Federal Reserve Governor Warsh as the Next Fed Chair, Replacing Powell

JN ACCESS RANKING

-

Producer Behind Pop Group XG Arrested for Cocaine Possession

-

Japan PM Takaichi’s Cabinet Resigns en Masse

-

Man Infected with Measles Reportedly Dined at Restaurant in Tokyo Station

-

Israeli Ambassador to Japan Speaks about Japan’s Role in the Reconstruction of Gaza

-

Videos Plagiarized, Reposted with False Subtitles Claiming ‘Ryukyu Belongs to China’; Anti-China False Information Also Posted in Japan