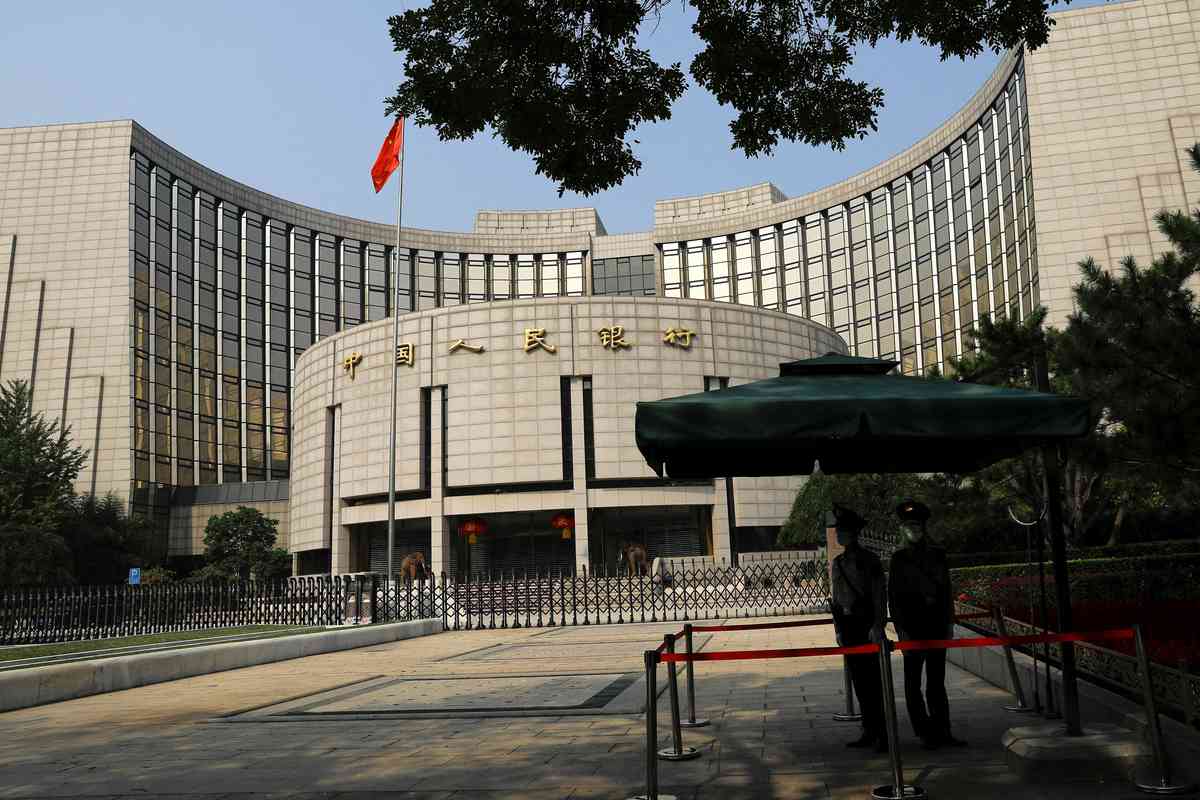

Paramilitary police officers stand guard in front of the headquarters of the People’s Bank of China, the central bank (PBOC), in Beijing, China September 30, 2022.

13:41 JST, January 20, 2025

SHANGHAI (Reuters) – China left benchmark lending rates unchanged for a third consecutive month, as expected, as a weakening yuan has limited Beijing’s monetary policy easing efforts.

At the monthly fixing on Monday, the one-year loan prime rate (LPR) was kept at 3.1%, while the five-year LPR was unchanged at 3.6%.

Most new and outstanding loans in China are based on the one-year LPR, while the five-year rate influences the pricing of mortgages.

In October 2024, Chinese lenders slashed lending benchmarks by bigger-than-expected margins to revive economic activity.

WHY IT’S IMPORTANT

China’s economy hit the government’s ambitions for 5% growth last year, effectively reducing the urgency for imminent monetary stimulus at a time the yuan currency is facing renewed depreciation pressure.

Banks’ narrowing interest rate margin also limits the scope for monetary easing.

BY THE NUMBERS

The one-year loan prime rate (LPR) was kept at 3.1%, while the five-year LPR was unchanged at 3.6%.

CONTEXT

China has stepped up measures ranging from verbal warnings, tweaks to capital flows and issuance of offshore yuan bills to put a floor under the declining yuan.

Investors are dialing back bets on near-term rate cuts in China, the derivatives market shows, as expectations grow that authorities will refrain from easing policy when the yuan is weakening.

The Politburo said earlier last month that China will adopt an “appropriately loose” monetary policy in 2025, the first easing of its stance in some 14 years, alongside a more proactive fiscal policy to spur economic growth. (Reporting by Shanghai newsroom; Editing by Jacqueline Wong and Shri Navaratnam)

Top Articles in News Services

-

Survey Shows False Election Info Perceived as True

-

Hong Kong Ex-Publisher Jimmy Lai’s Sentence Raises International Outcry as China Defends It

-

Japan’s Nikkei Stock Average Touches 58,000 as Yen, Jgbs Rally on Election Fallout (UPDATE 1)

-

Japan’s Nikkei Stock Average Falls as US-Iran Tensions Unsettle Investors (UPDATE 1)

-

Trump Names Former Federal Reserve Governor Warsh as the Next Fed Chair, Replacing Powell

JN ACCESS RANKING

-

Producer Behind Pop Group XG Arrested for Cocaine Possession

-

Japan PM Takaichi’s Cabinet Resigns en Masse

-

Man Infected with Measles Reportedly Dined at Restaurant in Tokyo Station

-

Israeli Ambassador to Japan Speaks about Japan’s Role in the Reconstruction of Gaza

-

Videos Plagiarized, Reposted with False Subtitles Claiming ‘Ryukyu Belongs to China’; Anti-China False Information Also Posted in Japan