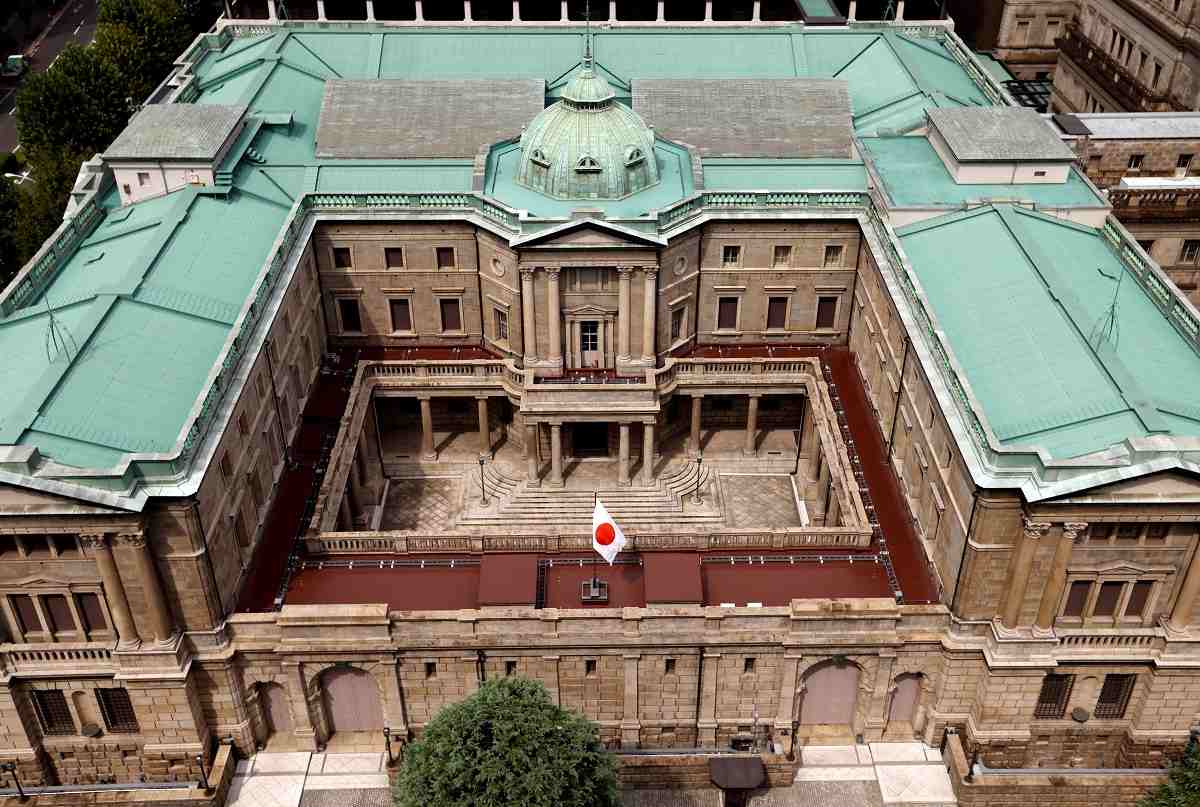

The Bank of Japan is seen in Tokyo in September 20, 2023.

14:36 JST, January 14, 2025

YOKOHAMA (Reuters) – The Bank of Japan will debate whether to raise interest rates next week as prospects of sustained wage gains heighten and the U.S. policy outlook becomes clearer in President-elect Donald Trump’s inaugural address, Deputy Governor Ryozo Himino said.

In a speech to business leaders in the city of Yokohama, Himino said on Tuesday it would “not be normal” for real interest rates to remain negative once Japan had overcome shocks and factors that caused deflation.

Various surveys and reports from the central bank’s regional branches had heightened hopes that wage growth would remain strong this year, he said.

Himino also said the U.S. economy was likely to remain strong for the time being, and the “broad direction” of U.S. economic policy would likely become clear in Trump’s inaugural address on Jan. 20.

The board will discuss whether to raise interest rates next week and reach a decision, based on the economic and price projections laid out in our quarterly outlook report, he said.

The remarks come ahead of the BOJ’s two-day policy meeting concluding on Jan. 24, when some analysts expect the bank to raise short-term rates from the current 0.25%. The board will also issue fresh quarterly growth and price forecasts that serve as the basis for setting monetary policy.

Himino’s views on wages and the U.S. policy outlook have been closely watched by markets, after Governor Kazuo Ueda cited uncertainty over the domestic wage outlook and Trump’s policies as reasons to hold off raising rates last month.

The remarks by Himino, coupled with rising U.S. Treasury yields, pushed up the benchmark 10-year Japanese government bond (JGB) yield to a nearly 14-year high of 1.245%.

His remarks could be interpreted as laying the groundwork for a January rate hike, said Katsutoshi Inadome, senior strategist at Sumitomo Mitsui Trust Asset Management.

In a quarterly report analyzing regional economies released last week, the BOJ said wage hikes were spreading to firms of all sizes and sectors, signaling that conditions for a near-term rate hike were continuing to fall into place.

Prospects of sustained wage gains and the increase in import costs due to a weak yen have heightened attention within the BOJ to rising inflationary pressures that may lead to an upgrade in its price forecast this month, sources have told Reuters.

The BOJ ended negative interest rates in March and raised its short-term rate target to 0.25% in July on the view Japan was on track to durably meet the bank’s 2% inflation target.

Ueda has signaled readiness to raise rates further if broadening wage hikes underpin consumption and allow companies to keep hiking prices not just for goods but services.

Top Articles in News Services

-

Survey Shows False Election Info Perceived as True

-

Hong Kong Ex-Publisher Jimmy Lai’s Sentence Raises International Outcry as China Defends It

-

Japan’s Nikkei Stock Average Touches 58,000 as Yen, Jgbs Rally on Election Fallout (UPDATE 1)

-

Japan’s Nikkei Stock Average Falls as US-Iran Tensions Unsettle Investors (UPDATE 1)

-

Trump Names Former Federal Reserve Governor Warsh as the Next Fed Chair, Replacing Powell

JN ACCESS RANKING

-

Producer Behind Pop Group XG Arrested for Cocaine Possession

-

Japan PM Takaichi’s Cabinet Resigns en Masse

-

Man Infected with Measles Reportedly Dined at Restaurant in Tokyo Station

-

Israeli Ambassador to Japan Speaks about Japan’s Role in the Reconstruction of Gaza

-

Videos Plagiarized, Reposted with False Subtitles Claiming ‘Ryukyu Belongs to China’; Anti-China False Information Also Posted in Japan