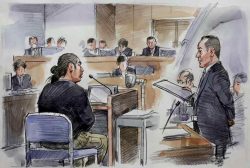

New Bank of Japan Governor Kazuo Ueda and Deputy Governors Ryozo Himino attend a news conference at the bank headquarters in Tokyo, Japan, April 10, 2023.

10:26 JST, December 8, 2023

Signals from Federal Reserve and European Central Bank officials have been behind the eye-popping moves in world bond markets recently, but on Thursday investors were reminded of the punch the Bank of Japan can pack.

If the pointers from Fed and ECB officials have been towards the lower interest rate environment coming into view, the BOJ is headed in the completely opposite direction.

The dramatic moves in Japanese markets on Thursday will likely continue to reverberate around Asia on Friday, and it is perhaps fitting that the region’s economic calendar is dominated by key Japanese indicators.

The latest household consumption, bank lending and current account data are on tap, as well as revised third quarter GDP. The other main event in Asia on Friday is the Reserve Bank of India’s interest rate decision.

If the RBI meets investors’ expectations – the key repo rate left unchanged at 6.50% for a fifth consecutive meeting, and signals it will be held there well into next year – there are unlikely to be any market fireworks.

There were plenty of fireworks in Japanese markets on Thursday, sparked by comments from BOJ Governor Kazuo Ueda about the exit from decades of ultra-low interest rate policy – the yen and bond yields soared, and stocks slumped.

These moves bear repeating, as they are a measure of how historic the BOJ’s shift is and how sensitive markets are to it.

The yen’s 2.7% surge against the dollar – it had gained as much as 4% earlier in the day – was its biggest in a year. There have been only seven better days for the yen in the last decade.

The five-year Japanese Government Bond yield recorded its biggest rise since the pandemic of almost 10 basis points – it has registered bigger daily spikes on only four occasions in the last 20 years.

Long-dated JGB yields spiked sharply higher too after a dismal auction of 30-year paper – the bid-to-cover ratio was the lowest since 2015 at 2.62, and the tail – the difference between the lowest bid and the average bid – was the longest on record.

The timing and scale of Japan’s inflation-fighting rate hikes is critical. Japan is the world’s largest creditor nation, so the potential repatriation flows are huge; while the yen is near its lowest, and the Nikkei stock market is near its highest, in more than 30 years.

According to Reuters polls, figures on Friday are expected to show Japanese household spending fell in October, and the economy was slightly weaker in the third quarter than thought.

"News Services" POPULAR ARTICLE

-

American Playwright Jeremy O. Harris Arrested in Japan on Alleged Drug Smuggling

-

Japan’s Nikkei Stock Average as JGB Yields, Yen Rise on Rate-Hike Bets

-

Japan’s Nikkei Stock Average Licks Wounds after Selloff Sparked by BOJ Hike Bets (UPDATE 1)

-

Japanese Bond Yields Zoom, Stocks Slide as Rate Hike Looms

-

Japan’s Nikkei Stock Average Buoyed by Stable Yen; SoftBank’s Slide Caps Gains (UPDATE 1)

JN ACCESS RANKING

-

Keidanren Chairman Yoshinobu Tsutsui Visits Kashiwazaki-Kariwa Nuclear Power Plant; Inspects New Emergency Safety System

-

Imports of Rare Earths from China Facing Delays, May Be Caused by Deterioration of Japan-China Relations

-

University of Tokyo Professor Discusses Japanese Economic Security in Interview Ahead of Forum

-

Japan Pulls out of Vietnam Nuclear Project, Complicating Hanoi’s Power Plans

-

Govt Aims to Expand NISA Program Lineup, Abolish Age Restriction