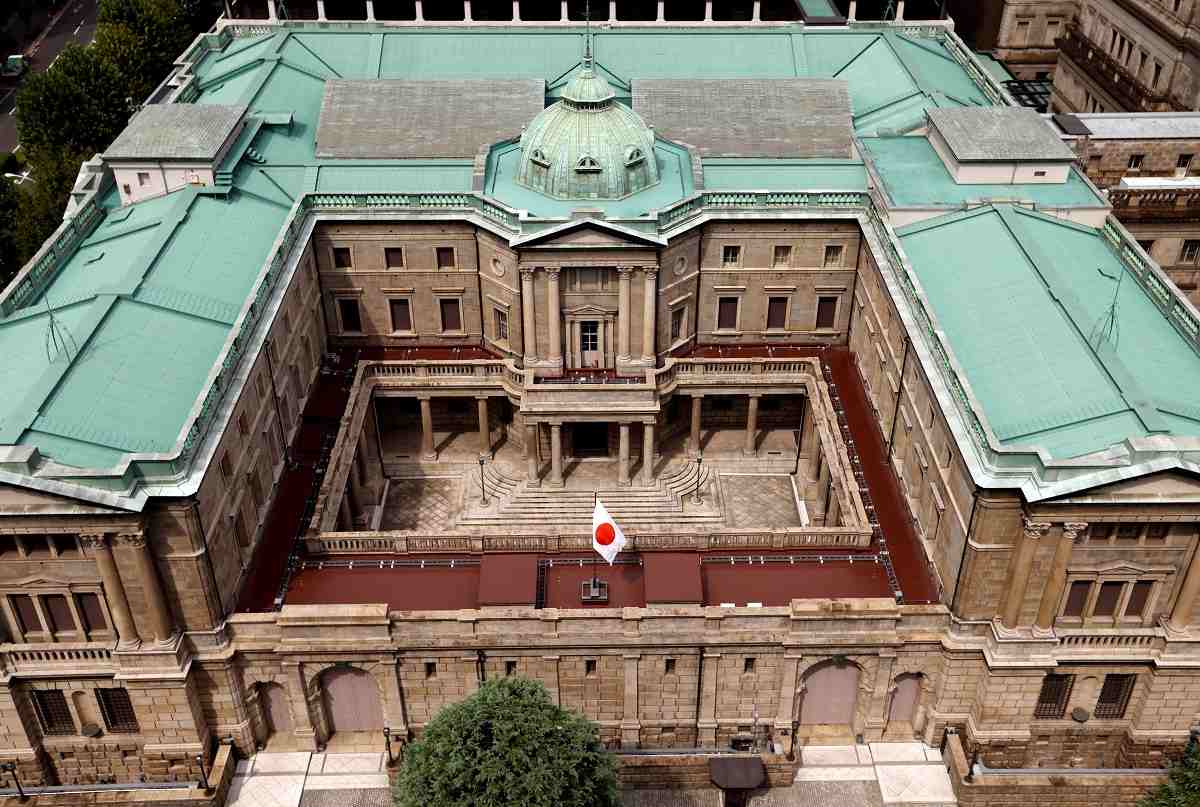

The Bank of Japan is seen in Tokyo in September 20, 2023.

17:32 JST, August 1, 2024

Tokyo, July 31 (Jiji Press)—Japan spent ¥5,534.8 billion on foreign exchange market interventions between June 27 and Monday, the Finance Ministry said Wednesday.

The dollar plunged against the yen July 11-12, prompting speculation that Japanese authorities conducted stealth yen-buying$,-selling interventions worth 5 trillion to ¥6 trillion in total.

Before the latest interventions, Japanese authorities stepped into foreign exchange markets in April-May, spending ¥9.7 trillion to support the yen as the dollar surged above ¥160 on April 29.

Stealth interventions, in which authorities do not immediately disclose whether they have stepped into currency markets, are aimed at raising the efficacy of operations by creating market uncertainty about their timing.

The total amount spent on interventions during the latest one-month period was revealed for the first time in Wednesday’s disclosure. Details of how much was spent on which day will be published in early November, together with data for August and September.

The dollar plunged from around ¥161 to around ¥157 on July 11, soon after the release of the U.S. consumer price index for June, and from around ¥159 to around ¥157 the following day, after the release of the U.S. producer price index.

Market players had estimated that Japanese authorities spent approximately between 3 trillion to ¥4 trillion on July 11 and about ¥2 trillion on July 12 to prop up the yen against the dollar.

On July 11, Masato Kanda, then Japanese vice finance minister for international affairs who was in charge of interventions, told reporters that he was “very concerned about moves that are different from economic fundamentals.” Kanda stepped down from the post Wednesday.

Top Articles in Business

-

Prudential Life Insurance Plans to Fully Compensate for Damages Caused by Fraudulent Actions Without Waiting for Third-Party Committee Review

-

Narita Airport, Startup in Japan Demonstrate Machine to Compress Clothes for Tourists to Prevent People from Abandoning Suitcases

-

Japan, U.S. Name 3 Inaugural Investment Projects; Reached Agreement After Considerable Difficulty

-

Toyota Motor Group Firm to Sell Clean Energy Greenhouses for Strawberries

-

SoftBank Launches AI Service for Call Centers That Converts Harsh Customer Voices into Softer Voices

JN ACCESS RANKING

-

Japan PM Takaichi’s Cabinet Resigns en Masse

-

Japan Institute to Use Domestic Commercial Optical Lattice Clock to Set Japan Standard Time

-

Israeli Ambassador to Japan Speaks about Japan’s Role in the Reconstruction of Gaza

-

Man Infected with Measles Reportedly Dined at Restaurant in Tokyo Station

-

Videos Plagiarized, Reposted with False Subtitles Claiming ‘Ryukyu Belongs to China’; Anti-China False Information Also Posted in Japan