A sign on a train on the JR Kashii Line in February states that it is being operated automatically.

11:35 JST, March 18, 2021

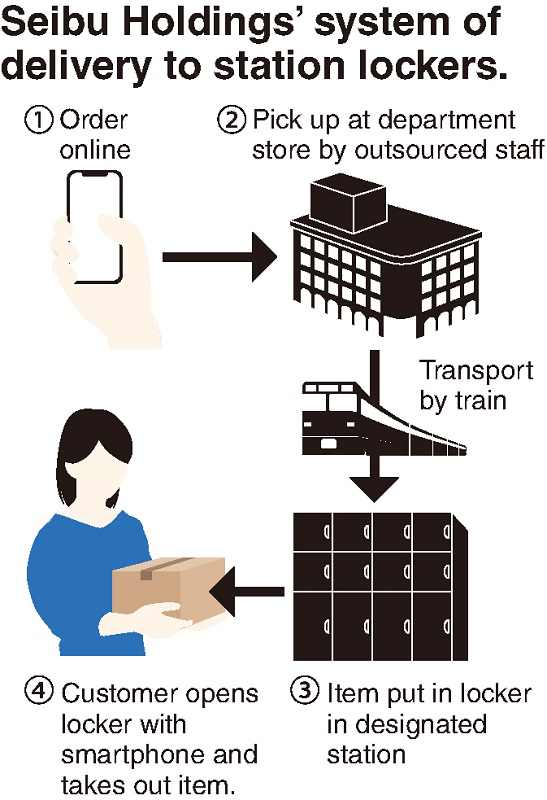

A row of orange lockers stands in Tokyo’s Ikebukuro Station. People who have placed online orders with the Seibu Ikebukuro department store can hold up a smartphone near the lockers to open them. Their purchases, such as cosmetics or sweets, are waiting inside.

The service was started in February by Seibu Holdings Inc., the parent company of Seibu Railway Co., as one of a number of measures railway companies are taking to get back on track in the unstable economy.

The ordered items are transported from the department store to the lockers by staff outsourced by Seibu Holdings. The service is aimed at making better use of railway station lockers, which are being used less frequently, and has been expanded to Tokorozawa Station in Saitama Prefecture and Fujimidai Station in Tokyo’s Nerima Ward.

Products associated with department stores, such as high-grade chocolates, are popular and the service is growing steadily, according to the company.

The new service was introduced under the leadership of Wataru Ito, 39. A former NHK announcer who made a career change to venture capital management, Ito’s unique background landed him a job with Seibu Holdings in April last year, where he was put in charge of new projects. “This is the first step to transforming the functions of train stations,” Ito said.

Meanwhile, East Japan Railway Co. (JR East) opened the first-ever shared office space on a train platform at Nishi-Kokubunji Station in Kokubunji, Tokyo, also in February.

The measure was part of the company’s “in-house multitasking” initiatives launched to weather the novel coronavirus pandemic. “When I saw stations where the number of passengers plummeted, I felt we would need to look for new businesses,” said a 30-year-old employee, who is working in the real estate business while also serving as a conductor.

Automated driving

One evening in early February, the driver boarded a train at Saitozaki Station on the JR Kashii Line in Fukuoka, and soon after an announcement came over the speakers inside the cars: “The train is now being switched over to self-driving mode.” After confirming all was clear in front, the driver simultaneously pressed the two buttons necessary to get the train moving. The train gradually picked up speed, and from there, slowing down, speeding up and stopping were all done automatically. The driver only kept his hand on the emergency brake button, just in case.

Kyushu Railway Co. (JR Kyushu) started automated operation of a train on a 12.9-kilometer stretch of track between Saitozaki and Kashii stations in December last year. It marked the first time in the country that an automated train operated on a section that includes crossings. JR Kyushu aims to operate “driverless” trains in the future staffed only with non-driver personnel.

In normal operation, the driver sits in the cockpit and accelerates or stops the train using a lever. To become a driver, a candidate has to go through classroom instruction and technical training, obtain a national license, and gain practical on-board instruction from senior drivers. By operating more automated trains, the company intends to reduce the cost and time needed to train drivers and overcome a shortage of workers.

Combining cargo and passengers

For railway companies, distribution of goods looks to be a promising source of income.

West Japan Railway Co. (JR West) sees ridership reaching only about 90 percent of pre-pandemic levels after the pandemic is over. As such, the company decided to carry cargo usually transported by delivery trucks on Shinkansen bullet trains. The decision was met with much skepticism, with critics saying it was an inefficient use of Shinkansen cars designed for passengers. But the company had no choice, and the policy was adopted.

In conjunction with JR Kyushu, the company held a test using Sanyo and Kyushu Shinkansen trains in which about eight cardboard boxes were loaded into an empty space of a Shinkansen car. Fresh foods such as fish and vegetables produced in Kagoshima Prefecture were transported to hotels in Osaka and Kyoto. This combined cargo-passenger method is also progressing at JR East and Hokkaido Railway Co. (JR Hokkaido).

JR West halted business development focusing on construction of commercial facilities, hotels and condominiums along train lines, and started building logistics centers in the Kansai and Chugoku regions with an eye on expanding online shopping. “We can’t rely solely on railway users,” JR West President Kazuaki Hasegawa said. “Rather, we need a certain extent of businesses that can expand.”

Rush-hour rates

Fares, which serve as the main source of railway income, are decided by the so-called “fully distributed cost method.” It basically works the same as for electricity rates, with fares calculated by adding profits to labor, maintenance and other costs. Due to the highly public nature of the railway business, maximum fares must be approved by the central government.

In response to a decline in passengers, JR East and others will start a test of awarding points to commuters who ride in off-peak hours. This is aimed at reducing the extra trains that have to be added during rush hours and to more efficiently deploy station personnel. The company is eyeing the use of increased fares during rush hours in the future.

The Land, Infrastructure, Transport and Tourism Ministry has been considering the introduction of a “dynamic pricing system,” in which fares fluctuate depending on real-time booking and usage. This is quite prevalent overseas, and is already in use in Japan in the airline and highway bus industries.

Top Articles in Business

-

Prudential Life Insurance Plans to Fully Compensate for Damages Caused by Fraudulent Actions Without Waiting for Third-Party Committee Review

-

Narita Airport, Startup in Japan Demonstrate Machine to Compress Clothes for Tourists to Prevent People from Abandoning Suitcases

-

Japan, U.S. Name 3 Inaugural Investment Projects; Reached Agreement After Considerable Difficulty

-

Toyota Motor Group Firm to Sell Clean Energy Greenhouses for Strawberries

-

SoftBank Launches AI Service for Call Centers That Converts Harsh Customer Voices into Softer Voices

JN ACCESS RANKING

-

Japan PM Takaichi’s Cabinet Resigns en Masse

-

Japan Institute to Use Domestic Commercial Optical Lattice Clock to Set Japan Standard Time

-

Israeli Ambassador to Japan Speaks about Japan’s Role in the Reconstruction of Gaza

-

Man Infected with Measles Reportedly Dined at Restaurant in Tokyo Station

-

Videos Plagiarized, Reposted with False Subtitles Claiming ‘Ryukyu Belongs to China’; Anti-China False Information Also Posted in Japan